Bitcoin at $95K: Last Chance to Buy Before Rocketing to $107K?

Bitcoin's price takes a breather—dipping to $95K—but analysts see this as a prime buying opportunity before the next leg up.

Why the dip? Markets digesting over-leveraged longs. Why the rebound? Institutional FOMO hasn't even peaked yet.

Targets ahead: A swift reclaim of $100K psychological resistance, then a sprint toward $107K. On-chain data shows whales accumulating at these levels—retail traders still hesitant (as usual).

Bearish case? Macro risks loom—like that pesky 2% inflation print the Fed keeps pretending matters. Bulls counter: Bitcoin's scarcity math hasn't changed. Tick tock, next halving.

Bottom line: This isn't financial advice, but if you're waiting for a 'safe' entry... you might end up buying the top again.

Bitcoin Price Prediction – Path Back to $107K?

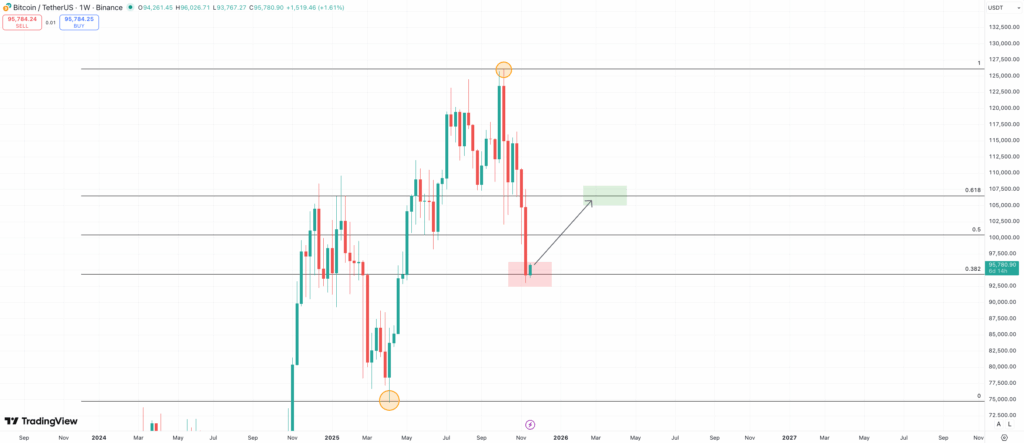

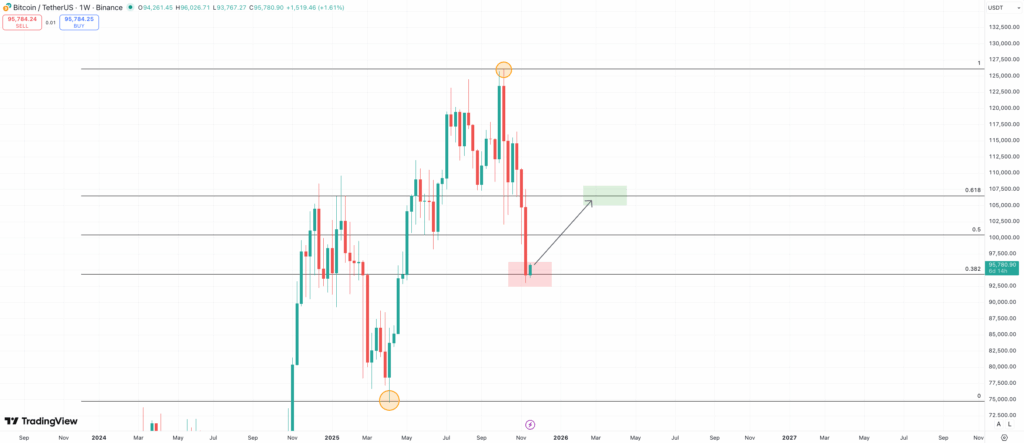

Where does that $107,000 target come from? It’s based on a few key technical factors, starting with Fibonacci levels. If you look at the weekly chart and trace Bitcoin’s bull run from April to October, this current dip lands right in the $93,000 to $95,000 zone.

That’s the 0.382 Fibonacci retracement level, and so far, price is trying to hold there. That’s a positive sign. If this support holds, technical traders see the 0.618 Fibonacci level as the logical upside target. And that line falls almost perfectly at $107,000.

Also, Bitcoin’s daily chart shows this $95,000 zone is a strong historical support area, matching a cluster of wicks from late April and early May. The strength of this support level suggests buy orders could be stacked up here.

Plus, the coin’s daily RSI hit oversold territory last Friday and has already started to rise in the days since. Taken together, this mix of factors suggests buyers could be about to step back in.

Macro Factors Line Up for a Sharp Bitcoin Rebound

Some bigger macro factors could help support a Bitcoin rally to $107,000. For starters, the target itself isn’t crazy. A jump from today’s price represents about 11.8% upside. For an asset as volatile as Bitcoin, this kind of MOVE is well within its normal range.

