Solana ETF Explosion: How High Will SOL Rocket After Historic Spot Approval?

Wall Street just opened the floodgates—Solana spot ETFs hit the market, and the crypto world is holding its breath for what comes next.

The Institutional Onslaught

Traditional finance finally caught up with what crypto natives knew all along. SOL's institutional debut sends shockwaves through portfolios that once dismissed blockchain as digital fairy dust. The real question isn't whether SOL will climb—it's how high the rocket fuel from regulated investment vehicles will propel this ecosystem.

Market Mechanics Unleashed

Spot ETFs don't just create demand—they fundamentally reshape supply dynamics. Every institutional dollar flowing in tightens available circulation while validating Solana's blistering transaction speeds and developer momentum. The same Wall Street suits who once called crypto a scam now scramble to explain yield projections to pension fund managers.

The Price Trajectory

Historical patterns from Bitcoin's ETF rollout suggest initial volatility followed by sustained upward pressure. But Solana's unique positioning—the speed demon of smart contract platforms—could amplify those effects exponentially. Watch for the classic finance sector cycle: denial, curiosity, FOMO, then frantic allocation adjustments.

Just remember—when your taxi driver starts asking about SOL price targets, the smart money has already been positioning for months. The beautiful irony of decentralized tech needing regulatory approval to go truly mainstream? Priceless.

How Bullish Are The Spot Solana ETFs?

The approval of spot Solana ETFs marks a major milestone for the broader crypto market, especially considering the key role that Bitcoin and ethereum ETFs played in triggering their rallies earlier this year.

Bitwise Asset Management’s BSOL ETF aims to stake 100% of its holdings, offering investors both price exposure and staking rewards within a regulated structure. This could dissuade sporadic selling pressure on SOL.

On its first day of trading, BSOL recorded around $56 million in trading volume, the highest opening-day figure of any ETF launch this year. Notably, this does not include the $220 million in seed capital that was deployed prior to launch.

Analysts at JPMorgan estimate that Solana ETFs could attract between $3 billion and $6 billion in inflows over the next 12 months, a figure that WOULD represent a meaningful portion of Solana’s total market capitalization.

🚨 According to analysts, new Solana-staking ETF could attract up to $6B in inflows within its first year – a wave of capital that could help fuel a potential $SOL rally to $400+, backed by strong demand and bullish technicals 🚀 https://t.co/wmlovliBr8 pic.twitter.com/ZPhpXwn5oy

— Solana Daily (@solana_daily) October 28, 2025

This potential influx of institutional funds could tighten supply and amplify price momentum if broader market conditions remain favourable.

Adding to the bullish outlook, Fidelity has now enabled direct Solana purchases for its 45 million U.S. brokerage clients, giving retail investors seamless access to the token through familiar channels.

With ETF inflows, staking incentives, and retail access all converging, the outlook for Solana appears stronger than ever.

Solana Price Prediction: How High Can SOL Go?

Solana is showing renewed strength after bouncing from a major support zone NEAR $189, where on-chain data suggests over 24.5 million SOL were accumulated by investors. This accumulation zone has now become a critical area to watch as bullish sentiment builds around the asset.

The recent approval of Solana spot ETFs and Fidelity’s decision to enable direct Solana purchases for its 45 million U.S. brokerage clients have both added momentum to the rally.

Technical strategist Jelle noted that Solana has successfully defended its key support once again and looks ready for a “cracking end to the year,” maintaining a target of $600.

Solana Meme Coins In High Demand, Snorter Tipped As The Next 10x Crypto

Solana-based meme coins are acting as high beta plays for SOL, often amplifying its moves during bullish phases. Among these, Snorter (SNORT) has quickly caught the market’s attention following its strong presale performance, where it raised more than $5.5 million in short order.

