SOL Price Prediction 2025: Can Solana Really Hit $400? Technicals & Market Trends Analyzed

- SOL Technical Analysis: Bullish or Bearish?

- Institutional Moves: Big Money Bets on Solana

- The $400 Question: Is Gemini AI's Prediction Realistic?

- Market Sentiment: Divided But Leaning Bullish

- Solana's RWA Revolution: More Than Just Hype?

- Controversy Alert: Yakovenko's "Digital Slop" Comments

- Short-Term Price Action: What to Watch

- Is SOL a Good Investment Right Now?

- SOL Price Prediction: Your Questions Answered

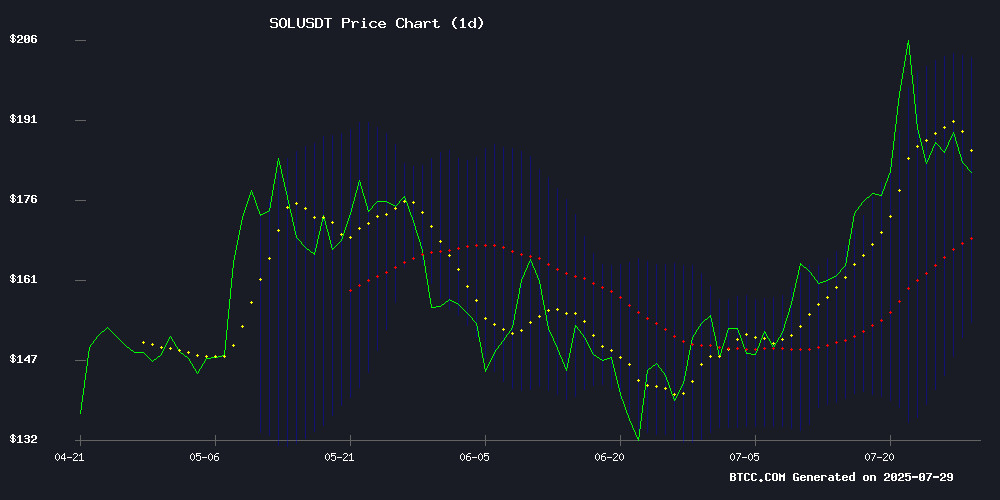

Solana (SOL) is currently trading at $184.79, showing bullish technical signals while facing key resistance at $188. With institutional players like ARK Invest and Upexi making big moves, and Gemini AI predicting a potential $400 price target by 2025, SOL presents an intriguing investment case. This analysis dives DEEP into the technical indicators, market sentiment, and fundamental developments shaping Solana's price trajectory.

SOL Technical Analysis: Bullish or Bearish?

SOL's current price sits comfortably above its 20-day moving average ($178.12), suggesting underlying strength. The MACD shows narrowing gaps between signal lines - typically a precursor to momentum shifts. What's particularly interesting is how the price is dancing around the middle Bollinger Band, which often acts as a springboard for the next major move.

The BTCC team notes: "SOL's technical setup shows classic consolidation patterns we often see before significant moves. The $188 resistance is the line in the SAND - break that, and we could see rapid upside."

Institutional Moves: Big Money Bets on Solana

Nasdaq-listed Upexi just expanded its SOL treasury strategy with a $500 million equity line, adding to its existing 1.8 million SOL holdings. Even more telling? ARK Invest's recent partnership with SOL Strategies for institutional-grade staking solutions. When Cathie Wood's firm makes moves like this, the market pays attention.

These developments suggest institutions are playing the long game with Solana, looking beyond short-term volatility. The numbers speak for themselves - Upexi's SOL stash already shows $58 million in unrealized gains, with staking generating about $26 million annually.

The $400 Question: Is Gemini AI's Prediction Realistic?

Google's Gemini AI recently made waves with its $400 SOL price prediction for 2025. At current levels, that would mean a 109% upside. While AI predictions should always be taken with a grain of salt, the rationale isn't entirely baseless.

