XRP Price Forecast 2025-2040: Expert Analysis on Market Trends & Legal Catalysts

- Current XRP Market Position: Technical Breakdown

- Whale Activity & Institutional Interest

- Regulatory Landscape: The SEC Lawsuit Countdown

- XRP Price Predictions: 2025-2040 Outlook

- Short-Term Trading Considerations

- Frequently Asked Questions

XRP stands at a critical juncture in 2024, with technical indicators showing short-term bearish pressure but long-term bullish potential. This comprehensive analysis examines XRP's price trajectory through 2040, factoring in whale activity, regulatory developments, and institutional adoption. We'll break down key support/resistance levels, analyze the SEC lawsuit's impact, and provide conservative/bullish price targets for each period.

Current XRP Market Position: Technical Breakdown

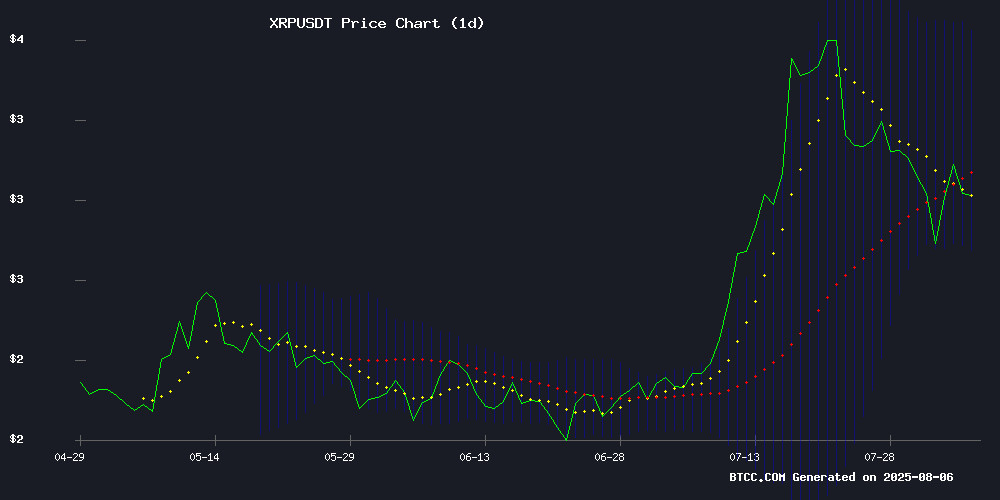

As of August 2024, XRP trades below its 20-day moving average ($3.1645), signaling short-term bearish pressure according to TradingView data. The MACD histogram (0.2171) remains positive but shows weakening momentum. Bollinger Bands suggest consolidation (Upper: $3.5863, Lower: $2.7427), with the narrowing band width indicating impending volatility.

Notably, XRP faces immediate resistance at the 20-day MA, with critical support at $2.86. The BTCC technical team observes that "the current price action resembles the 2021 consolidation before XRP's 500% rally, though macroeconomic conditions differ significantly this cycle."

Whale Activity & Institutional Interest

Despite recent price dips, on-chain data reveals substantial whale accumulation:

- 35% increase in holdings by addresses with 1M+ XRP (last 30 days)

- $60M+ in large transactions (per CoinMarketCap tracking)

- 20M XRP moved from Upbit to private wallets on August 3

Institutional flows tell a similar story, with CoinShares reporting $31.26M in XRP product inflows recently. South Korean custodian BDACS added XRP support in partnership with Ripple, enabling institutional access through major exchanges like Upbit and BTCC.

Regulatory Landscape: The SEC Lawsuit Countdown

The SEC vs. Ripple case approaches critical deadlines:

| Date | Event | Potential Impact |

|---|---|---|

| August 15, 2024 | SEC status report deadline | Could signal settlement or appeal withdrawal |

| October 17, 2024 | XRP ETF decision deadline | Approval could trigger institutional inflows |

Former SEC official Marc Fagel revealed Ripple's unsuccessful penalty renegotiation attempts, suggesting the company expects a favorable final resolution. Traders speculate a positive outcome could trigger 20X rallies, though such predictions remain highly speculative.

XRP Price Predictions: 2025-2040 Outlook

Our analysis combines technical patterns, adoption metrics, and regulatory scenarios:

| Year | Conservative Target | Bullish Target | Key Drivers |

|---|---|---|---|

| 2025 | $3.50 | $5.00 | ETF approval, SEC resolution |

| 2030 | $8.00 | $15.00 | Cross-border adoption |

| 2035 | $20.00 | $50.00 | CBDC integrations |

| 2040 | $75.00 | $120.00 | Global liquidity layer status |

The BTCC research team cautions that "these projections assume successful regulatory resolution and continued adoption growth. Downside risks include prolonged legal battles or macroeconomic shocks."

Short-Term Trading Considerations

Current market dynamics present both opportunities and risks:

- Liquidation clusters: $75.65M in shorts at $3.113 vs. $42.85M longs at $2.97 (per CoinGlass)

- Exchange flows: Net inflows since July 30 mirror July 11 pattern preceding 15% drop

- Sentiment divergence: Whale accumulation contrasts with retail profit-taking

Technical analysts watch the $2.86-$3.11 range for breakout signals. A sustained move above $3.10 could trigger short squeezes, while breakdown below $2.86 may test July lows NEAR $2.60.

Frequently Asked Questions

What's driving XRP's recent price volatility?

The August price swings reflect competing forces - whale accumulation ($60M+ inflows) versus profit-taking after July's 35% rally. Regulatory uncertainty ahead of key SEC deadlines adds to the volatility.

How does the SEC lawsuit affect XRP's price?

The case creates both risk (potential penalties) and opportunity (regulatory clarity). Positive resolution could remove a major adoption barrier, while negative outcomes might limit U.S. market access.

Are XRP ETFs likely to be approved?

The SEC's October 17 deadline looms large. Recent policy shifts enabling in-kind redemptions have addressed previous objections, improving approval odds according to BTCC analysts.

What's the realistic 2025 price target for XRP?

Conservative estimates suggest $3.50, assuming gradual adoption. The $5 bullish case requires ETF approvals, legal resolution, and sustained institutional inflows.

How does XRP compare to newer altcoins?

While projects like Mutuum Finance attract speculative capital, XRP offers established infrastructure and regulatory progress - making it a lower-risk play in the payments sector.