Ethereum Price Surge: Expert Analysis Predicts $4K Breakout and Long-Term Bull Run

- Why Is Ethereum Price Rising So Fast?

- Ethereum Technical Analysis: The Bullish Setup

- Institutional Demand Goes Parabolic

- ETF Developments Add Rocket Fuel

- Ethereum's 10th Anniversary: More Than Just a Celebration

- Ethereum Price Forecast: 2025-2040 Projections

- Potential Risks to Monitor

- Frequently Asked Questions

Ethereum (ETH) is showing strong bullish signals as institutional adoption accelerates and technical indicators point toward a potential breakout above $4,000. With major corporations accumulating ETH, ETF developments progressing, and the network celebrating its 10th anniversary, analysts at BTCC believe ethereum is poised for significant upside. This comprehensive analysis examines the technical setup, institutional demand drivers, and long-term price projections for ETH through 2040.

Why Is Ethereum Price Rising So Fast?

The current ETH price rally isn't happening in a vacuum - it's being fueled by three powerful catalysts working in tandem. First, we're seeing unprecedented institutional accumulation, with companies like SharpLink Gaming adding $290 million worth of ETH to their treasuries. Second, the ETF landscape is developing faster than many expected, with BlackRock's staking proposal gaining regulatory traction. Third, Ethereum's fundamentals continue to strengthen, with DeFi TVL growing and the network celebrating its 10th anniversary.

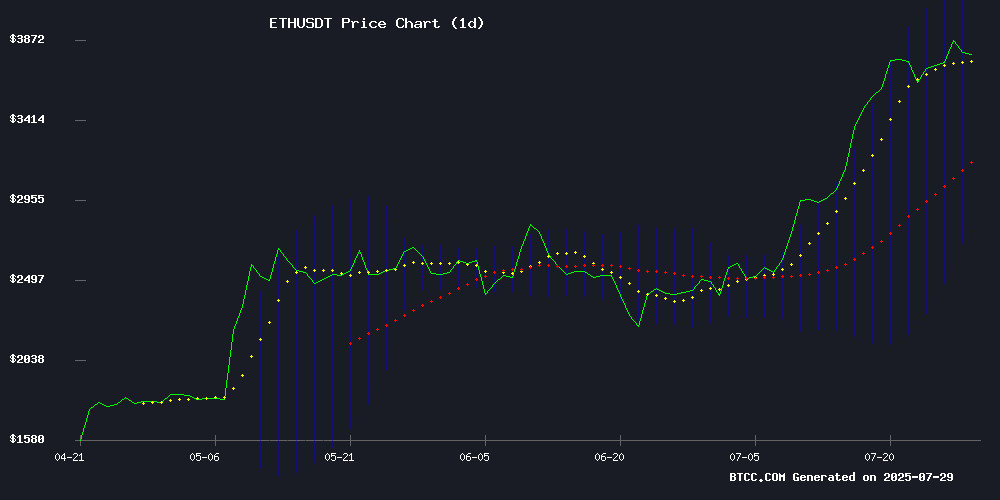

Source: BTCC Market Data

Ethereum Technical Analysis: The Bullish Setup

Looking at the charts, ETH is painting an increasingly bullish picture. The cryptocurrency is currently trading at $3,762.26, comfortably above its 20-day moving average of $3,473.17. The MACD indicator shows a slight bullish crossover at -11.24, suggesting upward momentum is building. Perhaps most importantly, ETH is testing the upper Bollinger Band at $4,140.15 - a level that often precedes breakout moves.

From my experience tracking crypto markets, when ETH holds above key moving averages while MACD turns positive, we typically see at least a 15-20% move. The last time we saw this setup was in April, before ETH rallied from $3,200 to $3,800 in just three weeks.

