Bitcoin Sentiment Split as $70K–$100K Predictions Explode, Santiment Reveals

Bitcoin's psychological battlefield heats up as analysts clash over the digital gold's trajectory.

The Great Divide

Market sentiment fractures down the middle—bulls see clear skies toward six figures while bears warn of storm clouds gathering. Santiment's latest data shows traders can't agree whether we're witnessing a prelude to new highs or a classic crypto correction.

Price Prediction Wars

The $70,000–$100,000 forecast range dominates conversations, creating tension between institutional optimism and retail skepticism. Every whale movement gets overanalyzed while traditional finance veterans watch from the sidelines—still trying to understand why anyone would choose decentralized math over their perfectly good centralized banks.

Market Psychology Unpacked

Fear and greed dance their eternal tango as volatility returns. The same data points spark opposite conclusions across trading desks worldwide. One analyst's breakout pattern is another's bull trap setup.

Where's the smart money really flowing? Follow the blockchain, not the headlines—the truth usually hides in plain sight between the polarized takes.

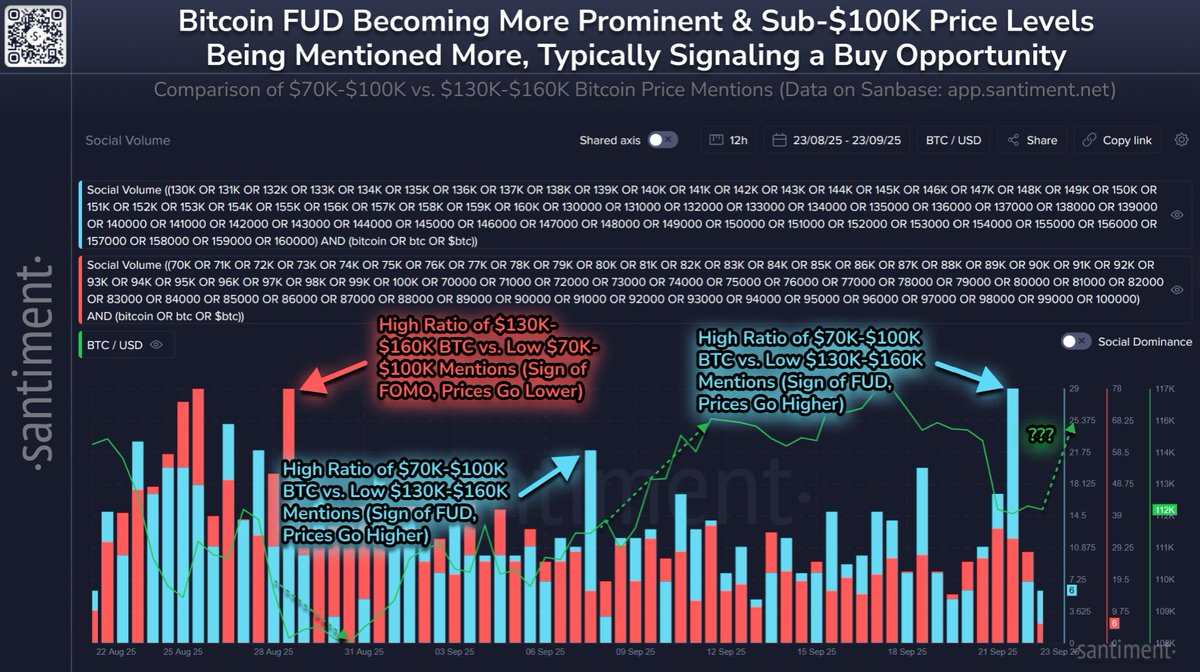

Sub-$100K calls dominate chatter

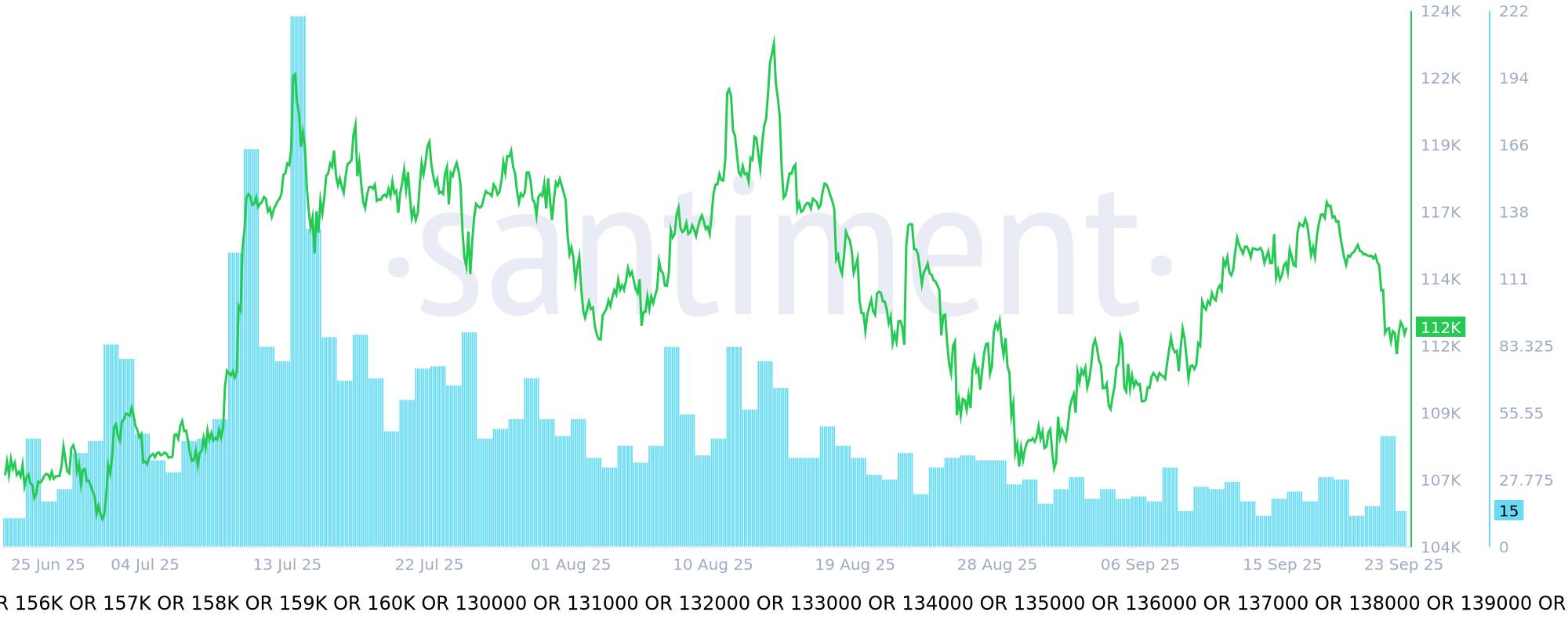

Charts tracking social volume show a growing share of commentary focused on Bitcoin falling below six figures. Mentions of $70K to $100K have been outpacing bullish calls, a pattern Santiment interprets as a form of fear, uncertainty, and doubt (FUD). This type of crowd anxiety, the firm suggests, can often signal buying opportunities as pessimism peaks.

When social sentiment leans heavily toward bearish predictions, traders historically see an increased probability of upward price reactions as markets look to move against the majority’s expectations.