Solana has shown remarkable resilience since its June lows, rallying 51%. The platform's dominance in real-world asset tokenization (RWA) is growing exponentially, with $500 million in value now on-chain - a 200% increase this year alone. Token Extensions are solving real compliance headaches for institutions, making SOL increasingly attractive for serious capital.

Market Sentiment: Divided But Leaning Bullish

Current sentiment presents a fascinating dichotomy. On one hand, we're seeing:

- Sustained negative Spot Taker CVD (showing sell-side pressure)

- Dwindling network activity per Artemis Terminal data

- Short-term technical resistance at $188

Yet counterbalancing this are:

- Strong institutional accumulation (like Upexi's $23 million daily withdrawals)

- Growing RWA adoption

- Improving technical indicators

As one trader put it: "SOL's chart looks like a coiled spring - the fundamentals say up, but the market needs to decide when."

Solana's RWA Revolution: More Than Just Hype?

The real-world asset narrative might be Solana's most compelling case. Projects like Homebase are slicing apartment buildings into $100 NFT shares, while the platform's speed makes it ideal for high-frequency trading of tokenized commodities. The numbers don't lie - 680% monthly growth in RWA wallets suggests this isn't just speculative froth.

What's particularly clever is how Token-2022 extensions embed compliance directly into assets. For institutions dipping toes into crypto waters, this solves major regulatory headaches that have traditionally kept big money on the sidelines.

Controversy Alert: Yakovenko's "Digital Slop" Comments

Solana co-founder Anatoly Yakovenko stirred the pot by calling meme coins and NFTs "digital slop." The irony? Much of Solana's post-FTX revival came from these very assets. The community backlash was swift, with critics pointing out that even OpenSea's CMO called the remarks "disappointing."

This highlights crypto's eternal tension between purist ideals and market realities. As one developer quipped: "You can't hate the slop when it's paying your bills."

Short-Term Price Action: What to Watch

Key levels to monitor:

| Level | Significance |

|---|---|

| $188 | Breakout could trigger rapid upside |

| $178 | 20-day MA support |

| $170 | Psychological support zone |

The RSI at 50 leaves room for movement either way, while the MACD's slight bearish divergence contrasts with strong volume trends. It's this technical tug-of-war that makes SOL such an interesting watch right now.

Is SOL a Good Investment Right Now?

Let's break down the key metrics:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +3.75% | Bullish momentum |

| MACD | -0.7335 | Bearish but improving |

| Bollinger %B | 0.55 | Neutral territory |

The BTCC analyst team suggests: "SOL presents an asymmetric opportunity - the upside potential significantly outweighs downside risks at these levels, especially for investors with 6-12 month horizons."

This article does not constitute investment advice.

SOL Price Prediction: Your Questions Answered

What is the SOL price prediction for 2025?

Gemini AI has projected SOL could reach $400 by end of 2025, representing 109% upside from current levels around $191. This prediction considers Solana's growing institutional adoption, RWA expansion, and improving technical indicators.

Is Solana a good investment right now?

SOL presents an interesting risk/reward proposition. Technicals show bullish momentum (price above 20MA), though MACD remains slightly bearish. Institutional activity (like Upexi's $500M equity line) suggests smart money is accumulating, making SOL attractive for medium-term investors.

What is Solana's key resistance level?

The $188 level represents critical resistance. A decisive breakout could validate bullish institutional narratives and trigger significant upside momentum, while failure to breach may lead to retesting lower supports around $178.

Why are institutions buying Solana?

Institutions like Upexi and ARK Invest are attracted to Solana's speed, low costs, and RWA capabilities. Upexi's treasury strategy has already generated $58M in unrealized gains, while ARK's staking partnership signals long-term confidence in SOL's infrastructure.

What are the risks of investing in SOL?

Key risks include: potential failure at $188 resistance, bearish MACD divergence, and short-term sell-side pressure shown in Spot Taker CVD metrics. The asset also remains volatile, with 24-hour trading ranges exceeding 4% recently.