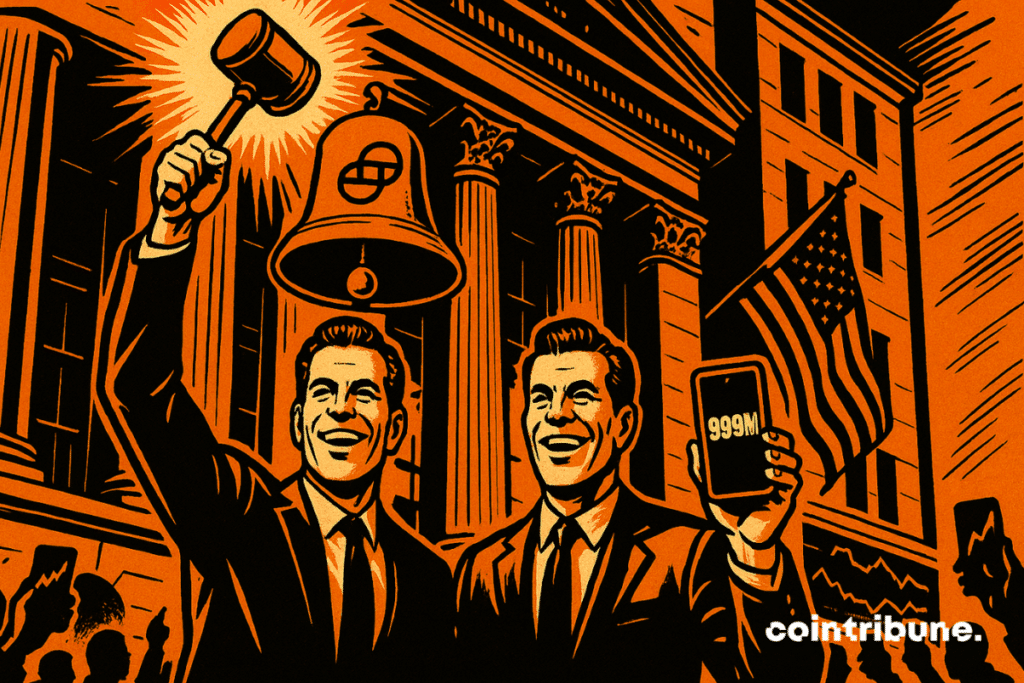

Gemini IPO Demand Skyrockets 20x Over Supply in Frenzied Market Debut

Gemini's public offering just shattered expectations—investors clamored for 20 times more shares than were available.

Wall Street Meets Crypto Mania

The exchange's debut turned into a feeding frenzy—traditional finance colliding head-on with digital asset euphoria. Orders flooded in from institutional whales and retail traders alike, all desperate for a piece of the action.

Supply Can't Keep Up

Twenty times oversubscribed doesn’t just signal interest—it screams FOMO. Even the most conservative portfolios are suddenly itching for crypto exposure. Who needs balanced diversification when you can ride a rocket?

The Aftermath: Greed or Genius?

Sure, the bankers will pocket their fees and call it innovation. But let’s be real—when’s the last time a traditional IPO saw this kind of manic demand? Probably never. Crypto continues to rewrite the rules, whether Wall Street’s ready or not.

In brief

- Gemini, the exchange founded by the Winklevoss brothers, makes its IPO debut on the Nasdaq under the symbol GEMI.

- The IPO was set at 28 dollars per share, above the expected range, for a total raise of 425 million dollars.

- Demand exceeded all expectations, with interest 20 times higher than the available supply, valuing Gemini at around 3.3 billion dollars.

- A private investment of 50 million dollars by Nasdaq strengthens the legitimacy and attractiveness of the operation.

An IPO under tension : between high valuation and explosive demand

The company Gemini Space Station, the legal entity behind the Gemini crypto exchange, officially launched its IPO today on Nasdaq, under the symbol GEMI. The introduction price was set at 28 dollars per share, thus exceeding the expected range of 24 to 26 dollars.

This introduction allowed to raise 425 million dollars through the sale of 15.1 million Class A shares, less than initially anticipated volume. However, this decrease in the number of shares was offset by exceptional demand.

Demand for shares was more than 20 times greater than the available supply. As such, Gemini’s market capitalization stands around 3.3 billion dollars on its first day of listing.

This operation was accompanied by several favorable market signals, which demonstrate real interest in the Gemini case :

- Strong institutional support : a private investment of 50 million dollars was injected by Nasdaq, highlighting a form of strategic validation ;

- Valuation above forecasts : the final price exceeds an already upwardly revised range, reflecting investor confidence ;

- Limited supply, massive demand : the oversubscription ratio, above 20:1, reflects strong investor interest in a context still cautious towards crypto companies ;

- Positioning in the current sector dynamics : Gemini joins Circle (CRCL) and Bullish (BLSH), other listed crypto players, in a wave of IPOs marking a gradual return of the sector to public markets.

With this IPO, Gemini achieves a solid financial operation from a technical perspective, despite a reduced supply. It remains to be seen if this stock market success will last on the markets, in a sector still marked by volatility and regulatory challenges.

Gemini targets tokenization and crypto payments

Beyond the IPO figures, Gemini’s leaders aim to send a clear message on the company’s strategic direction. In documents submitted to investors and relayed by the press, the platform highlights its commitment to positioning itself on asset tokenization and the expansion of card-based payments.

Gemini already offers a credit card providing crypto rewards, as well as an internal stablecoin. The company indicates that there is strong untapped potential in tokenization and digital payments. Additionally, it underlines a gradual repositioning towards high value-added services, complementary to simple crypto trading.

While its transaction volumes remain modest compared to Coinbase, Gemini intends to leverage its brand image and regulatory compliance to build a sustainable growth base.

Products related to consumption, such as cards or payment tools, could enable it to reach a wider audience beyond seasoned traders. By diversifying, Gemini seeks to protect itself from crypto market volatility while meeting the expectations of its new shareholders.

This stock market debut could thus open a new chapter for Gemini, which, after years spent in the shadow of giants like Coinbase or Binance which already holds 67% of stablecoin reserves, now asserts its long-term ambition.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.