Ethereum Price Prediction 2025: Will ETH Hit $5,000 Amid Technical Consolidation and Upgrade Catalysts?

- What's the Current Technical Setup for Ethereum?

- How Are Market Sentiment and Fundamentals Shaping ETH's Trajectory?

- What Key Price Levels Should Traders Watch?

- How Might the Fusaka Upgrade Impact Ethereum's Price?

- What Are the Contradictory On-Chain Signals Telling Us?

- Could Ethereum Really Reach $5,000 or Even $10,000?

- What Trading Strategies Are Emerging for ETH?

- How Does Ethereum Compare to Other Cryptocurrencies in September 2025?

- Ethereum Price Prediction: The Verdict

- Ethereum Price Prediction FAQs

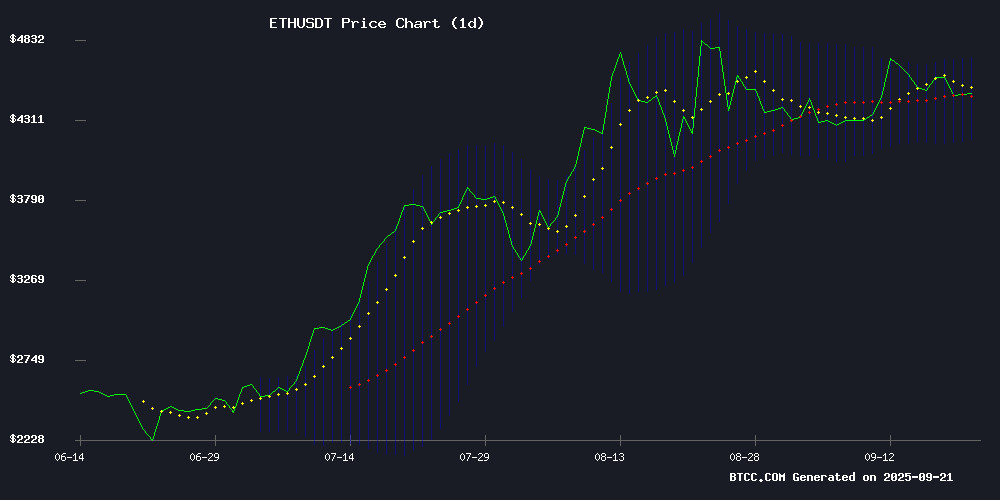

As of September 21, 2025, Ethereum (ETH) is trading at $4,473.16, showing signs of technical consolidation near key moving averages while facing both bullish and bearish pressures. The cryptocurrency finds itself at a critical juncture, with the upcoming Fusaka upgrade in December creating positive momentum while validator exits and long-term holder distribution raise concerns. This comprehensive analysis examines ETH's technical setup, fundamental catalysts, and potential price trajectories through the lens of market data and expert commentary.

What's the Current Technical Setup for Ethereum?

Ethereum's price action reveals a textbook consolidation pattern as of September 2025. The asset is currently trading slightly above its 20-day moving average ($4,449.72), suggesting this level may serve as immediate support. The MACD indicator shows bearish momentum at -86.90, though the narrowing gap with its signal line (-21.41) hints at weakening downward pressure.

Bollinger Bands paint an interesting picture - with price action hugging the middle band while upper resistance sits at $4,714.01 and lower support at $4,185.43. This creates a well-defined trading range that ETH has respected throughout September. The compression of these bands suggests volatility may be coming soon.

The BTCC research team notes: "Ethereum appears to be building a base around $4,400. A sustained break above the 20-day MA could trigger momentum toward the upper Bollinger Band, while failure to hold this support might test the $4,185 lower band."

How Are Market Sentiment and Fundamentals Shaping ETH's Trajectory?

Ethereum faces a complex sentiment landscape in late 2025. The anticipated Fusaka upgrade scheduled for December 3 has developers and investors buzzing about potential network improvements, including optimized data verification and increased gas limits. Historically, such upgrades have served as bullish catalysts despite short-term volatility.

However, blockchain data reveals conflicting signals. Glassnode reports Ethereum's Liveliness metric hitting a year-to-date high of 0.704, indicating increased selling from long-term holders. Meanwhile, accumulating addresses now hold 28 million ETH - more than double their June holdings - marking the steepest accumulation wave since 2018.

This creates what analysts call a "tug-of-war" scenario between profit-taking veterans and institutional newcomers. The validator exit queue crossing 2.6 million ETH (worth $12 billion) with a 44-day wait time adds another LAYER of complexity to ETH's near-term outlook.

What Key Price Levels Should Traders Watch?

| Price Level | Significance | Probability |

|---|---|---|

| $4,185 | Strong Support (Lower Bollinger Band) | High |

| $4,450 | 20-Day Moving Average | Medium |

| $4,714 | Upper Resistance (Bollinger Band) | Medium |

| $5,000 | Psychological Resistance | Low-Medium |

Noted analyst Michael van de Poppe identifies $3,600-$3,800 as a potential accumulation zone should current supports fail, while the $4,200 level remains crucial for maintaining bullish structure. The formation of a cup-and-handle pattern could develop if ETH holds above its 50-day SMA.

