Market Washout Sets Stage for Ethereum’s Explosive Next Rally

Clearing the decks for ETH's next major move

The Great Crypto Purge

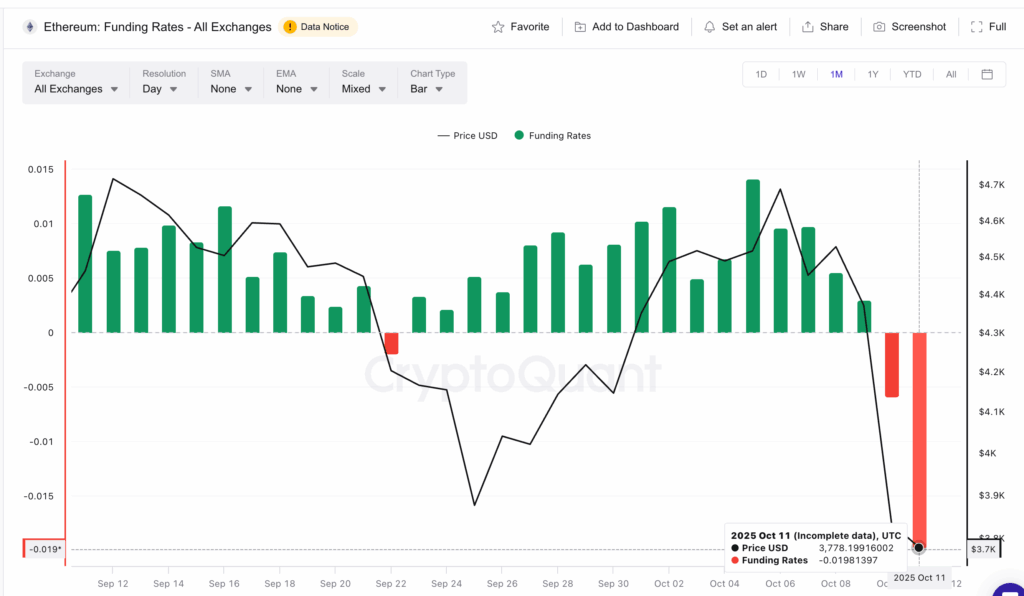

Market corrections aren't just painful—they're necessary. The recent washout swept away weak hands and overleveraged positions, creating the perfect foundation for Ethereum's next upswing. Think of it as spring cleaning for blockchain assets.

Ethereum's Reset Button

While paper hands panic, smart money recognizes opportunity. This consolidation phase mirrors previous setups that preceded ETH's most dramatic rallies. The fundamentals haven't changed—if anything, they've strengthened through the turbulence.

Timing the Comeback

History doesn't repeat, but it often rhymes. Current technical patterns suggest we're approaching the inflection point where accumulation turns into acceleration. The same traders who fled to 'safe' assets will soon be chasing ETH's momentum—typical Wall Street behavior, always late to the party.

Get ready—the smart money is already positioning for Ethereum's next leg up while traditional finance debates whether crypto is 'real.'

Meanwhile, the taker buy ratio, a measure of real-time market demand, has climbed from 0.47 to 0.50, suggesting that buying pressure is beginning to meet selling volume again. A similar setup last month preceded a 13% rally in Ethereum.

READ MORE:

If ethereum holds above $3,430, the structure for a recovery remains intact. A decisive move above $3,810 could confirm strength, potentially opening the door toward $4,280 – a roughly 13% upside from current levels. A drop below $3,350, however, would nullify the setup and hand control back to sellers.

After one of the year’s most volatile trading sessions, Ethereum may have found the conditions it needs for a sharp rebound – not because sentiment is bullish, but precisely because it isn’t.

![]()