Bitcoin Price Prediction: Time to Buy the Dip Before November Rally to $125K?

Bitcoin's recent dip has traders buzzing - is this the buying opportunity of the year before November's projected surge?

The $125K Target

Market analysts are pointing to historical patterns and institutional accumulation as key indicators. While traditional assets stumble, Bitcoin's fundamentals remain rock-solid. The upcoming halving cycle effects are just starting to manifest.

Institutional FOMO Meets Retail Panic

Wall Street's latest darling continues to attract serious capital while retail investors hesitate. Sound familiar? It's the same pattern we've seen before every major breakout. The smart money isn't waiting for perfect entry points - they're building positions now.

Technical Setup Screens Bullish

Key support levels held during the recent pullback, creating what technical analysts call a 'springboard' formation. Volume patterns suggest accumulation, not distribution. The charts are whispering what fundamentals are shouting.

November Catalyst Calendar

Multiple catalysts align for next month: institutional product launches, regulatory clarity milestones, and seasonal trends that have historically favored digital assets. The stars are aligning for what could be Bitcoin's most explosive month yet.

While traditional finance veterans clutch their pearls over volatility, crypto natives recognize this dance. It's the same hesitation that left many watching from the sidelines during previous cycles. The question isn't whether you should buy - it's whether you can afford not to.

Bitcoin, on the other hand, has shown relative resilience, maintaining a 1% loss on the week, according to CoinMarketCap data.

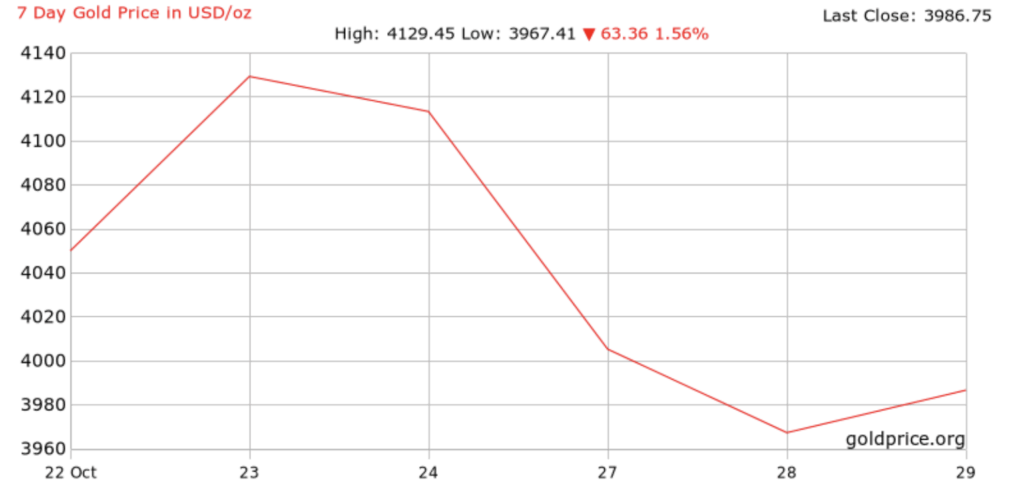

Experts point to the historical lead-lag relationship between the two stores of value, where a pause in gold often precedes a surge in Bitcoin, and vice versa. “Gold’s latest pullback reflects a partial easing of geopolitical tensions, trade frictions, and profit-taking,” said Tim Sun, Senior Researcher at HashKey Group.

This divergence has sparked speculation that Bitcoin may be poised for a rebound. Ryan McMillin, chief investment officer at crypto fund manager Merkle Tree Capital,, “The pause in gold’s momentum could give Bitcoin space to rally in a catch-up trade.” However, he cautioned that gold’s recent strength makes a swift rebound unlikely, suggesting a slower recovery process.

Historical Patterns Suggest a Gradual Recovery for Gold

Historical analysis supports this view. Data spanning 45 years shows that when gold drops 10% in six days, it typically takes around two months to recover, yielding an average return of 8.39%. Sun emphasized that the demand drivers for bitcoin and gold differ significantly: “Gold demand is dominated by sovereign wealth funds, central banks, and conservative asset managers. Bitcoin flows, by contrast, are still largely driven by ETFs and investors with higher risk appetite.”

Gold is down -10% over the past 6 days.

The past 10 times this happened, gold rallied every time over the next 2 months.

When bounce? 🤔 $GLD pic.twitter.com/B6WtiOZqQI

— Subu Trade (@SubuTrade) October 28, 2025

Despite gold’s short-term weakness, both analysts maintain a cautiously bullish outlook for Bitcoin. McMillin highlighted that the top cryptocurrency is entering a phase of growing institutional adoption and liquidity, which could fuel its next leg higher. Sun echoed this optimism, predicting a “range-higher” trajectory for Bitcoin supported by a gradual recovery in macro liquidity, while expecting gold to follow a “choppy, upward-sloping path” underpinned by widening global fiscal deficits and ongoing risk events.

As investors navigate these shifts, the contrasting performance of gold and Bitcoin underscores the evolving dynamics of traditional and digital stores of value, with market participants closely watching whether Bitcoin will capitalize on gold’s pause to assert its strength.

![]()