🚀 Bitcoin & Stellar Surge: Crypto Market Outlook – Europe Update August 6

Crypto bulls charge ahead as Bitcoin flirts with key resistance levels and Stellar shows unexpected muscle. Here’s what’s shaking up the digital asset space today.

Bitcoin’s make-or-break moment

The OG crypto tests critical overhead supply—traders either see a springboard to new highs or a trapdoor back to consolidation. Meanwhile, institutional inflows hit a 3-week high (because nothing says 'hedge against inflation' like volatile internet money).

Stellar’s quiet ascent

XLM quietly outperforms major alts as cross-border payment rumors swirl. The network’s low fees attract developers, though skeptics whisper ‘cheap doesn’t equal adoption’ between sips of overpriced CBDC Kool-Aid.

The macro wildcard

With EU regulators simultaneously drafting MiCA 2.0 and Googling ‘how to blockchain,’ crypto markets shrug off traditional finance’s existential crisis. As one anonymous trader put it: ‘Banks fear decentralization like vampires fear sunlight.’

Bitcoin Price Forecast: BTC stuck below $114,000 as ETF outflows extend to four days

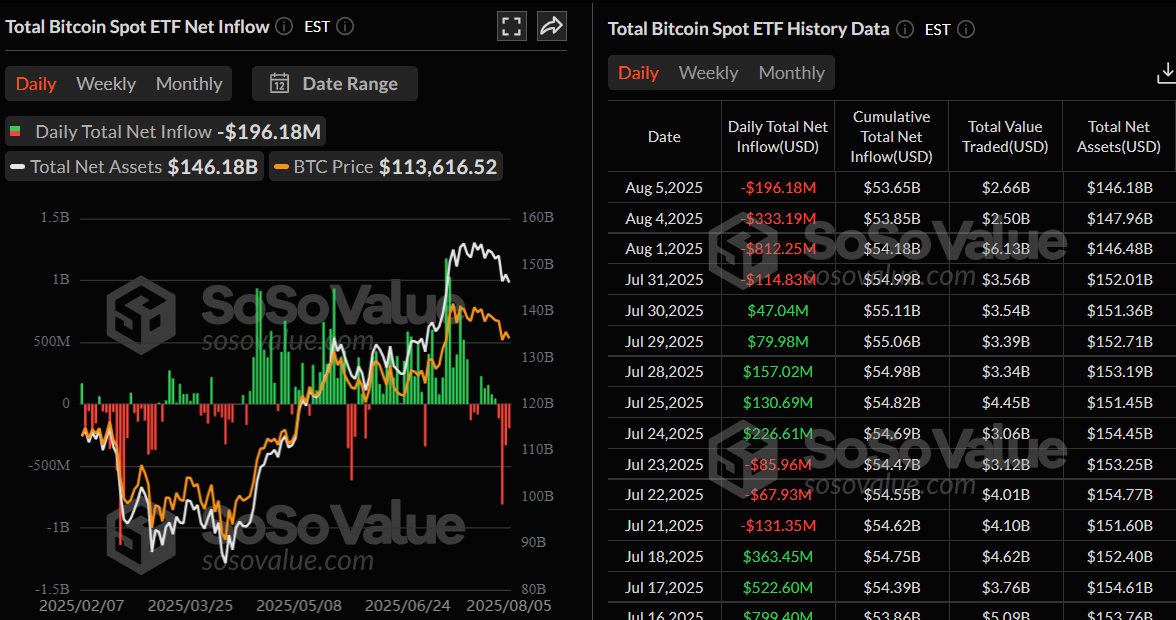

Bitcoin (BTC) remains under pressure on Wednesday, trading below $114,000 after a failed attempt to reclaim its $116,000 resistance, as institutional demand weakens further. US-listed spot Exchange Traded Funds (ETFs) recorded $196 million in outflows on Tuesday, extending their losing streak to four consecutive days. Meanwhile, Japan’s SBI Holdings made headlines by filing for a dual-asset crypto ETF, which, if approved, would provide exposure to both BTC and XRP.

Stellar Price Forecast: XLM downtrend likely to continue as bearish bets surge

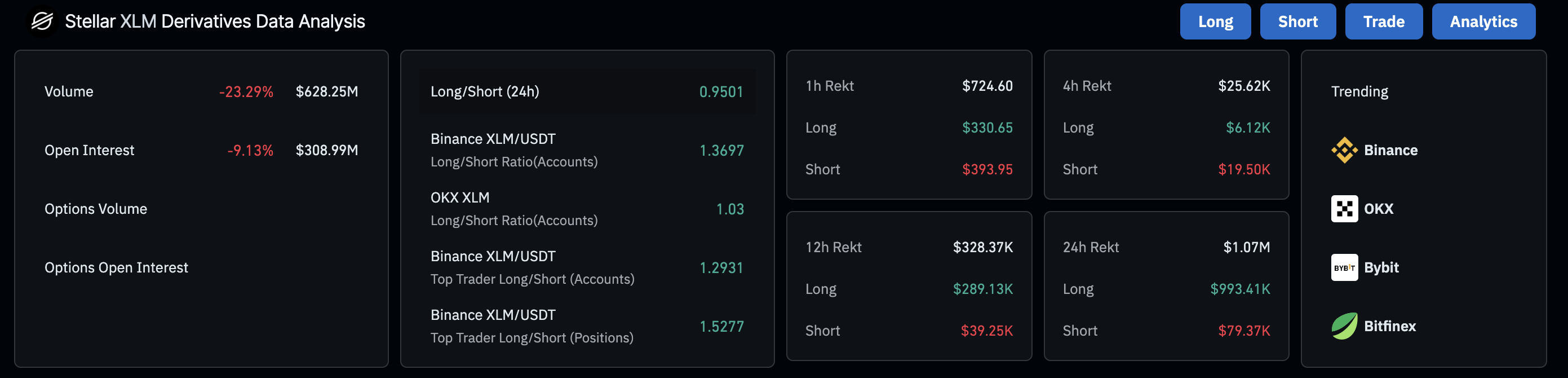

Stellar (XLM) depreciates by nearly 2% at press time on Wednesday as it continues to trade within a falling channel pattern on the 4-hour time frame. Investors anticipate a steeper correction as Optimism in XLM derivatives wanes, with bearish bets rising and open interest declines.

Summer break for the crypto market

The cryptocurrency market began August with a relatively narrow range of $3.6-3.8 trillion, ending Wednesday at $3.72 trillion. The support received in the area of previous peaks set in December and January suggests that this is a temporary pause to lock in profits and gain liquidity before a new surge. At the same time, however, such sluggishness is turning away the most active traders, who are used to seeing multiple rallies. Now they have moved on to very small projects.