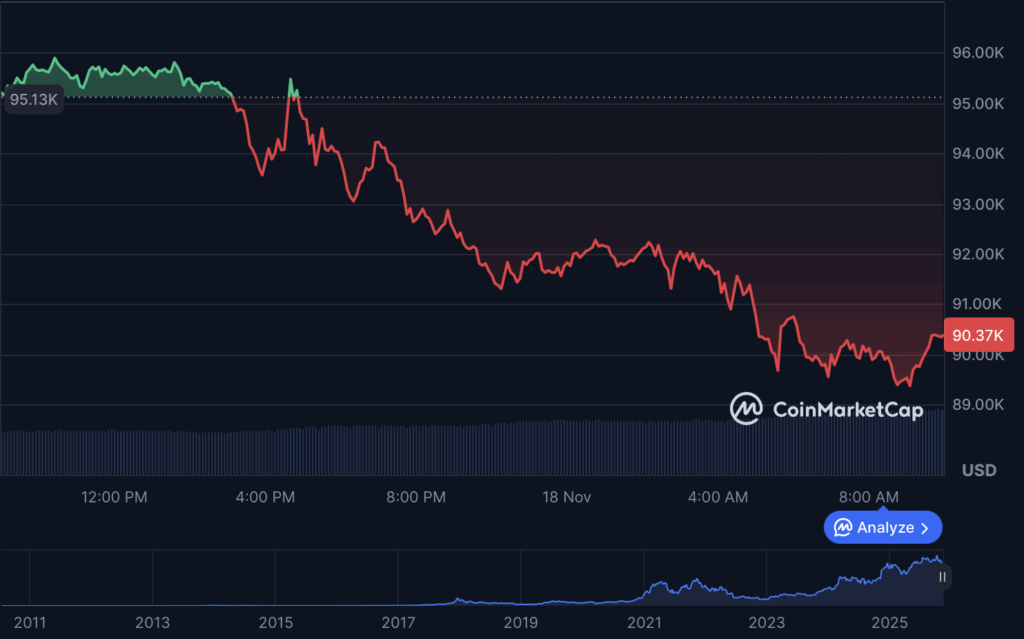

Bitcoin’s $90K Plunge Sparks Crypto Carnage - When Will the Bleeding Stop?

Digital assets tumble as Bitcoin leads massive selloff

The Domino Effect

Bitcoin's collapse from $90,000 triggered a cascade of liquidations across crypto markets. Margin calls hit leveraged positions while panic selling intensified the downward spiral. Trading volumes surged as both retail and institutional investors scrambled for exits.

Technical Breakdown

Key support levels shattered like glass as the flagship cryptocurrency lost nearly 40% of its value in three weeks. The fear and greed index hit extreme fear territory while social sentiment turned overwhelmingly bearish. Even traditional finance skeptics are nodding with that 'I told you so' smirk.

Market Psychology

Investor confidence evaporated faster than a meme coin's utility. The 'buy the dip' crowd got quieter while short sellers piled on. Some analysts claim this is just another cycle shakeout, but the charts tell a different story - one that Wall Street veterans find all too familiar.

Until Bitcoin reclaims critical resistance zones, this crypto winter shows no signs of thawing. Meanwhile, traditional finance continues collecting fees while digital assets bleed out.

Despite briefly flashing green on the hourly chart, BTC continues to face aggressive sell volume, and the inability to recover the mid-$90K range keeps broader market confidence near its lowest point in months.

Ethereum followed a nearly identical trajectory, trading at $3,023 after a fresh 5.49% daily decline and a weekly loss approaching 15%.

Large withdrawals from ETH pairs and thinning liquidity have made each downturn sharper, with sellers firmly controlling the trend.

Stablecoins – USDT and USDC – held their pegs as usual, but their trading activity revealed a defensive mood. Both posted minimal movement while absorbing significant flight-to-safety volume as investors exited volatile altcoins.

Among the majors, XRP fell to $2.15, sliding nearly 12% this week after repeated rejections near the $2.30 resistance zone. BNB showed a slightly softer decline at $910, although it still posted a 6.5% weekly loss.

Solana experienced the steepest volatility among leading LAYER 1s. Now at $136.92, SOL has shed more than 16% over the past week despite strong ETF-related hype earlier in the month. Traders attribute the abrupt reversal to aggressive deleveraging and market-wide risk aversion rather than any protocol-specific catalyst.

Lower-cap majors were not spared either: TRON (TRX) dipped to $0.287, although its weekly damage remains comparatively mild at just over 3%, making it one of the most resilient assets in the top rankings.

Across the board, the story is the same: sellers remain in control, liquidity is thinning, and every minor bounce is being sold into. With the average crypto RSI sitting at 40, markets are approaching oversold territory, but the absence of bullish catalysts suggests that volatility could remain elevated throughout the week.

Unless Bitcoin reclaims the low-$90K region with strong volume, traders expect continued uncertainty – and the possibility that the market has not yet found its near-term floor.

![]()