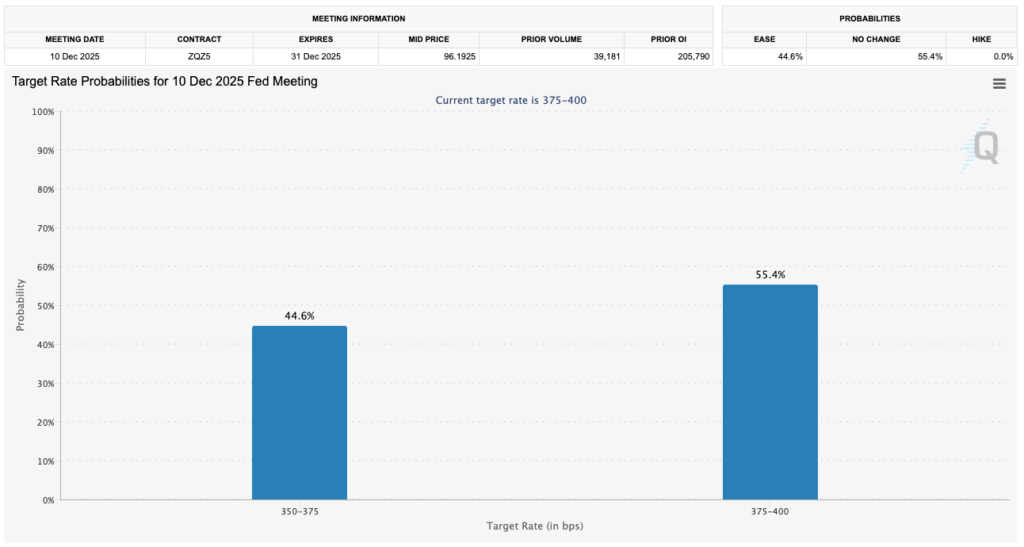

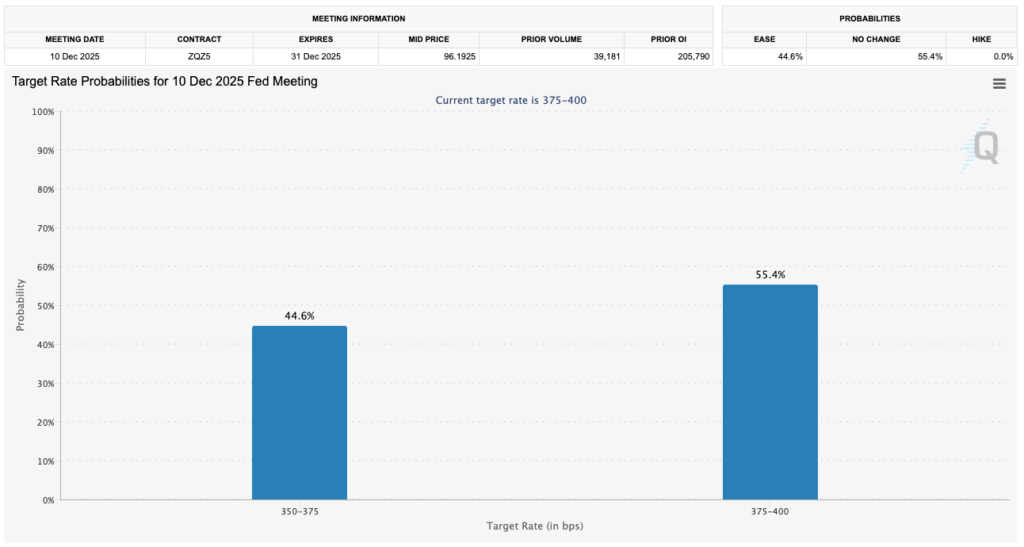

But what could trigger it? The biggest potential factor is a return to a risk-on macro environment. If the Fed does decide to cut rates next month – currently a 44% probability – it WOULD increase market liquidity even more. This increased liquidity is crucial, as it often flows into risk assets like Bitcoin.

We’re also watching the institutional front. Although the spot BTC ETFs are hemorrhaging capital right now, any swing back into inflows would be a positive catalyst.

That’s what makes this period of sustained selling so interesting; institutional investors often use price dips to accumulate assets at a discount. And if that becomes apparent, retail is typically quick to follow.

A Potential Beneficiary – Bitcoin Hyper Nears $28M in Presale as New Layer-2 Project Goes Viral

A Bitcoin rebound to $107,000 would likely pull the entire market up with it. We’ve seen it before – a strong Bitcoin creates a bullish environment that’s especially good for altcoins. It’s this dynamic that has many keeping tabs on new projects like Bitcoin Hyper (HYPER).

Bitcoin Hyper is being built to address Bitcoin’s long-standing scalability problems. The Bitcoin blockchain – while extremely secure – is slow and expensive, handling around 3-4 TPS these days. This bottleneck has largely limited its use to just storing value.

While other Bitcoin Layer-2s, such as the Lightning Network, excel when it comes to payments, they lack smart contract programmability. Bitcoin Hyper aims to address both issues simultaneously. Its solution is to integrate the Solana VIRTUAL Machine (SVM), giving it massive potential speed – we’re talking up to 65,000 TPS.

And this plan is drawing attention. The native HYPER token is still in presale, having raised $27.8 million to date. Right now, HYPER tokens are available at a fixed price of $0.013285 – and they can also be staked, with dynamic APY rates of up to 41%.

The crypto commentator Borch Crypto told his 93,000 YouTube subscribers last week that this is the “best crypto presale” of the year. So, given its Bitcoin-linked nature and enormous presale funding, Bitcoin Hyper could be one of the best low-cap plays to capitalize on a BTC recovery.

Visit Bitcoin Hyper PresaleThis publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

![]()