Bitwise’s Game-Changing Solana Staking ETF Set to Revolutionize Institutional Crypto Investment

Wall Street's crypto awakening just hit hyperdrive—Bitwise drops the institutional gateway drug they've been waiting for.

The Staking Revolution Goes Mainstream

Forget complicated validator setups and technical nightmares. Bitwise's new Solana ETF packages staking rewards into a clean, regulated wrapper that traditional finance actually understands. No more custody headaches, no more regulatory uncertainty—just pure yield capture wrapped in SEC-approved packaging.

Why This Changes Everything

Institutions have been circling crypto for years like nervous cats. They want the returns but fear the complexity. This ETF cuts through the noise, bypassing technical barriers that kept billions on the sidelines. Suddenly, pension funds and endowments can access Solana's staking yields without touching a private key.

The Institutional Floodgates

Watch the domino effect unfold. Once one major player dips in, the herd mentality kicks in. Portfolio managers who've been quietly researching crypto now have their compliance-approved entry point. The same crowd that waited for Bitcoin ETFs now gets their staking fix—Wall Street's version of having your cake and eating it too.

Because nothing gets traditional finance excited like finding new ways to collect yield while pretending they understand the technology behind it.

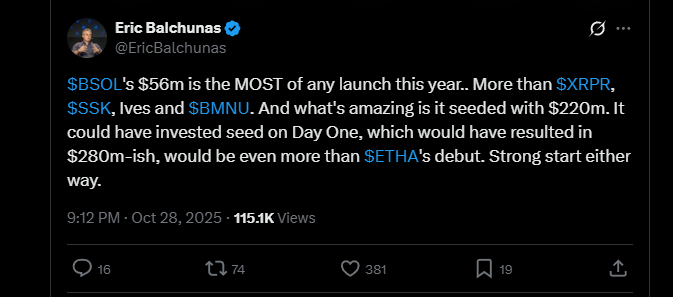

“Investors now receive not only the returns from Solana itself but also roughly 7% additional Solana per year, which functions similarly to a dividend in traditional finance,” Hougan said. The ETF’s launch involved $222 million in assets, representing over 1.1 million SOL tokens, and Bloomberg analyst Eric Balchunas noted it achieved the largest trading volume of any ETF debut in 2025.

READ MORE:

The regulatory environment in the U.S. was crucial to making staking ETFs possible. Hougan emphasized that under former SEC Chair Gary Gensler, even standard ethereum ETFs faced long delays, and staking functionality would have been “unthinkable.” Recent shifts in regulatory attitudes, however, cleared the way for more sophisticated proof-of-stake products.

The debut of BSOL, along with Grayscale’s Solana Trust ETF (GSOL), is seen as a proof-of-concept for staking-focused ETFs, potentially paving the way for other TradFi products that integrate proof-of-stake protocols. Hougan predicts that staking ETFs could soon become a primary method for investing in Solana globally, combining convenience, yield, and network support in one product.

![]()