NFT Market Explodes: $574M Monthly Sales Smashes All Records

Digital collectibles just flexed their financial muscle—hard. The NFT market roared past half a billion dollars in monthly sales, leaving skeptics scrambling to update their 'bubble' narratives.

No fluke, no fad

This isn't some meme-fueled anomaly. At $574 million, the numbers scream mainstream adoption. Blue-chip projects and new entrants alike are cashing in while traditional art dealers clutch their pearls.

Wall Street's FOMO moment

Watch hedge funds suddenly 'discover' digital ownership now that the receipts are undeniable. Funny how blockchain credibility arrives when there's a comma in the revenue figure.

The revolution will be tokenized

From pixelated punks to AI-generated masterpieces, NFTs are rewriting the rules of creative commerce. And this record? Just the opening bid.

En bref

- Les ventes de NFT atteignent 574 millions de dollars en juillet, soit le deuxième plus haut niveau de 2025.

- La valeur moyenne des transactions grimpe à 113,08 dollars, un sommet depuis six mois.

- Ethereum domine avec 275,6 millions de dollars de ventes, en hausse de 56%.

- Les CryptoPunks et Pudgy Penguins mènent la danse avec des performances exceptionnelles.

NFTs Shine Again with $574 Million in Sales in July

In July 2025, the NFT market posted its best monthly performance since the start of the year, with $574 million in recorded sales. That’s a remarkable 47.6% increase from June’s $388.9 million, making it the second-highest monthly total this year, just behind January’s peak of $678.9 million.

However, behind this sharp rise in total value lies a more nuanced trend. The total number of transactions dropped from 5.5 million to 5 million. This seemingly contradictory decline actually points to a shift in investor behavior.

Buyers are now favoring rarer and more highly valued assets, as evidenced by the average price per NFT, which jumped to $113.08—a six-month high.

This shift reflects the growing maturity of the market. The era of impulsive purchases of low-effort collections appears to be over. Collectors are now focusing their attention on projects with cultural, artistic, or technological legitimacy.

This tightening demand explains the 17% drop in the number of unique buyers, now down to 713,085, while the number of sellers ROSE by 9% to reach 405,505. The imbalance between buyers and sellers highlights this phase of natural selection within the market.

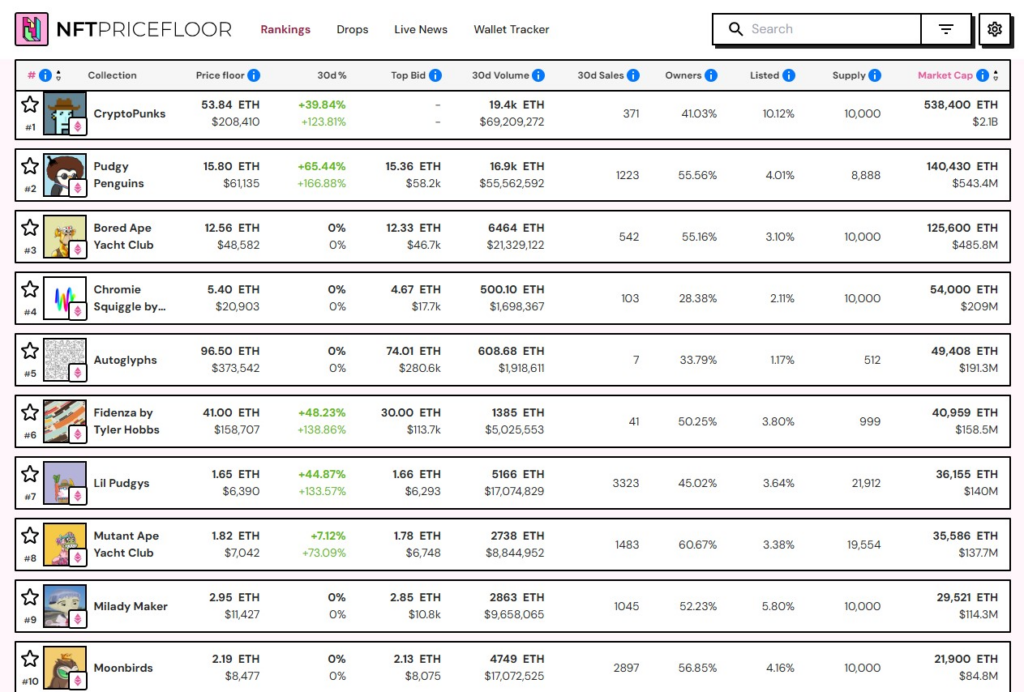

Meanwhile, the sector’s total market cap currently stands at around $8 billion, according to NFT Price Floor data—a 21% increase in just a few days.

Ethereum Reinforces Its Position as the Leading Ecosystem

The spectacular surge in Ether’s price—up 62% to over $3,900—has provided a boost to NFT collections built on the ethereum blockchain.

This momentum translated into $275.6 million in sales in July, a 56% monthly increase, confirming Ethereum’s dominance in the NFT space.

ETHUSDT chart by TradingViewThis supremacy is no coincidence. The ten most valuable collections in the market all operate on Ethereum, making it the undisputed standard for premium NFTs.

CryptoPunks maintain their lead with $69.2 million in 30-day trading volume, closely followed by Pudgy Penguins, which posted $55.5 million.

Pudgy Penguins’ performance is particularly noteworthy: their floor price soared by 65.44%, outpacing even the legendary CryptoPunks in terms of growth.

This standout result has overshadowed other historic giants like the Bored APE Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC), now relegated to the background.

Bitcoin and Polygon complete the podium of most active blockchains, with $74.3 million and $71.6 million in sales, respectively. Cardano stands out with 102% growth, while Solana posted more modest gains of 8%.

This hierarchy confirms Ethereum’s dominant position, combining technical robustness, liquidity, and cultural recognition.

More broadly, this resurgence of the NFT market is part of a wider bullish trend across the crypto ecosystem, marked by renewed interest in altcoins. Swiss bank Sygnum even anticipates the imminent arrival of “Altseason,” referring to “a major rotation of capital” toward alternative projects.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.