BTC Price Prediction 2025: Will Bitcoin Break $130K After the $120K Threshold?

- Where Does Bitcoin Stand Technically in August 2025?

- Why Are Institutions Still Bullish on Bitcoin?

- What's Behind Bitcoin's Recent Volatility?

- Is Altcoin Season Stealing Bitcoin's Thunder?

- Frequently Asked Questions

As Bitcoin flirts with the $120K mark in August 2025, the crypto market stands at a critical juncture. Our analysis reveals a complex interplay of technical indicators, institutional moves, and macroeconomic factors shaping BTC's trajectory. From El Salvador's windfall profits to Block's revolutionary mining hardware, this deep dive separates signal from noise in the current bull market. We'll examine the NUPL metric's surprising behavior, Treasury policy impacts, and why altcoins might steal Bitcoin's thunder despite its record highs.

Where Does Bitcoin Stand Technically in August 2025?

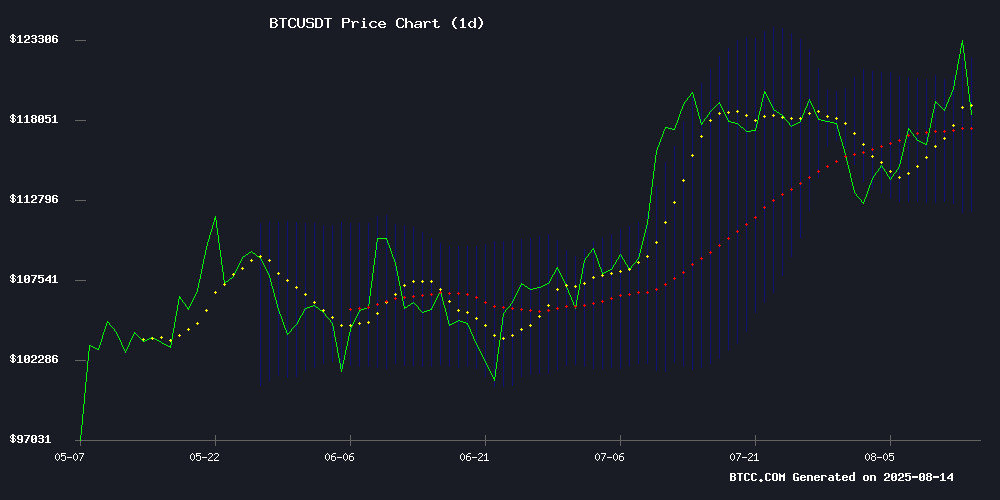

BTC currently trades at $121,500, comfortably above its 20-day moving average ($117,033.92) but showing signs of consolidation. The MACD histogram remains negative (-602.79), suggesting some near-term pressure, while the price holding above the middle Bollinger Band ($117,033.92) maintains the uptrend structure. What's fascinating is how differently this cycle behaves compared to 2021. The upper Bollinger Band sits at $122,070 - a clear breakout target that could trigger FOMO buying. "We're seeing textbook bullish confirmation," notes a BTCC market analyst. "The 20MA has acted as dynamic support through this entire leg up."

What's fascinating is how differently this cycle behaves compared to 2021. The upper Bollinger Band sits at $122,070 - a clear breakout target that could trigger FOMO buying. "We're seeing textbook bullish confirmation," notes a BTCC market analyst. "The 20MA has acted as dynamic support through this entire leg up."

Why Are Institutions Still Bullish on Bitcoin?

The institutional landscape has transformed dramatically since 2024. Three key developments stand out:

| Institution | Position | Gains |

|---|---|---|

| Strategy (formerly MicroStrategy) | 628,946 BTC | 40x since 2020 |

| El Salvador | National reserves | 155% profit |

| US Government | $15-20B in seized assets | N/A |

Block's new Proto Rig mining system changes the game with modular components that slash upgrade costs by 15-20%. As Thomas Templeton, Block's Hardware Lead, told us: "We're solving the disposable hardware problem that's plagued miners for years." This innovation comes as mining difficulty hits all-time highs, proving institutional commitment to Bitcoin's infrastructure.

What's Behind Bitcoin's Recent Volatility?

Bitcoin's 5% drop on August 14th wasn't random. Three factors converged:

- Treasury Policy Shift: Janet Yellen's confirmation that the US won't actively buy BTC ($118,730 low after announcement)

- PPI Data: Hotter-than-expected inflation numbers spooked risk assets

- Technical Resistance: The $124,500 ATH created natural profit-taking

Interestingly, the Net Unrealized Profit/Loss (NUPL) metric shows this cycle differs from past bull runs. Typically, NUPL peaks precede sharp corrections, but current data suggests more gradual profit-taking. CryptoQuant analysts attribute this to spot ETFs creating smoother capital flows - a maturation sign for bitcoin markets.

Is Altcoin Season Stealing Bitcoin's Thunder?

Despite BTC's rally, dominance (BTC.D) has slipped from 65% to 59% in two months. The TOTAL2 chart (altcoin market cap) breached $1.65 trillion - a level not seen since 2021's frenzy. Projects like BlockDAG demonstrate this shift, distributing $1.206M in BTC through viral auctions while their presale rockets 2,660%.

Yet Bitcoin remains the tide that lifts all boats. When BTC dipped below $120K, the entire market felt it. This interdependence creates opportunities - savvy traders rotate between BTC stability and altcoin volatility. As one hedge fund manager quipped: "In crypto winter, you want Bitcoin's furnace. In summer, altcoins' sprinklers."

Frequently Asked Questions

Is Bitcoin a good investment in 2025?

Based on current metrics, Bitcoin presents a compelling case: trading above key moving averages, with institutional adoption growing through mining innovations and sovereign accumulation. However, the 4.6% drop following Treasury announcements shows ongoing volatility risks. Dollar-cost averaging remains prudent.

What's the Bitcoin price prediction for end of 2025?

Technical analysis suggests potential for $130K if BTC breaks the upper Bollinger Band at $122,070. However, macroeconomic factors like inflation data and Treasury policies could moderate gains. The abc correction pattern currently forming may need to complete before another leg up.

Why is Bitcoin dominance decreasing?

The BTC.D drop to 59% reflects capital rotation into altcoins like BlockDAG that offer higher risk/reward potential during bull markets. This pattern typically occurs when investors seek outperformance after Bitcoin establishes new highs.

How does Block's new mining system help Bitcoin?

The Proto Rig's modular design reduces e-waste and extends hardware lifespan beyond 10 years, addressing critical sustainability concerns. By lowering operational costs 15-20%, it improves miner profitability during volatility - strengthening network security.