Bitcoin Plunges to $92K – Is This the Start of a Major Correction or a Buying Opportunity?

Bitcoin's sudden drop to $92,000 has traders scrambling—is this a healthy pullback or the beginning of a prolonged downturn?

Market indicators show mixed signals: while derivatives traders are hedging aggressively, on-chain data reveals whales accumulating at these levels. The $90K support level becomes critical.

Remember when traditional analysts called Bitcoin 'dead' at $60K? Good times.

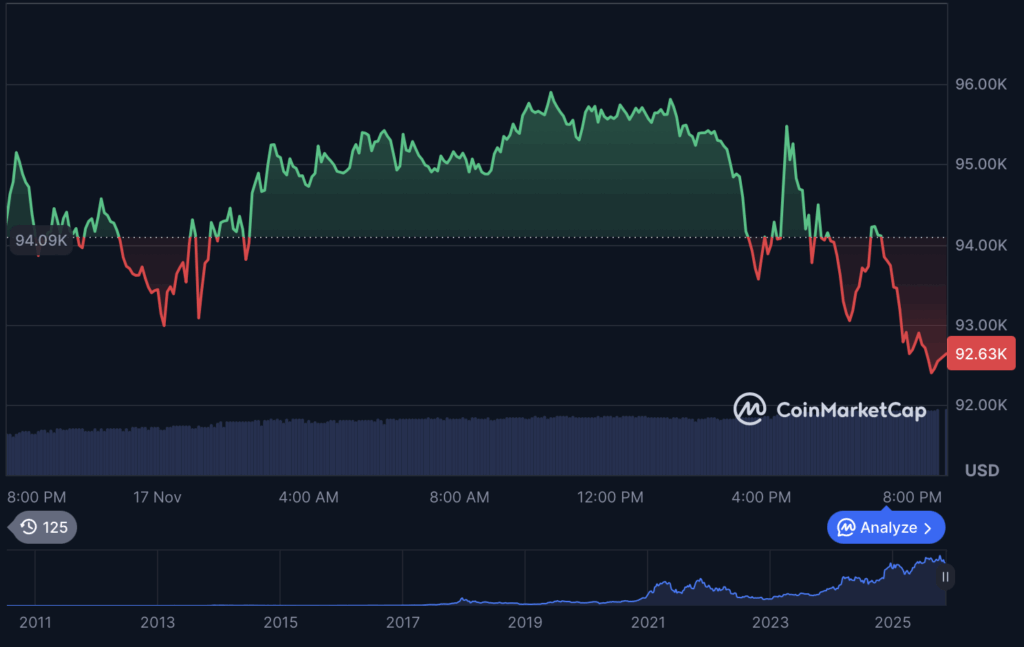

Bitcoin Falls Toward Key Support

Bitcoin is leading the downturn, sliding to $92,861, down over 12% on the week. The drop has erased most of November’s gains and pushed BTC dangerously close to a critical support region under $92K. Despite trading volume above $87 billion in the past 24 hours, buyers are struggling to absorb the steady wave of sell orders.

Onchain metrics show Bitcoin’s circulating supply at 19.95 million BTC, but the current downturn has overshadowed the milestone as panic selling grows.

READ MORE:

