Bitcoin Under Pressure: Political Turmoil Meets Whale Short Squeeze - What’s Next?

Bitcoin faces renewed selling pressure as Washington drama and institutional positioning collide.

The Perfect Storm

Political uncertainty rattles crypto markets while whale accounts pile into short positions - creating a classic battle between fear and opportunity. Washington's latest circus act sends traditional investors scrambling, but crypto veterans know this dance all too well.

Whale Watching Intensifies

Major holders increasing short exposure signals either sophisticated hedging or outright bearish sentiment. Either way, it's creating volatility that would make your average stock trader need a stiff drink.

Market Mechanics in Play

When political chaos meets coordinated shorting, you get the kind of price action that separates diamond hands from paper hands. The same institutions that once mocked crypto now can't stop trading it - funny how that works.

Bottom Line: Temporary turbulence or fundamental shift? History suggests Bitcoin has weathered worse - and come out stronger every time.

Bitcoin Faces Pressure from Whale Selling and Macro Jitters

Bitcoin Faces Pressure from Whale Selling and Macro Jitters

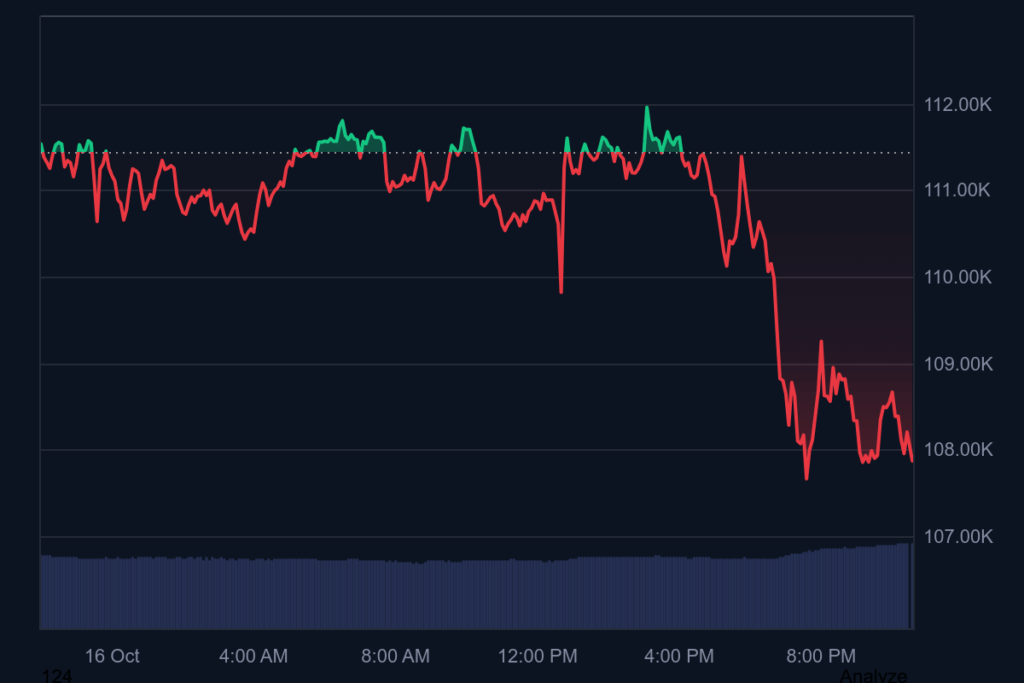

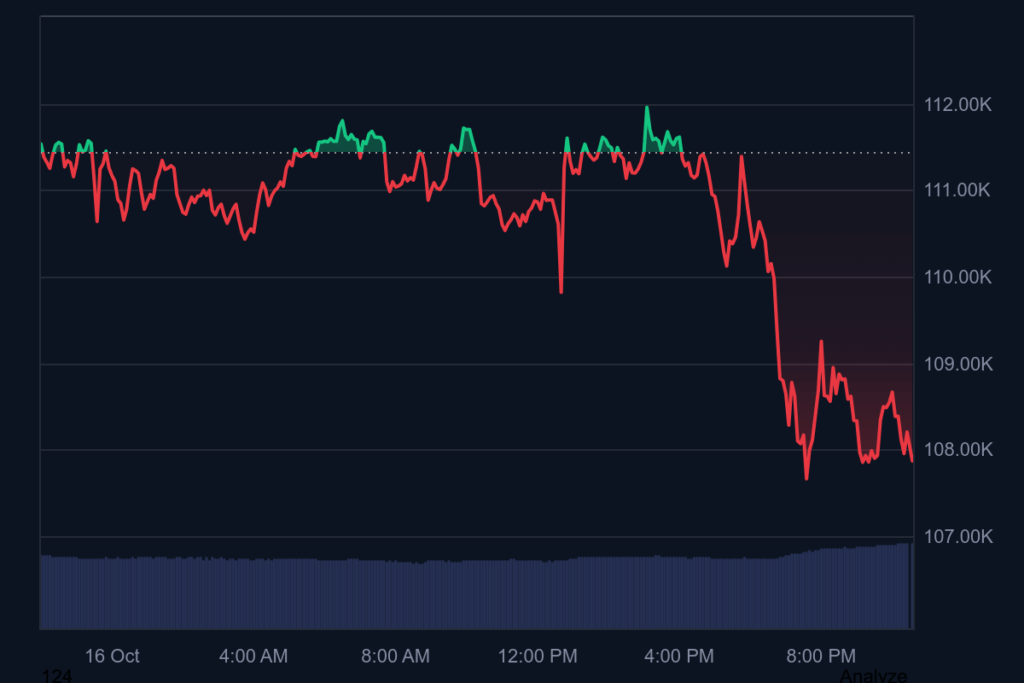

Technically, Bitcoin’s daily chart shows weakening momentum, with the $110,000 mark now acting as resistance. A close below $108,000 could open the door to $105,000 if broader sentiment deteriorates. Trading volume remains elevated around $80 billion, suggesting heavy repositioning by both retail and institutional investors.

At the time writing Bitcoin is trading at $107,900.

![]()