Ethereum’s Comeback Stalls: Can ETH Break Free From Market Turbulence?

Ethereum's price action looks like a Wall Street intern's first trading bot—erratic, uncertain, and desperately needing caffeine. The smart contract pioneer keeps testing support levels while Bitcoin and altcoins flirt with volatility.

Gas fees aren't the only thing burning holders lately. The network's transition to PoS was supposed to be the bullish catalyst, but even defi degens seem distracted by shiny new L1s. Meanwhile, institutional money keeps playing hide-and-seek with crypto ETFs—classic finance, always late to the party but demanding premium seating.

Will Ethereum's next upgrade finally trigger the breakout? Or is this just another 'accumulation phase' (read: bagholders coping)? One thing's certain: when ETH moves, it won't ask for permission.

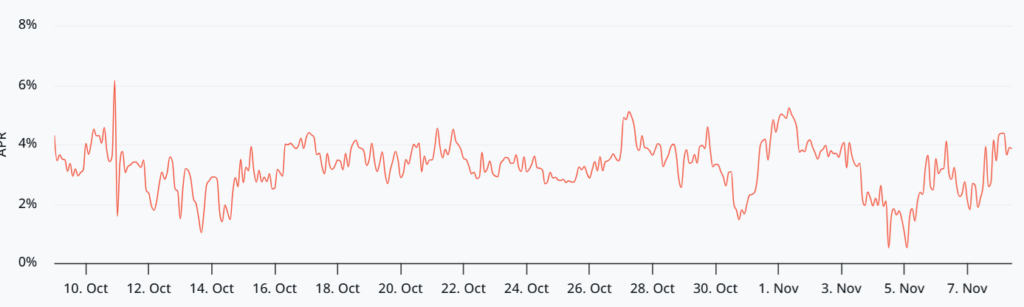

At the same time, Ethereum’s fundamentals have softened. The total value locked (TVL) in DeFi protocols has dropped 24% in 30 days to $74 billion, following a $120 million exploit on Balancer v2. DApp revenues fell 18% in October to $80.7 million, indicating reduced network activity and lower staking yields.

READ MORE:

Meanwhile, U.S.-listed ethereum spot ETFs recorded $507 million in outflows this month, highlighting declining institutional demand. This lack of inflows has weighed on sentiment, even as onchain metrics show slight improvement – active addresses rose 5%, and transactions increased 2% over the past week.

The next potential catalyst for ETH is the Fusaka upgrade, expected in early December, which aims to improve scalability and security. However, with risk appetite fading, derivatives markets softening, and institutional flows turning negative, analysts say Ethereum faces an uphill battle to reclaim the $3,900 level in the near term.

![]()