Bitcoin’s Next Big Move: Fed Policy and Global Trade Developments Hold the Keys

Bitcoin's fate hangs in the balance as central bankers and trade negotiators pull the strings.

The Fed's Tightrope Walk

Every interest rate whisper from the Federal Reserve sends shockwaves through crypto markets. Bitcoin traders watch the dot plot like hawks—knowing one wrong move could trigger a cascade of liquidations or fuel the next rally.

Global Trade Winds Shift

Supply chain disruptions, tariff talks, and geopolitical tensions create the perfect storm for Bitcoin's narrative as digital gold. When traditional corridors clog up, crypto flows accelerate—bypassing decades-old financial gatekeepers.

The Institutional Dance

Wall Street's embrace cuts both ways. ETF approvals bring liquidity but also tie Bitcoin's performance closer to traditional market sentiment. The very decentralization purists champion gets tested when BlackRock's moves move markets more than Satoshi's whitepaper.

So while economists debate inflation targets and trade deficits, Bitcoin quietly builds its case as the hedge against their collective uncertainty—proving once again that the most interesting monetary policy happens outside marble-columned buildings.

Bulls Face Stiff Resistance

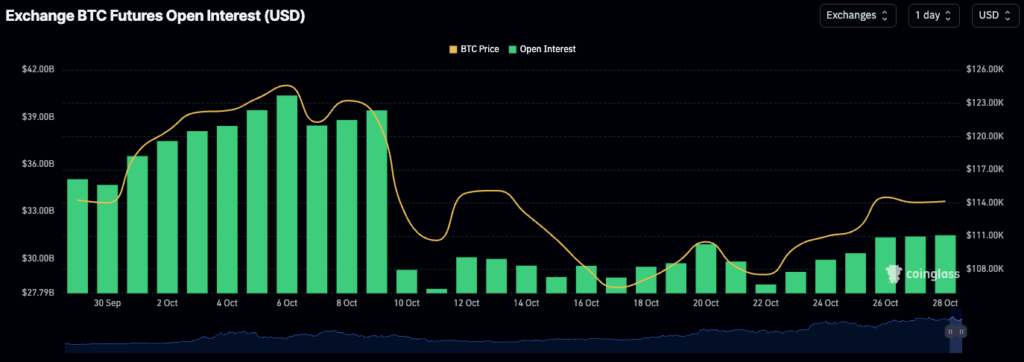

Despite the recent rebound, Bitcoin’s upward MOVE remains fragile. Global open interest has recovered to $31.5 billion, well below its October peak above $40 billion, signaling that traders are still cautious. Data from CoinGlass shows a clear split between retail and institutional behavior – smaller investors continue to buy dips, while large players are using rallies to reduce exposure.

Spot Bitcoin ETFs, however, tell a different story. Net inflows have turned positive again, with over $260 million added in the past three sessions and nearly half a billion flowing in on Oct. 21, shortly after BTC dipped below $108,000.

READ MORE:

Awaiting the Fed and Global Signals

Markets are largely expecting the Federal Reserve to cut rates by 25 basis points, but crypto traders have been quick to scale back risk ahead of the announcement – a familiar pattern before FOMC meetings. Many are also keeping an eye on Thursday’s scheduled meeting between US President Donald Trump and Chinese President Xi Jinping.

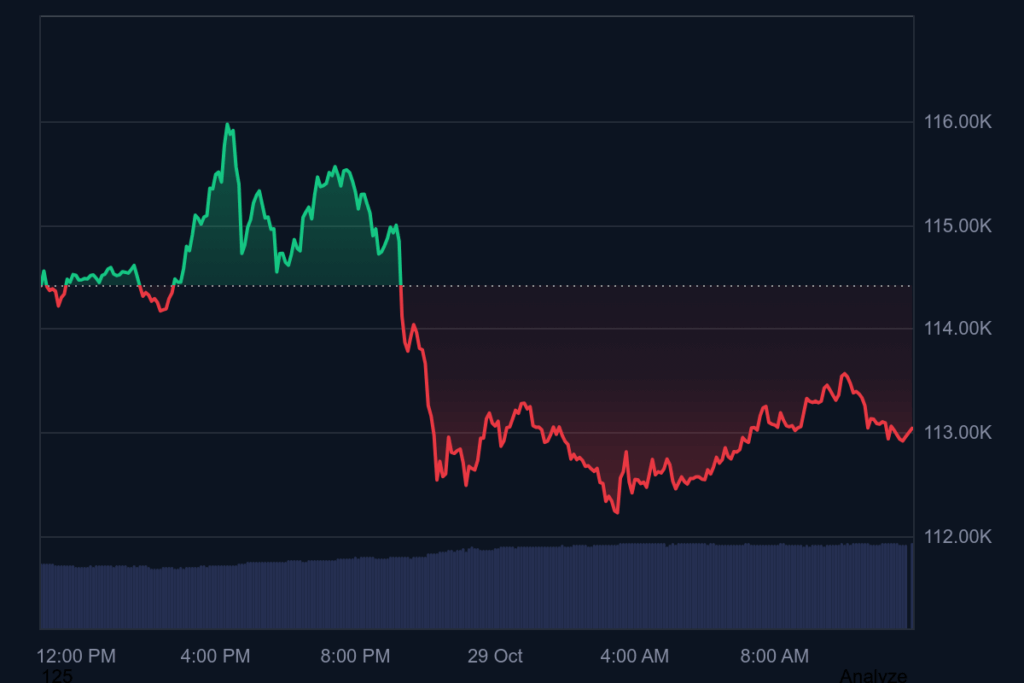

A favorable outcome could reignite bullish sentiment, but if trade talks stumble, both equities and crypto could face a sharp pullback. Until then, analysts expect bitcoin to stay locked in its current range between $110,000 and $116,000 – a pattern of uncertainty until the week’s major events play out.

At the time of writing, Bitcoin is trading NEAR $113,000, marking a 1.3% decline over the past 24 hours.

![]()