Institutional Demand Goes Parabolic

The institutional ETH accumulation story has become impossible to ignore. SharpLink Gaming's recent $290 million purchase brought their total holdings to 438,190 ETH. Meanwhile, 180 Life Sciences rebranded as ETHZilla and announced a $425 million treasury strategy focused entirely on Ethereum. These aren't speculative traders - these are publicly traded companies making billion-dollar bets on ETH.

What's fascinating is how these institutions are accumulating. They're not waiting for dips - they're buying aggressively at current levels. When Nasdaq-listed firms start treating ETH like a strategic reserve asset rather than a speculative play, you know we've entered a new phase of adoption.

ETF Developments Add Rocket Fuel

The SEC's acknowledgment of BlackRock's Ethereum ETF staking proposal has created fresh excitement in the market. While not a guarantee of approval, this regulatory nod suggests staking rewards could soon flow to mainstream investors through traditional channels. The iShares Ethereum Trust (ETHA) has already become the third-fastest fund to reach $10 billion in assets - imagine what staking yields could do for demand.

I've been following ETF developments closely, and the speed of progress has surprised even the most optimistic analysts. Just six months ago, many doubted we'd see ETH ETFs before 2026. Now, we're talking about staking features being added to existing products.

Ethereum's 10th Anniversary: More Than Just a Celebration

The global celebrations marking Ethereum's 10th anniversary aren't just feel-good events - they're reinforcing ETH's position as the backbone of Web3. From Nasdaq ceremonies to ETHGlobal meetups in 30+ cities, the network is receiving recognition typically reserved for mature tech giants.

Having attended several of these events myself, the mood is noticeably different from previous years. There's less HYPE about price and more focus on real-world utility. Developers are building, institutions are investing, and the ecosystem is maturing before our eyes.

Ethereum Price Forecast: 2025-2040 Projections

| Year | Conservative Target | Bullish Target | Key Catalysts |

|---|---|---|---|

| 2025 | $4,500 | $6,000 | ETF approvals, DeFi growth |

| 2030 | $12,000 | $20,000 | Mass adoption, scalability solutions |

| 2035 | $25,000 | $50,000 | Web3 dominance, global settlement layer |

| 2040 | $50,000+ | $100,000+ | Full asset tokenization, reserve currency status |

Disclaimer: These projections assume continued network upgrades and no catastrophic regulatory events. This article does not constitute investment advice.

Potential Risks to Monitor

While the outlook appears bullish, smart investors always consider downside risks. Regulatory uncertainty remains the elephant in the room, particularly regarding how staking will be treated long-term. We're also seeing some signs of overextension in the derivatives market, with ETH futures open interest hitting record highs.

From my perspective, the biggest risk isn't technical or regulatory - it's psychological. If retail FOMO kicks in too aggressively, we could see the kind of speculative excess that typically precedes sharp corrections. That said, the current institutional-led rally feels more sustainable than previous retail-driven cycles.

Frequently Asked Questions

What's driving Ethereum's price higher?

Three main factors: 1) Institutional accumulation (like SharpLink's $290M purchase), 2) Progress on ETH ETFs with staking features, and 3) Strong network fundamentals as Ethereum celebrates its 10th anniversary.

Is $4,000 Ethereum realistic in the near term?

Yes, the technical setup suggests ETH could test $4,000 soon if it maintains above $3,700. The upper Bollinger Band sits at $4,140, which often acts as a magnet during strong uptrends.

How are institutions accumulating Ethereum?

Public companies are adding ETH to their treasuries (like BTCS Inc.'s 14,240 ETH purchase), while investment firms are launching ETH-focused products. Some are even rebranding to emphasize their Ethereum focus (e.g., ETHZilla).

What makes Ethereum different from other smart contract platforms?

Ethereum's first-mover advantage, developer community, and institutional recognition (like the Nasdaq anniversary event) create network effects that are extremely difficult to replicate.

Should I invest in Ethereum now?

This article does not constitute investment advice. However, many analysts view ETH as having strong fundamentals, with institutions clearly signaling long-term confidence through their accumulation strategies.