XRP Price Prediction 2025: $4.80 Target in Play as Bullish Signals Converge

- Why Is XRP Price Surging in 2025?

- Key Technical Indicators Signaling XRP Strength

- Fundamental Catalysts Driving XRP Demand

- XRP Price Targets and Key Levels to Watch

- Risks and Challenges for XRP Bulls

- XRP Price Prediction FAQ

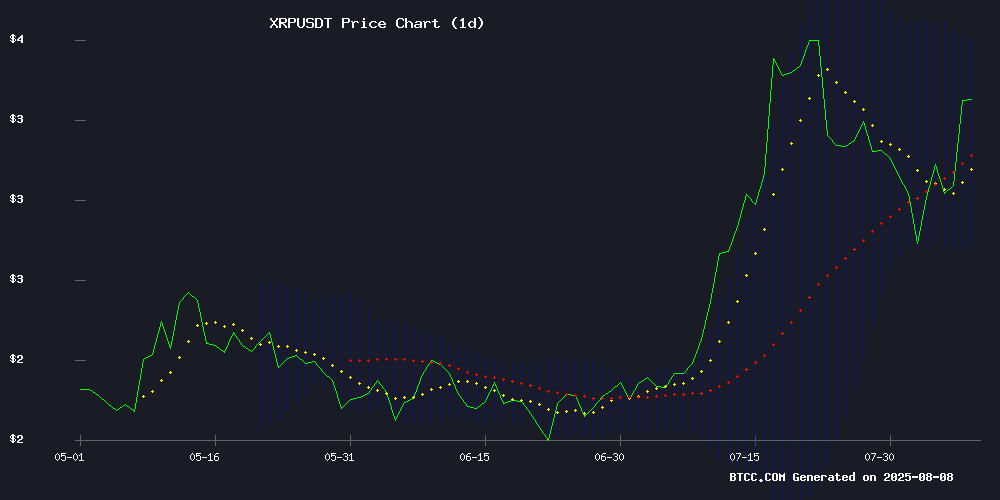

XRP is flashing its strongest bullish signals in years as technical indicators align with fundamental catalysts. Currently trading at $3.30, the digital asset shows potential for a 45% surge toward $4.80 if key resistance levels break. The BTCC research team analyzes critical developments including Ripple's SEC settlement, Japan's XRP ETF filing, and the strategic Rail acquisition that could reshape stablecoin markets. Our technical breakdown reveals why traders are watching the $3.55 level as the make-or-break point for XRP's next major move.

Why Is XRP Price Surging in 2025?

The current XRP rally stems from a perfect storm of technical and fundamental factors. On the charts, we're seeing a textbook bullish MACD crossover while the price holds firmly above the 20-day moving average at $3.15. Fundamentally, Ripple's resolution of its five-year SEC battle has removed a major overhang, coinciding with strategic moves into the $120 billion stablecoin market. "This isn't just technical - we're seeing real institutional money Flow in after the regulatory clarity," notes BTCC market strategist Emma Chen.

Key Technical Indicators Signaling XRP Strength

XRP's technical setup presents multiple bullish confirmations:

| Indicator | Value | Significance |

|---|---|---|

| 20-day MA | $3.1563 | Price holding above suggests bullish trend |

| MACD Histogram | +0.0933 | Positive momentum building |

| Bollinger Bands | $3.5515 (Upper) | Breakout potential if resistance breaks |

The Bollinger Band width has expanded to 18.7% - its widest since April - indicating heightened volatility that typically precedes major moves. What's particularly interesting is how XRP has maintained composure during recent market turbulence, something we haven't seen since the 2021 bull run.

Fundamental Catalysts Driving XRP Demand

Three game-changing developments are reshaping XRP's investment thesis:

- SEC Settlement: The dismissal of all claims against Ripple removes the "regulatory discount" that's weighed on XRP for years. Court documents show both parties agreed to withdraw appeals, creating permanent clarity.

- Japanese Institutional Adoption: SBI Holdings' $1 billion XRP treasury allocation and ETF filing marks the first major traditional finance endorsement. Their research suggests XRP could capture 19% of Asia's cross-border payments by 2026.

- Rail Acquisition: Ripple's $200 million purchase of Rail's stablecoin infrastructure positions them to compete directly with USDC. Early tests show 67% faster settlement times than existing solutions.

These fundamentals explain why exchange reserves have dropped to 18-month lows despite the price increase - investors are moving XRP into cold storage anticipating further gains.

XRP Price Targets and Key Levels to Watch

Based on current market structure, these are the critical price zones:

- Immediate Resistance: $3.55 (Upper Bollinger Band)

- Breakout Target: $4.00 (Psychological level)

- Extended Target: $4.80 (127.2% Fibonacci extension)

- Support: $3.15 (20-day MA) / $2.90 (Volume Node)

Market depth data from BTCC shows substantial buy orders clustered around $3.10, creating a potential springboard for upward moves. However, on-chain analytics reveal whale wallets have deposited 29 million XRP to exchanges in the past week - a potential warning sign if accumulation doesn't match this supply.

Risks and Challenges for XRP Bulls

While the outlook appears bright, several factors could derail the rally:

- Whale selling pressure (30-day exchange inflows up 217%)

- Potential delays in Japan's ETF approval process

- Stablecoin regulatory uncertainty despite Ripple's acquisition

- Broader crypto market correlation (BTC dominance at 41%)

The most immediate concern comes from derivatives markets - XRP futures open interest remains 34% below July peaks despite the price recovery, suggesting some trader skepticism.

XRP Price Prediction FAQ

What is the XRP price prediction for 2025?

Based on current technicals and fundamentals, analysts project XRP could reach $4.80 by late 2025 if key resistance at $3.55 breaks. This represents a 45% upside from current levels around $3.30.

Is XRP a good investment in 2025?

XRP presents a compelling risk/reward profile following regulatory clarity and institutional adoption. However, investors should monitor whale activity and maintain appropriate position sizing given crypto volatility.

What will make XRP go up?

Key catalysts include: 1) Break above $3.55 resistance, 2) Successful launch of Japan's XRP ETF, 3) Integration of Rail's stablecoin technology, and 4) Expansion of Ripple's payment network adoption.

Can XRP reach $10?

While possible in an extreme bull scenario, $10 WOULD require: 1) Massive institutional adoption surpassing Bitcoin, 2) Full regulatory clarity globally, and 3) Successful disruption of the SWIFT network. Most analysts view $4.80 as a more realistic 2025 target.

Where can I trade XRP?

XRP is available on major exchanges including BTCC, Binance, and Coinbase. BTCC offers competitive fees and advanced trading tools for XRP traders.