Market Panic, Saylor Buys: MicroStrategy Adds $835M in Bitcoin Amid Chaos

While retail investors fled, Michael Saylor's MicroStrategy doubled down—snapping up 14,620 BTC at $57,000 apiece. The move brings their total stash to 174,530 BTC ($9.8B).

Wall Street analysts gasped as the company leveraged convertible notes for the purchase—because nothing says 'confidence' like debt-fueled crypto accumulation.

Meanwhile, Bitcoin's price volatility spiked to 90% annualized. Traders citing 'macro uncertainty' as the cause clearly haven't met Saylor's diamond hands.

Bitcoin Drops as Saylor Buys

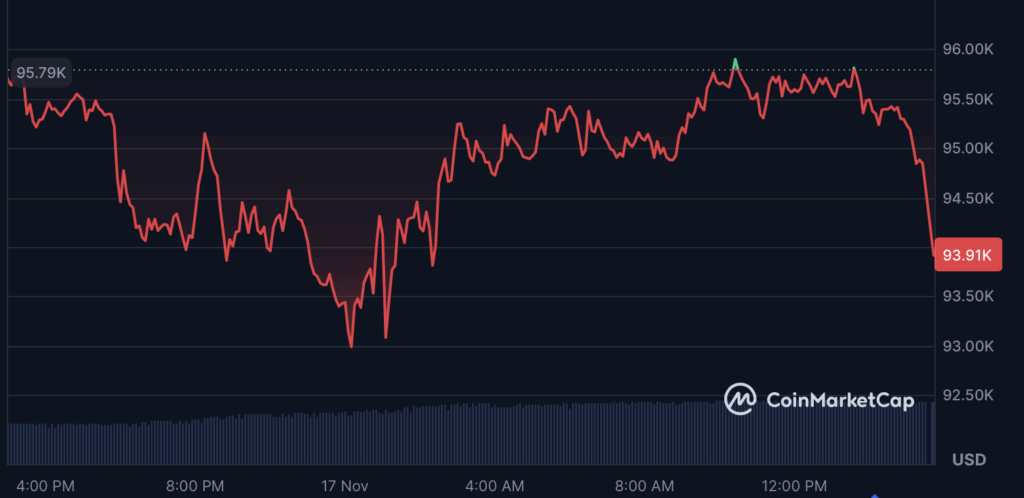

The aggressive accumulation comes at a moment when the crypto market is under renewed pressure. At the time of writing, Bitcoin is trading around $93,910, down more than 1.5% over the last 24 hours, and 11.5% on the week.

The leading crypto has shed momentum in November, with its price trending downward after a series of macro-driven sell-offs, ETF outflows, and government-shutdown turbulence. Despite the weakness, Saylor appears unfazed – continuing to buy into the volatility as BTC tests the mid-$90K range.

Strategy’s Giant Stack Nears 650K BTC

With the latest purchase, Strategy’s holdings are approaching an unprecedented 650,000 BTC, a number rivaling the reserves of some early crypto exchanges and even nation-state treasuries. The firm remains the single largest corporate holder of bitcoin globally.

Saylor emphasized the long-term thesis: accumulating as much BTC as possible while supply tightens and institutional demand accelerates.

readmore id=”180273″]

Market Eyes BTC’s Next Move

Bitcoin’s struggle to hold support NEAR $94K has traders cautious, but Saylor’s continued buying highlights a growing divide between long-term conviction and short-term sentiment.

If BTC rebounds, Strategy’s massive position could become even more dominant. If the downturn continues, the company appears ready to keep stacking.

For now, the message from Saylor is clear: dips are not dangers — they’re invitations.

![]()