Whale Dump Spooks Bitcoin Bulls as Onchain Outflows Refuse to Let Up

Bitcoin's rally hits turbulence as whales cash out—again.

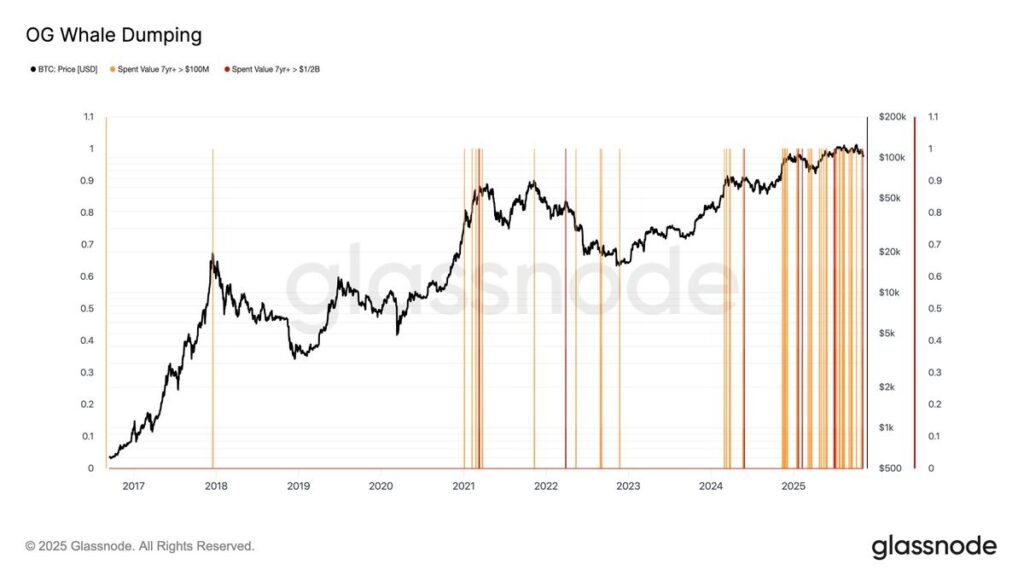

### The Great Whale Exodus

Big players are dumping bags, triggering domino-effect sell pressure. Onchain data shows relentless outflows—no 'buy the dip' cavalry in sight.

### Paper Hands or Smart Money?

Retail FOMO meets institutional skepticism. The crypto old guard mutters about 'overleveraged longs' while TradFi sharks circle for bargains.

### The Cynic's Corner

Another day, another 'healthy correction' narrative from crypto influencers—just ignore their leveraged long positions getting liquidated.

One major whale, identified by Lookonchain as “Bitcoin OG Owen Gunden,” recently3,600 BTC (around $372 million), including 500 BTC deposited to Kraken, potentially signaling active liquidation.

READ MORE:

However, not all analysts see these moves as outright selling. On-chain researcher Willy WOO suggested that some of the large transfers could be non-selling events, such as migrating funds to Taproot addresses for enhanced security or custody reshuffling among institutional treasuries.

Technically, Bitcoin’s price structure isn’t helping confidence. A break below the $100,650 support line could send BTC tumbling toward $89,600, representing a roughly 12% drop from current levels.

Analysts warn that Bitcoin must hold above its 50-week exponential moving average (EMA), currently near $100,900, to avoid a sharper correction toward $92,000 or lower.

While bitcoin remains resilient compared to previous cycles, the persistent movement of coins from the oldest wallets adds a layer of uncertainty – and for traders eyeing new highs, the actions of these early adopters may prove to be one of the biggest obstacles standing in the way.

![]()