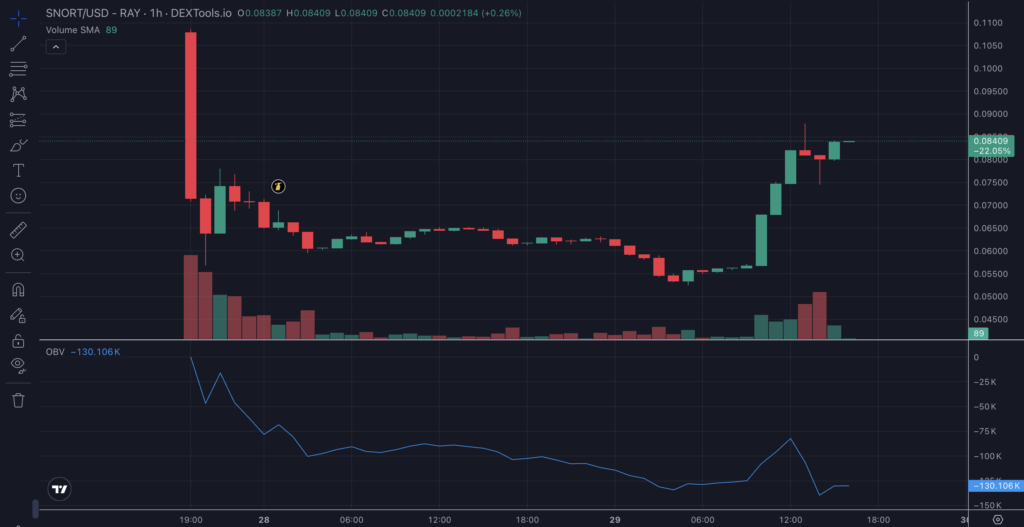

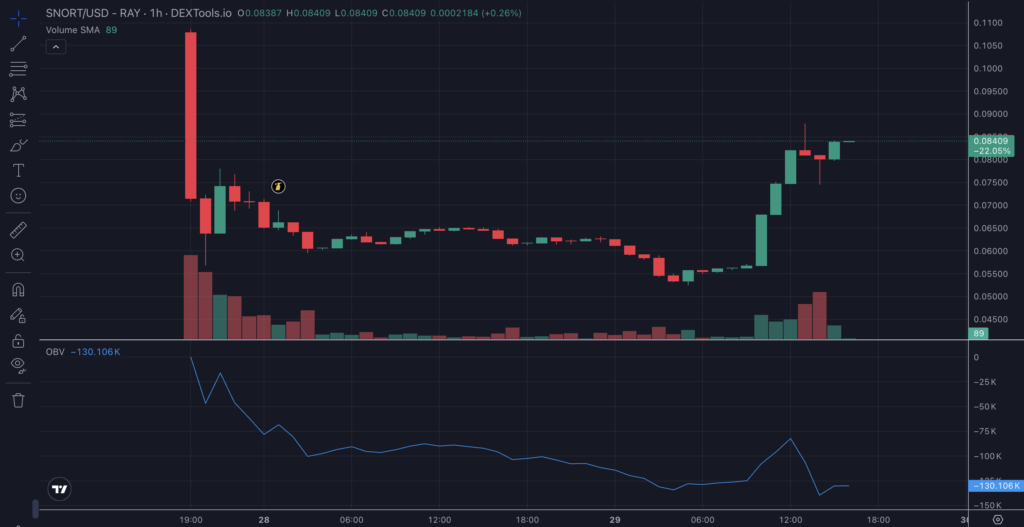

SNORT’s open market performance is no less impressive than its presale performance.

After an initial correction, the token has formed a local bottom and is now pushing towards a new all-time high. It is already up by 55% from today’s low, trading at $0.084 with a market cap of $2.02 million.

The price chart shows SNORT forming a base after touching lows near $0.052, with recent candles suggesting accumulation and an early reversal pattern taking shape. If sustained, this could mark the bottom for the token’s first trading phase.

Snorter powers a full-stack Telegram sniper bot built natively on Solana.

Among other low-cap altcoins, bitcoin Hyper has emerged as another attractive buy. Following a string of six-figure investments from whales, it has already raised over $25 million in its ICO.

Being the newest BTC layer-2 coin, it is no surprise that HYPER is being viewed as a high upside altcoin. In fact, another BTC layer-2 token Stacks (STX) has a peak valuation of over $5 billion.

Notably, Bitcoin Hyper is also a part of the Solana ecosystem. Firstly, its architecture is powered by the Solana VIRTUAL Machine. Moreover, SOL holders are allowed to directly purchase HYPER during its ongoing presale by just swapping.

As a result, HYPER is expected to benefit from Solana’s upcoming rally, with many calling it the next 10x crypto.

Buy Bitcoin Hyper

![]()