Crypto ETFs Dominate: 50% of 2025’s Hottest U.S. Fund Launches

Crypto ETFs aren't just entering the mainstream—they're bulldozing it. Half of this year's most successful U.S. fund launches? Digital asset plays. Wall Street's latest gold rush looks suspiciously like blockchain.

Why the frenzy? Institutions finally figured out what retail knew for years—you can't ignore returns that outpace traditional markets 3-to-1. Even the SEC stopped dragging its feet after seeing nine-figure inflows.

The twist? These aren't your anarchic 2017 ICOs. Today's crypto funds boast BlackRock-level infrastructure—with all the compliance theater that entails. Guess revolution does come with a prospectus after all.

One cynical take: Nothing unites finance bros faster than a new way to repackage volatility as 'innovation.' But when the fees roll in, who's complaining?

In Brief

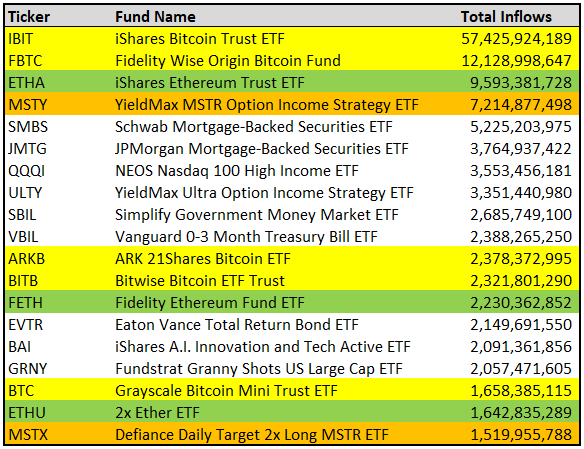

- Crypto ETFs dominate U.S. launches, with 10 of the top 20 funds tied to digital assets.

- The top 4 new ETFs are all crypto-focused, led by IBIT with $57.4B inflows.

- Ethereum ETFs hit $1B in a single day, surpassing Bitcoin spot ETF inflows.

Bitcoin and Ethereum ETFs Claim Top Spots in U.S. Launches

Since the beginning of 2024, more than 1,300 new exchange-traded funds have started trading in the U.S. ETF analyst Nate Geraci reports that among the 20 best-performing launches, 10 are tied to cryptocurrency. Even more telling, the top four overall performers are all crypto-focused.

The iShares Bitcoin Trust (IBIT) leads with $57.4 billion in inflows, far ahead of any other fund. In second place is the Fidelity Wise Origin Bitcoin Fund (FBTC), which has taken in $12.1 billion. The iShares ethereum Trust (ETHA) ranks third with $9.59 billion, while the YieldMax MSTR Option Income Strategy ETF (MSTY) is fourth with $7.2 billion, supported by MicroStrategy’s large Bitcoin holdings.

Other strong performers in the top 20 include:

- ARK 21Shares Bitcoin ETF (ARKB) saw $2.38B in inflows, ranking 11th overall.

- The Bitwise Bitcoin ETF Trust (BITB) followed closely with $2.32B, taking 12th place.

- Fidelity’s Ethereum Fund ETF (FETH) attracted $2.23B, securing the 13th position.

- Grayscale Bitcoin Mini Trust (BTC) recorded $1.66B, placing it in the 17th spot.

- The 2x Ether ETF (ETHU) crossed $1.6B in inflows, earning the 18th ranking.

- Defiance’s Daily Target 2x Long MSTR ETF (MSTX) also exceeded $1.5B, holding 19th place.

Among the highest performers are five spot Bitcoin ETFs, two spot Ethereum ETFs, two strategy-focused products, and one Leveraged Ethereum ETF.

BTCUSDT chart by TradingViewEthereum Sees Record-Breaking Investor Inflows

Ethereum-based exchange-traded funds have enjoyed a surge in investor interest. Last month, July, marked their strongest performance yet, with $5.37 billion flowing into spot ETH funds. Over the same period, they recorded a 19-day streak of daily inflows, showing steady demand. The run ended briefly in early August with a short spell of outflows, but interest quickly returned.

Monday marked a milestone, with $1 billion moving into spot ETH exchange-traded funds in a single day—the largest daily inflow on record for these products. From the start of July to that point, ETH spot ETFs accumulated nearly $1.5 billion more than Bitcoin spot ETFs, according to Geraci’s post.

Ethereum’s growing prominence has been helped by companies adding it to their balance sheets. While Bitcoin quickly gained traction with its straightforward story as “digital gold,” Ethereum took more time for investors to fully grasp.

Now, it’s increasingly recognized as a key building block for the financial systems of the future, which has strengthened its appeal.

Regulated ETFs Drive Broader Crypto Adoption

The momentum behind crypto-focused exchange-traded funds signals a wider shift in how investors are engaging with the asset class.

Rather than opting for direct purchases of digital currencies or relying on complicated setups, many are turning to regulated, exchange-traded options. Listed on established U.S. markets, these funds provide easier entry points and align well with the frameworks used by traditional investment firms.

Bitcoin remains the largest and most recognized cryptocurrency, but ETH’s recent performance suggests the gap could narrow. Strong inflows, a clearer investment narrative, and its increasing use in various financial applications are giving Ethereum new momentum in the ETF market.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.