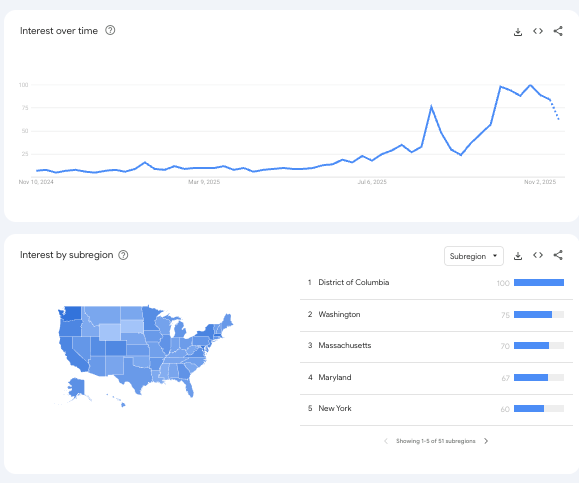

America’s AI Panic: Google Searches for "AI Bubble" Surge 950% as Fear Hits Mainstream

Fear is going viral. Searches for "AI bubble" have exploded nearly 10x as retail investors finally wake up to the risks—right as Wall Street keeps pumping the hype.

Main Street vs. The Machines: While Silicon Valley VCs double down on AI startups, mom-and-pop investors are suddenly questioning whether the emperor has no clothes. The timing couldn't be worse—or more suspicious.

Bonus jab: Nothing unites Americans quite like the realization they might've bought the top. Again.

Echoes of the Dot-Com Era

The spike in search activity mirrors a broader wave of warnings from economists and market strategists. Many are drawing comparisons to the late 1990s, when soaring internet valuations vastly outpaced actual business performance. AI startups today are being valued at extraordinary multiples despite producing modest or experimental revenues, while major corporations are spending aggressively on data centers and high-performance computing with no confirmed path to quick returns.

Several studies have noted that most enterprises experimenting with generative AI are not yet seeing measurable productivity improvements – a disconnect that resembles the optimism-reality gap from the Dot-com run-up.

READ MORE:

Why This AI Cycle Is Different – and Why It Still Might Be Risky

Despite the parallels, analysts note key differences that make the current boom more structurally grounded. Unlike the Dot-com bubble – largely driven by untested ideas and companies burning cash – the AI surge is anchored by profitable, well-capitalized giants such as Nvidia and Palantir. AI is already embedded in cloud tools, search engines, enterprise systems, and consumer tech, meaning its value is not purely hypothetical.

Heavy investment in chips, servers, and infrastructure also reflects real and rapidly growing demand. The physical backbone of AI is tangible in a way that early internet speculation was not.

But these strengths haven’t settled concerns. Economists caution that even transformative technologies can experience painful corrections if investment outpaces adoption. The fear is that companies may be overbuilding computational capacity and overestimating how quickly businesses can monetize advanced AI models – setting the stage for a sharp pullback if expectations fail to materialize.

![]()