LTC Price Prediction 2025: Can Litecoin Hit $200 as ETF Hype Builds?

- What's Driving Litecoin's Current Price Action?

- How Might ETF Developments Impact LTC's Price?

- What Other Factors Could Influence LTC's Trajectory?

- Technical Analysis: Road to $200

- Expert Perspectives on Litecoin's Outlook

- Litecoin Price Prediction FAQs

Litecoin (LTC) is showing bullish signals as it trades above key technical levels while the crypto community eagerly awaits potential spot ETF approvals. Currently priced at $118.47, LTC would need a 69% surge to reach the psychological $200 milestone. Our analysis examines the technical setup, institutional developments, and market forces that could propel Litecoin's price in the coming months.

What's Driving Litecoin's Current Price Action?

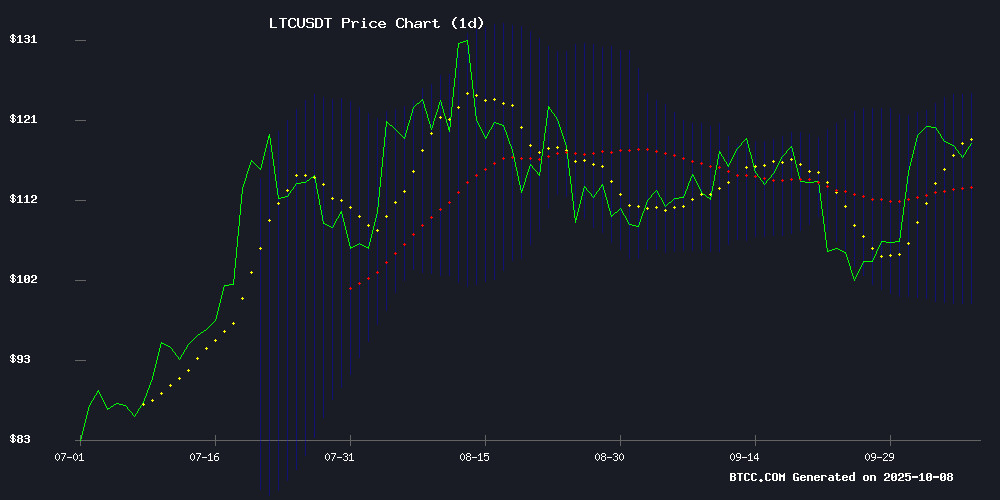

As of October 2025, Litecoin maintains a strong position above its 20-day moving average ($111.96), suggesting underlying strength despite short-term volatility. The MACD indicator shows slight bearish momentum at -2.65, but price action remains comfortably within the Bollinger Band range of $99.47 to $124.46.

Source: BTCC Trading Platform

Source: BTCC Trading Platform

The BTCC research team notes: "Litecoin's technical structure appears resilient, with the $124.46 upper Bollinger Band representing the immediate resistance level. A decisive break above this could open the path toward $150."

How Might ETF Developments Impact LTC's Price?

The crypto market is buzzing with anticipation as Canary Capital's spot Litecoin ETF (proposed ticker: LTCC) moves through final regulatory stages. The 0.95% management fee, while higher than Bitcoin ETFs, reflects the specialized nature of this emerging product category.

Bloomberg's senior ETF analyst Eric Balchunas recently tweeted: "The LTCC filing details suggest we're in the endgame. If approved, this could bring substantial institutional liquidity to Litecoin markets."

However, potential headwinds remain:

- Possible US government shutdown delaying SEC review

- Competitive pressure from other altcoin ETFs

- Market volatility affecting risk appetite

What Other Factors Could Influence LTC's Trajectory?

Beyond ETF speculation, several macroeconomic and industry-specific factors are shaping Litecoin's outlook:

Institutional Adoption Through New Index Products

S&P Global's Digital Markets 50 Index, combining cryptocurrencies with crypto-exposed equities, is gaining traction. This hybrid approach provides traditional investors with diversified exposure while maintaining exchange-traded convenience.

Tokenization Wave Creating New Demand

With tokenized assets surpassing $1B in market value and transfer volumes doubling monthly, platforms like Dinari are bridging traditional finance with blockchain infrastructure. Nasdaq's recent SEC petition for tokenized equity offerings signals growing institutional interest in these hybrid products.

Macroeconomic Conditions Affecting Risk Assets

The current interest rate environment and inflation trends continue to influence investor appetite for alternative assets like cryptocurrencies. Litecoin's correlation with broader market movements remains a key consideration.

Technical Analysis: Road to $200

| Current Price | Target | Required Gain | Key Resistance |

|---|---|---|---|

| $118.47 | $200.00 | 68.8% | $124.46 |

Reaching $200 WOULD require Litecoin to:

- Break through immediate resistance at $124.46

- Establish new support above $150

- Maintain bullish momentum amid potential ETF approval

- Avoid significant market-wide corrections

Expert Perspectives on Litecoin's Outlook

Cameron Drinkwater of S&P Dow Jones Indices observes: "Digital assets are becoming Core to investment strategies, whether for diversification or innovation. Products like Litecoin ETFs represent the next phase of this evolution."

The BTCC analysis team adds: "While the $200 target is ambitious, the combination of technical positioning and positive regulatory developments creates a favorable environment for gradual upward movement. Investors should monitor ETF approval timelines and broader market sentiment."

This article does not constitute investment advice. cryptocurrency investments carry substantial risk.

Litecoin Price Prediction FAQs

What is Litecoin's current price and technical position?

As of October 2025, Litecoin trades at $118.47, above its 20-day moving average of $111.96. The price sits within the Bollinger Band range of $99.47 to $124.46, with the upper band representing immediate resistance.

How close are we to a Litecoin ETF approval?

Canary Capital's spot Litecoin ETF (LTCC) has submitted amended S-1 filings, typically the final step before launch. However, potential government shutdowns could delay the SEC's review process.

What would it take for LTC to reach $200?

Litecoin would need approximately 69% growth from current levels, requiring breaks through multiple resistance points and sustained bullish momentum, potentially fueled by ETF approval and institutional inflows.

How does Litecoin's potential ETF compare to Bitcoin ETFs?

The proposed LTCC carries a 0.95% management fee, higher than most bitcoin ETFs, reflecting its status as a newer product in a developing market segment.

What are the main risks to Litecoin's price growth?

Key risks include regulatory delays, broader market corrections, competitive pressure from other altcoins, and changes in institutional appetite for crypto products.