How Might the Fusaka Upgrade Impact Ethereum's Price?

Scheduled for December 2025, the Fusaka upgrade represents Ethereum's next major protocol enhancement, featuring 12 EIPs aimed at optimizing network performance. Key improvements include:

- Partial data blob verification for validators (reducing hardware requirements)

- Expanded blobspace capacity for Layer-2 solutions

- Increased gas limits for improved throughput

Testnet deployments throughout October will precede the mainnet launch, creating potential volatility events. Christine D. Kim noted in her analysis of the ACDC #165 developer call that "the upgrade transforms capital allocation calculus," suggesting long-term bullish implications despite possible short-term price fluctuations.

What Are the Contradictory On-Chain Signals Telling Us?

Ethereum's on-chain metrics present a fascinating dichotomy in September 2025. While long-term holders appear to be distributing their holdings (as shown by the rising Liveliness metric), institutional players are accumulating ETH at rates not seen since 2018.

The validator exit queue has reached unprecedented levels, with 2.6 million ETH waiting to unstake. Some analysts interpret this as potential selling pressure, while others suggest it may represent institutional players rotating between staking providers rather than exiting positions entirely.

Vitalik Buterin defended the validator queue mechanism, comparing it to military discipline: "An army cannot hold together if any percent of it can suddenly leave at any time." This design choice, while frustrating for some users, helps maintain network stability during periods of high volatility.

Could Ethereum Really Reach $5,000 or Even $10,000?

The path to $5,000 requires ETH to overcome several technical and psychological barriers. The immediate challenge lies at $4,700 (upper Bollinger Band resistance), followed by the round-number resistance at $5,000.

Several factors could propel ETH higher:

- Successful implementation of Fusaka upgrade in December

- Continued institutional accumulation reducing available supply

- Growing DeFi adoption and Layer-2 ecosystem expansion

- Potential approval of additional Ethereum ETF products

More bullish analysts point to Ethereum's position outside bubble territory on the Rainbow Chart, with the $9,000-$10,000 range emerging as a potential target in future market cycles. However, this WOULD require favorable macroeconomic conditions and sustained network growth.

What Trading Strategies Are Emerging for ETH?

The current market conditions have given rise to several popular trading approaches:

- Range Trading: Buying near $4,200 support and selling near $4,700 resistance

- Breakout Strategy: Waiting for confirmed break above $4,700 with volume before entering positions

- Upgrade Play: Accumulating ahead of Fusaka testnet deployments in October

- Institutional Follow: Tracking accumulation patterns of large holders

Algorithmic traders have developed specific strategies around the expected volatility compression during Fusaka's testnet phase, creating potential entry points for disciplined investors.

How Does Ethereum Compare to Other Cryptocurrencies in September 2025?

While ethereum consolidates, several ETH-based projects are making waves. MAGACOIN FINANCE's presale has surpassed $13.5 million, demonstrating continued interest in the Ethereum ecosystem. Grvt, a privacy-focused decentralized exchange, recently raised $19 million in Series A funding to address onchain finance challenges.

MetaMask's rumored native token development adds another layer of interest, with Consensys CEO Joe Lubin confirming progress toward decentralization of the popular wallet. The already-launched MetaMask USD (mUSD) stablecoin has reached a $53 million market cap since its introduction.

Ethereum Price Prediction: The Verdict

Ethereum finds itself at a crossroads in September 2025. The technical setup suggests consolidation within a $4,185-$4,714 range in the NEAR term, with the potential for breakout volatility as the Fusaka upgrade approaches.

Fundamentally, the network continues to evolve with meaningful upgrades, while on-chain data reveals both accumulation and distribution occurring simultaneously. This creates a complex but potentially rewarding environment for traders and investors.

A successful break above $4,700 could open the path to $5,000, though this requires resolving the current MACD bearish divergence and sustaining above the 20-day MA. Conversely, failure to hold $4,200 support might see ETH test lower levels around $3,800 before finding stronger bids.

This article does not constitute investment advice.

Ethereum Price Prediction FAQs

What is Ethereum's current price as of September 2025?

As of September 21, 2025, Ethereum (ETH) is trading at $4,473.16, showing consolidation near its 20-day moving average of $4,449.72 according to TradingView data.

When is the Fusaka upgrade scheduled?

Ethereum developers have tentatively scheduled the Fusaka upgrade for December 3, 2025, with testnet deployments throughout October.

What are the key support and resistance levels for ETH?

Key levels include support at $4,185 (lower Bollinger Band) and $4,200 (psychological support), with resistance at $4,700 (upper Bollinger Band) and $5,000 (psychological resistance).

Why are validators exiting Ethereum in large numbers?

The validator exit queue has reached 2.6 million ETH due to potential rotations between staking providers and some profit-taking, though Vitalik Buterin maintains this design preserves network stability.

Could Ethereum reach $10,000?

While $5,000 appears more likely in the near term, some analysts suggest $10,000 could be possible in future market cycles if adoption continues and macroeconomic conditions improve.