Retail impatience builds

In a separate update, Santiment pointed to rising bearishness among retail traders. Many smaller investors have shown impatience with recent sideways action, leading to an uptick in negative commentary online. The firm argues that this type of behavior often marks a washout of weaker hands, setting the stage for larger players to drive the next breakout.

“The latest trend shows a high amount of impatience and bearishness emerging from the retail crowd,” Santiment wrote. “This is a strong sign if you’ve been patiently awaiting a breakout as other small traders drop out.”

Fear vs greed: a balancing act

Bitcoin’s market psychology has long been influenced by the tug-of-war between fear and greed. Santiment’s data highlights this cycle: periods of extreme Optimism often precede corrections, while moments of fear and frustration have historically given way to renewed rallies.

READ MORE:

Right now, the skew toward bearish predictions under $100K, combined with falling retail confidence, may be forming the type of setup that contrarian traders look for. If history rhymes, the combination of FUD and weak retail positioning could offer a favorable entry point.

What to watch next

- Price levels: If bearish calls continue to dominate, Bitcoin could see upward pressure as contrarian forces step in.

- Retail capitulation: A further drop in small trader participation might clear the way for institutional flows.

- Social volume ratios: Tracking the balance between bullish $130K–$160K calls and bearish $70K–$100K calls remains a key leading indicator.

As of now, the data suggests that despite noisy predictions, the market may be setting up for a move that defies the retail crowd’s expectations. Traders looking for signals may find that the loudest fears often mark the quiet start of recovery.

![]()