Corporate Bitcoin Buying Spree: Q3 2025 Reveals Massive BTC Accumulation by Public Companies

Wall Street's digital gold rush hits unprecedented levels as quarterly filings expose staggering Bitcoin acquisitions.

The Corporate Treasury Transformation

Public companies are diving headfirst into cryptocurrency reserves, treating Bitcoin not as speculation but as strategic treasury assets. The Q3 numbers tell a story of institutional conviction that would make even the most skeptical banker raise an eyebrow.

Balance Sheet Revolution

Quarter after quarter, the pattern repeats—established corporations allocating significant capital to digital assets. They're not just dipping toes anymore; they're building entire swimming pools of Bitcoin exposure.

The Regulatory Dance

While accounting standards struggle to keep pace with crypto innovation, companies are finding creative ways to navigate the compliance landscape. Because nothing says 'financial prudence' like explaining Bitcoin volatility to shareholders during earnings calls.

The corporate embrace of Bitcoin continues accelerating—proving that when it comes to money, even the most traditional institutions eventually follow where the smart capital flows.

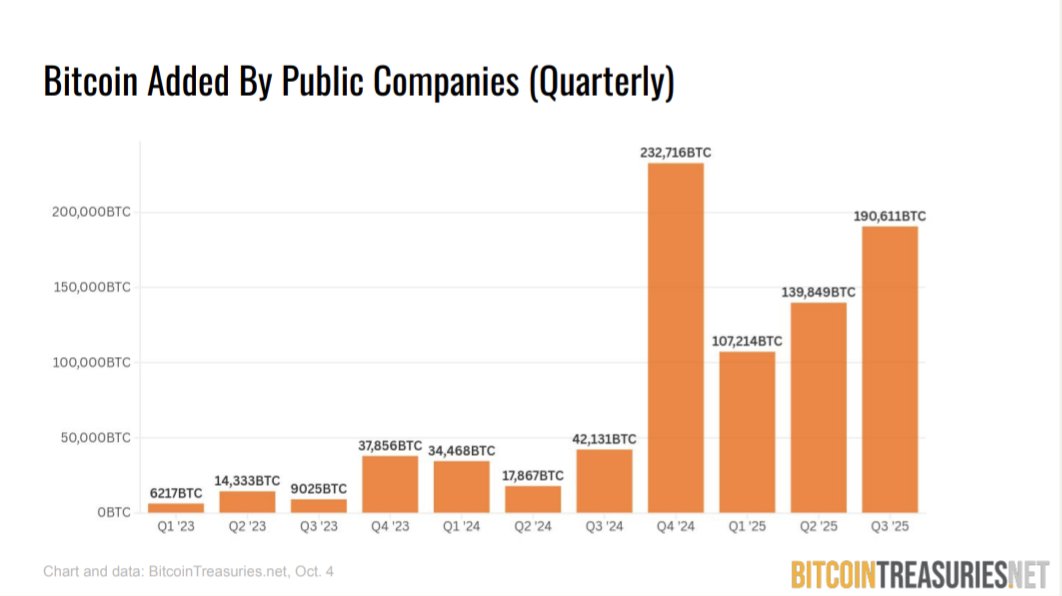

The chart shows a clear acceleration over the past year: corporate holdings grew from 107,214 BTC in Q1 2025 to 139,849 BTC in Q2, culminating in the near-200K surge this quarter.

Analysts note that the rise coincides with increasing treasury diversification by major U.S. and Asian firms, as well as Bitcoin’s integration into corporate balance sheets as a strategic hedge against inflation and fiat depreciation.

READ MORE:

This continued wave of corporate accumulation places Bitcoin’s adoption curve on par with early institutional phases of Gold and tech equities, reinforcing its status as a mainstream asset class for treasury reserves.

![]()