Mastercard’s $2 Billion Power Play: Buying Stablecoin Infrastructure Pioneer Zerohash

Payment giant makes boldest crypto move yet—acquiring the plumbing behind digital dollar transactions.

The Infrastructure Gambit

Mastercard isn't just dipping toes anymore—it's diving headfirst into the stablecoin revolution. This $2 billion acquisition snatches up the fundamental technology that makes digital dollars flow seamlessly across blockchain networks.

Beyond Plastic

The credit card behemoth recognizes what Wall Street still struggles with: the future of payments won't be plastic rectangles. Zerohash's infrastructure handles the unglamorous but critical work of settlement and compliance—the boring stuff that makes flashy crypto trades possible.

Strategic Positioning

While traditional finance debates blockchain merits, Mastercard just bought the highway system for digital currency. They're not waiting for regulatory clarity—they're building the roads everyone will eventually need to use.

Another case of established finance playing catch-up by writing checks rather than innovating—but hey, at least they're writing big ones.

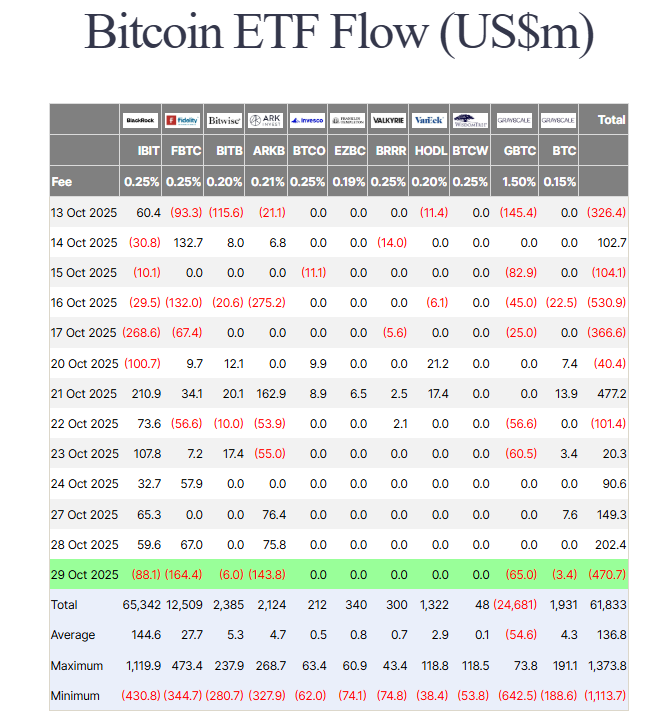

The setback came after a positive start to the week that saw roughly $350 million in combined inflows on Monday and Tuesday. Following Wednesday’s withdrawals, total net inflows across all U.S.-listed Bitcoin ETFs slipped to $61 billion, according to data from SoSoValue. Assets under management now stand NEAR $149 billion, equivalent to about 6.7% of Bitcoin’s market capitalization.

READ MORE:

The Fed’s decision to lower rates – its second consecutive cut – failed to lift risk appetite. Investors appear uncertain about how long monetary easing will continue amid persistent inflation concerns. Markets steadied later in the day after reports of a meeting between U.S.

President Donald TRUMP and Chinese President Xi Jinping, which hinted at potential progress on trade relations. Despite the day’s turbulence, Bitcoin ETFs remain a dominant force in institutional holdings, collectively managing more than 1.5 million BTC worth an estimated $169 billion. BlackRock’s IBIT continues to lead the group with over 805,000 BTC, trailed by Fidelity’s FBTC and Grayscale’s GBTC.

Market volatility has done little to dampen long-term Optimism among major Bitcoin backers. MicroStrategy chairman Michael Saylor reiterated his bullish view earlier this week, predicting that Bitcoin could reach $150,000 by the end of 2025 as adoption and institutional exposure deepen.

![]()