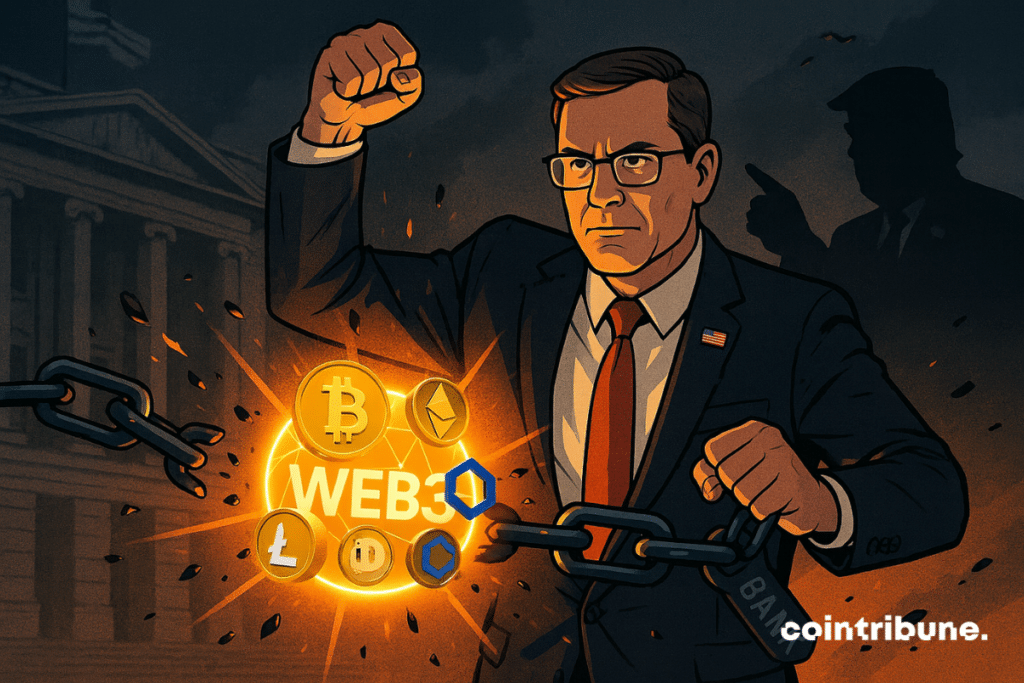

OCC Chief Vows to End Banking Discrimination Against Web3 in Landmark Policy Shift

Federal banking regulator drops hammer on discriminatory practices—Web3 firms finally getting seat at financial table.

The Crackdown Begins

OCC's top official declares war on legacy banking bias, forcing traditional institutions to stop treating crypto-native companies like second-class citizens. No more arbitrary account closures or endless compliance loops—just equal access to financial infrastructure.

Wall Street's Worst Nightmare

Banks now face strict scrutiny if they reject Web3 businesses without valid reasons. The move torpedoes decades of comfortable exclusionary policies that let traditional finance pretend blockchain didn't exist—unless they were secretly trading it themselves, of course.

New Rules, New Era

Chartered banks must develop clear Web3 onboarding frameworks instead of hiding behind vague 'risk management' excuses. Finally, someone called their bluff on the whole 'too risky' narrative—especially ironic coming from institutions that needed bailouts just over a decade ago.

The revolution isn't being televised—it's being banked.

In brief

- Jonathan Gould confirms that crypto debanking exists and that it will be gradually dismantled in the United States.

- The OCC applies Executive Order 14331 signed by Trump to guarantee fair banking access.

- The GENIUS Act now facilitates obtaining banking charters for crypto stablecoin issuers.

Crypto debanking: Gould breaks the taboo and Trump imposes his agenda

During a CoinDesk event in Washington, Jonathan Gould, head of the OCC, acknowledged that crypto companies’ debanking was real, echoing a criticism already made by Trump. This acknowledgment sounds like a late confession and a turning point for the ecosystem, long marked by a two-speed system where financial exclusion served as a silent weapon against innovation.

Behind this break, a clear political will: that of Donald Trump. His signing of Executive Order 14331, “Guaranteeing Fair Banking For All Americans,” mandated the OCC to eliminate any banking discrimination based on crypto activity. The official statement is clear:

The OCC is taking steps to end the weaponization of the financial system. We are working to root out bank activities that unlawfully debank or discriminate against customers on the basis of political or religious beliefs, or lawful business activities. If and when the OCC identifies such activity, it will take action to end it.

Jonathan V. Gould – Source: OCCIn practice, the OCC is already investigating the nine largest banks in the country. The goal: to identify those which might have closed accounts without legal justification. A small revolution in the American banking landscape, where cryptos MOVE from parias to clients under regulatory protection.

Between innovation and caution: the new banking deal

Jonathan Gould assures that supporting the crypto ecosystem does not mean sacrificing financial stability. According to him, innovation does not oppose safety nor the system’s solidity, as long as it is strictly regulated.

In short, crypto and banking safety can coexist, provided there are clear rules and rigorous supervision.

Within this framework, the OCC acts on several fronts. Vague mentions of “reputation risk” have been removed from banking manuals. The regulator is also working on enforcing the GENIUS Act, which makes it easier for stablecoin issuers to obtain a banking charter.

BSA/AML controls, often used as an excuse to block crypto actors, will be revised to avoid abuses.

This new climate is already attracting institutional investors’ attention. By establishing an understandable framework, the OCC seeks to reassure banks and funds, which had hesitated so far to dive into the Web3 universe. The idea is simple: less arbitrariness, more transparency, thus more trust.

Towards a crypto-friendly finance: a pivotal moment for the USA

This shift is not limited to symbolism. Industry analysts already see a concrete turning point for the markets’ future. Crypto companies, long hindered by banking obstacles, finally obtain clear regulatory recognition.

Some figures to remember:

- 9 major banks already targeted by the OCC for investigation;

- 239 million USD given by Elon Musk to support Trump’s crypto-friendly campaign;

- 135 million USD injected via the Fairshake PAC to promote pro-crypto candidates;

- 21 million USD in BTC donated by the Winklevoss brothers in August 2025.

The United States is reshaping its relationship with cryptos under the impetus of TRUMP and the OCC. The government is not only acting on regulation: it actively promotes the technology to financial institutions. The Treasury, through the Fed, has already announced a relaxation of its control over banks active in crypto. Between eased supervision and strong encouragements, Washington places crypto at the heart of its economic future.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.