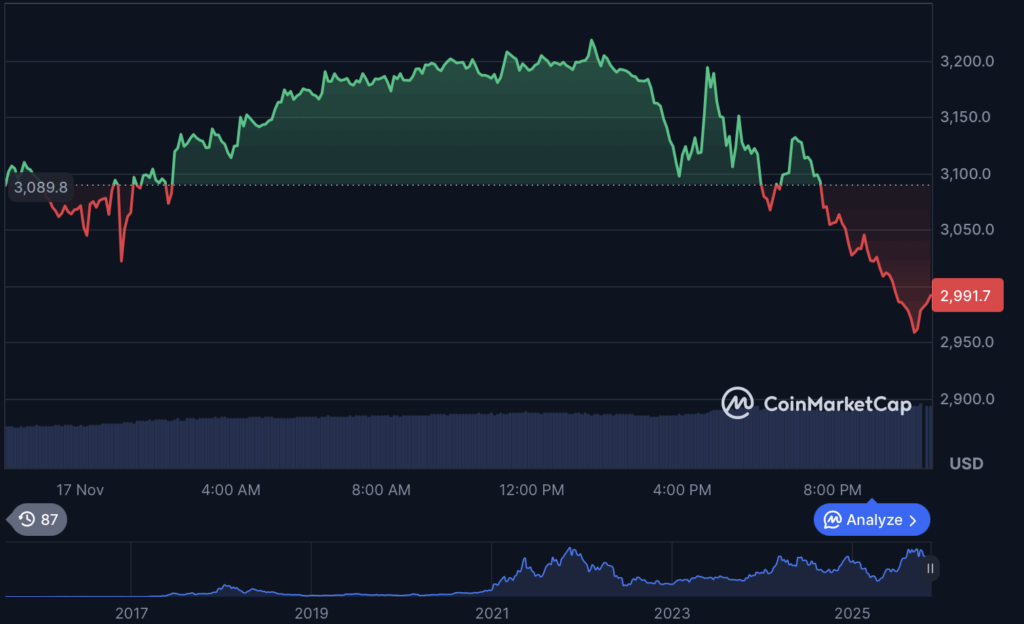

Ethereum Plunges Under $3K: Market Panic Triggers Fire Sale

ETH bulls got trampled today as the second-largest cryptocurrency nosedived below the $3,000 psychological barrier. Here's why traders are hitting the sell button—and what it means for your portfolio.

Blood in the Crypto Streets

The sell-off accelerated after liquidations cascaded through derivatives markets. ETH's 20% weekly drop now marks its worst performance since the 2022 bear market—just as Wall Street's 'crypto experts' were predicting new all-time highs.

Silver Lining Playbook

While leveraged longs got wrecked, on-chain data shows whales accumulating at these levels. Remember: every crypto winter eventually thaws—unless you sold at the bottom like a traditional finance fund manager chasing trends.

The drop has been amplified by a wave of liquidations and fading retail confidence. Many market participants had expected a strong year-end push from ethereum after months of elevated network activity and solid staking metrics.

Instead, sentiment has swung sharply, leaving ETH in one of its most uncertain stretches since the summer downturn.

READ MORE:

On the technical side, Ethereum is flashing heavy oversold signals. The daily RSI has collapsed to roughly 30, a level that often precedes short-lived recovery rallies but doesn’t guarantee them – especially in a macro environment that remains shaky.

Bitcoin is showing similar weakness, now trading around $91,579, extending a nearly 14% decline over the past week. The drop has pushed BTC deep into risk-off territory, with sellers dominating order books and upward momentum evaporating. Although Bitcoin has historically attracted dip buyers during sharp retracements, the current environment shows little urgency from bulls, suggesting that macro uncertainty and fading ETF inflows are weighing heavily on sentiment. Until BTC can reclaim key levels above $95,000, analysts warn that volatility may continue to intensify.

![]()