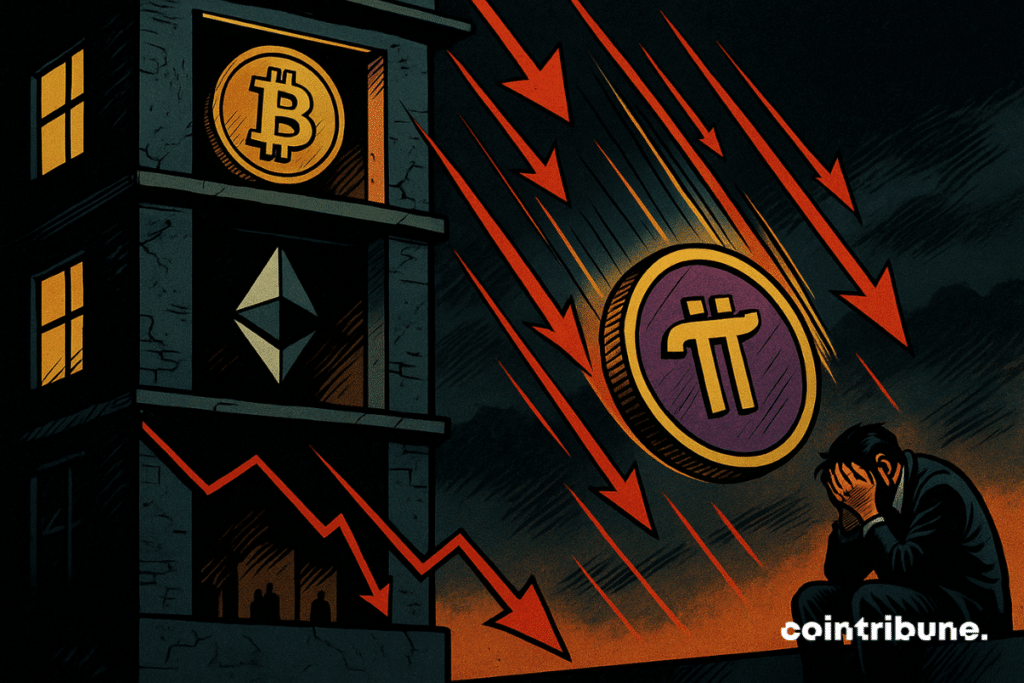

Pi Network in Freefall: Investor Confidence Craters as Project Teeters on the Brink

Another 'next Bitcoin' stumbles toward crypto's graveyard.

Pi Network—the mobile-mining project that promised to democratize crypto—now faces a brutal reckoning. Once-hyped PI tokens are trading like distressed assets, leaving early adopters scrambling.

The cracks are structural. No major exchange listings. Sparse developer activity. And that 'mainnet launch'? Still feels like vaporware after four years.

Retail investors aren't just disappointed—they're furious. Online forums overflow with accusations of exit scams and dead-end roadmaps. Meanwhile, the core team keeps tweeting moon emojis like a divorced dad trying to win back his family with lottery tickets.

Here's the cold truth: Pi became a cautionary tale about viral marketing trumping substance. When your whitepaper reads like a multi-level marketing scheme and your 'ecosystem' relies on relentless referral spam, maybe—just maybe—you weren't building the future of money.

Will Pi pull a Phoenix act? Stranger things have happened in crypto. But right now, it looks like another casualty of the 'get rich quick' mentality that plagues this industry.

In brief

- Pi Network falls and approaches its historic low, in a context of strong market instability.

- Its almost perfect correlation with Bitcoin (0.93) increases its vulnerability.

- Investors are losing confidence: capital is massively exiting, as shown by the continuous decline of the Chaikin Money Flow.

- Technical resistance at $0.362 remains out of reach, while the critical threshold of $0.310 could soon break.

Bitcoin pressure, a brutal mirror effect

The recent fall of Pi Network is not an isolated accident, but the direct reflection of its extreme dependence on bitcoin. While the market is undergoing a phase of uncertainty, crypto is sinking, dragged down by the market’s flagship asset. Several factual elements confirm this mechanism :

- The statistical correlation of 0.93 between Pi Network and bitcoin: this value indicates a near-perfect synchronization between the two assets ;

- Currently, the price of Pi Network has dropped to $0.30.

This situation poses a structural problem. Pi Network does not seem to exist as an autonomous asset on the market. It mechanically reacts to bitcoin’s trend, without its own catalyst.

This reinforces its vulnerability in an environment already weighed down by market indecision. In the absence of decoupling or differentiating fundamental elements, crypto risks continuing to evolve in BTC’s shadow, to the detriment of its long-term credibility.

Sentiment down and capital flight

Alongside the influence of bitcoin, the investment climate around PI Network is visibly deteriorating, according to several technical indicators.

One of the most notable signals concerns the Chaikin Money FLOW (CMF), which measures capital inflows and outflows. The CMF is steadily declining, indicating that capital outflows greatly exceed inflows.

This dominance of outgoing flows reflects one clear fact: investors are not content to remain passive; they are liquidating their positions. The phenomenon appears widespread and supports the idea of a massive withdrawal of confidence towards the project.

This constant selling pressure prevents any attempt at a sustained rebound. And even if a bullish scenario is mentioned in case of crossing the technical resistance at $0.362, this remains highly unlikely for now, given the unfavorable market conditions. Moreover, the critical threshold identified at $0.310 as the main support could soon be tested, increasing the possibility of a new historic low.

If this bearish scenario were to be confirmed, the consequences could be severe for the image of Pi Network facing major bugs, whose viability is already regularly questioned within the crypto community. A bullish return remains possible, provided the general sentiment is reversed, which WOULD probably involve a strong signal from the project, or major structural evolutions such as a centralized listing or a clarification of the business model.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.