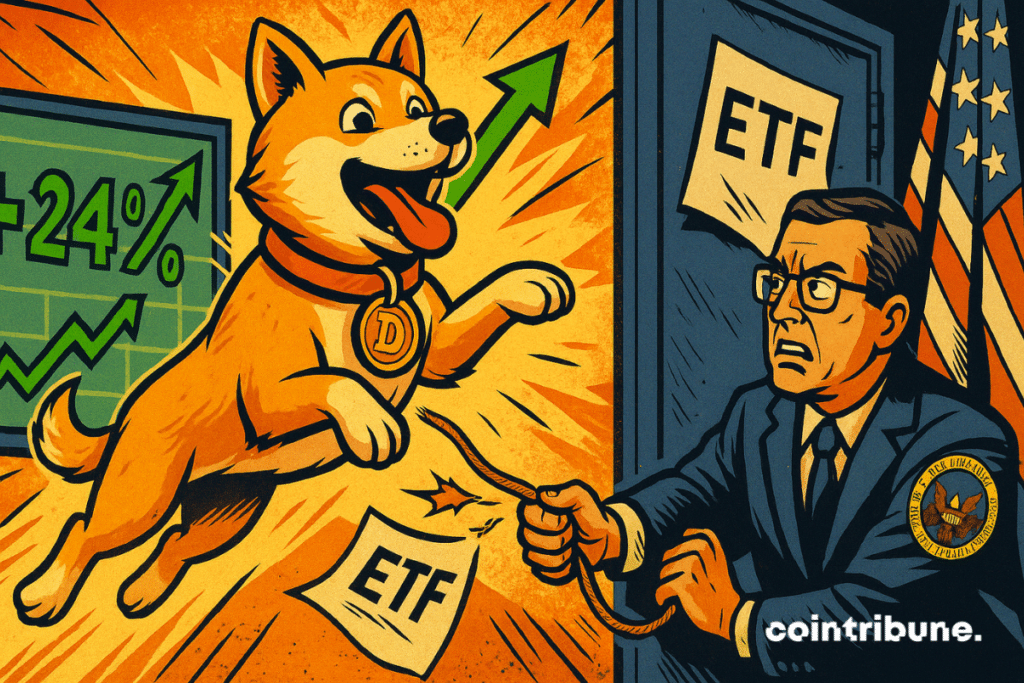

Dogecoin Defies Logic: ETF Delay? No Problem—Price Keeps Climbing

Dogecoin surges while its ETF gets pushed back—again. The meme coin that refuses to die just hit another high, leaving analysts scratching their heads and traditional finance veterans muttering into their lattes.

Why the rally?

Retail momentum—pure and simple. While Wall Street waits for paperwork, Main Street keeps buying. No institutional approval? No problem. Dogecoin’s community-driven hype machine operates on its own timeline—and its own rules.

Speculation trumps regulation—for now.

Maybe it’s the Elon effect, maybe it’s the memes, or maybe it’s just the beautiful chaos of crypto doing what it does best: making sense only to those who’ve stopped trying to make sense of it. Either way—Dogecoin’s pumping, and the suits are still stuck in committee.

Another day, another lesson in why you can’t apply old-world logic to new-world assets. But hey—if it works, it works. Even if it really, really shouldn’t.

In Brief

- Dogecoin price rises 4% to $0.26 despite the delay of its American ETF.

- The Rex-Osprey DOGE ETF, initially scheduled for September 12, is postponed by a week.

- Companies like CleanCore Solutions and Thumzup invest massively in DOGE.

Dogecoin Advances Despite the SEC

Friday, September 12, was supposed to mark a historic milestone with the listing of the Rex-Osprey Doge ETF.

Eric Balchunas, senior analyst at Bloomberg and a key reference for crypto ETFs, confirmed on Thursday the delay of this launch, probably until next Thursday. No official explanation accompanies this decision, fueling speculation about the SEC’s real motives.

Paradoxically, this bad news coincided with a remarkable performance of Dogecoin. The memecoin jumped nearly 4%, reaching $0.2603 according to CoinMarketCap.

This bullish reaction reflects a new market maturity, which now seems to incorporate these regulatory uncertainties as normal steps in the approval process.

This delay is part of a broader SEC strategy to buy time. The regulatory authority faces an unprecedented backlog with more than 90 crypto ETF applications pending.

Recent delays of the Bitwise dogecoin and Grayscale Hedera ETFs, postponed to November 12, illustrate this methodical approach aiming to handle applications in coordinated waves.

Balchunas nonetheless tempers expectations regarding the potential impact of this ETF. “The further you MOVE away from BTC, the fewer assets there will be.”, he explains to Cointelegraph.

Unlike traditional institutional investors who could only access Bitcoin with difficulty, DOGE enthusiasts already have direct access via exchanges.

DOGEUSDT chart by TradingViewIncreasingly Visible Institutional Signals

Beyond the speculation surrounding its image, Dogecoin is starting to attract traditional companies.

CleanCore Solutions, an industrial systems manufacturer, recently purchased $130 million worth of DOGE, thus reaching half of its goal set at one billion tokens. A first for a company in this sector, illustrating the gradual transformation of the memecoin into a treasury asset.

At the same time, Thumzup, a media company linked to the TRUMP family, announced the installation of 3,500 Dogecoin mining platforms. A strategy that resembles an implicit recognition of the token’s legitimacy in the crypto ecosystem.

These initiatives reinforce the image of an asset that, despite its parodic beginnings, now attracts institutional capital and strategic investments. Dogecoin seems to have crossed a threshold: from a mere “joke coin”, it is gradually establishing itself as an asset that some economic actors no longer hesitate to accumulate.

And if the SEC approves several altcoin ETFs by the end of the year – a hypothesis judged 90% probable by Bloomberg for DOGE, XRP and Cardano – the effect could be considerable. Such recognition would amplify a movement already underway in the markets.

In summary, Dogecoin continues to defy expectations. Despite the new delay of its American ETF, its price is rising, supported by now tangible institutional interest. More than a simple meme, it confirms its unique status: that of a joke turned, over the years, into a serious player in the crypto market.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.