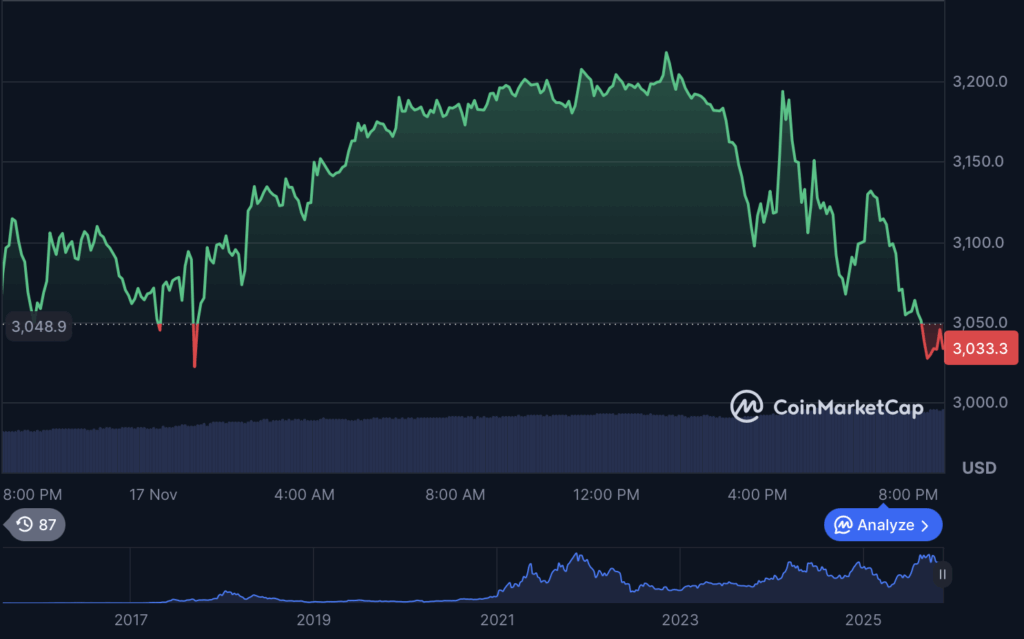

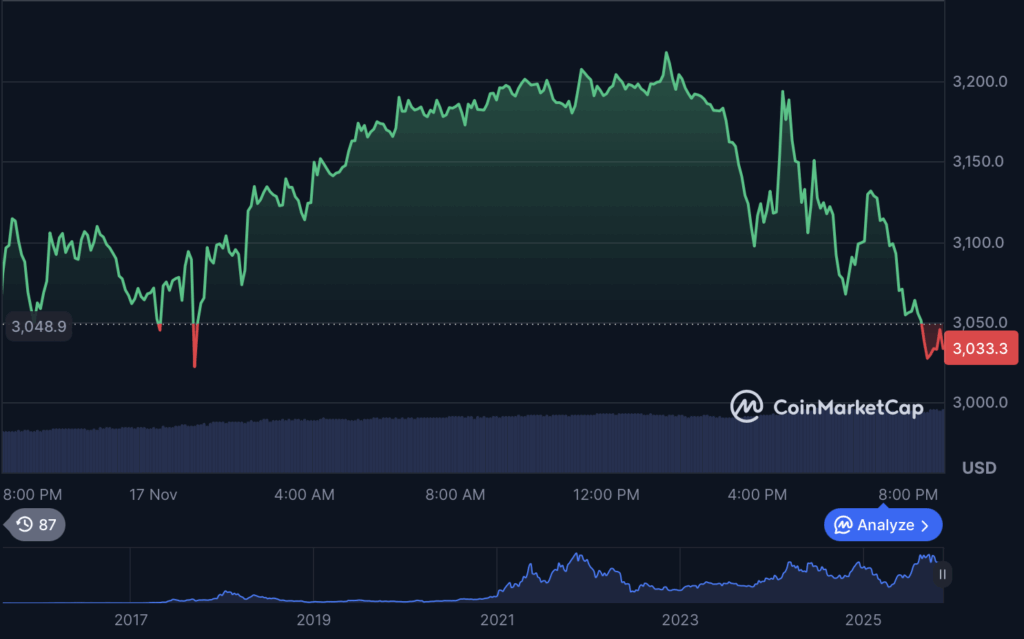

Ethereum and Altcoins Hit Even Harder

Ethereum is also under heavy pressure, falling to $3,045 after a 14.33% weekly decline. With volumes topping $38 billion, ETH has followed Bitcoin’s trajectory but with even sharper intraday swings.

Other majors are seeing similar or worse damage:

- Solana (SOL) has dropped to $131, bleeding 21.25% in seven days.

- XRP is at $2.16, losing over 15% this week.

- BNB slipped to $910, down 7.66% over the same period.

- TRON (TRX) remains one of the few assets holding relatively stable, showing only minor weekly losses.

Stablecoins such as USDT and USDC remain anchored NEAR $1 despite the turbulence, with USDT recording $147B in daily trading volume – a sign of heavy capital rotation and defensive positioning.

Market Still Searching for a Bottom

Altcoin season indicators show a reading of 31/100, suggesting Bitcoin is outperforming most of the market even as it declines. Analysts warn that this dynamic often appears during late stages of downturns, when capital concentrates into BTC before broader recovery attempts.

With fear at extreme levels, RSI oversold across the board, and liquidity draining from high-beta assets, traders are watching for stability signs from macro markets and ETF flow data.

For now, the entire crypto sector remains on edge – and volatility appears far from over.

![]()