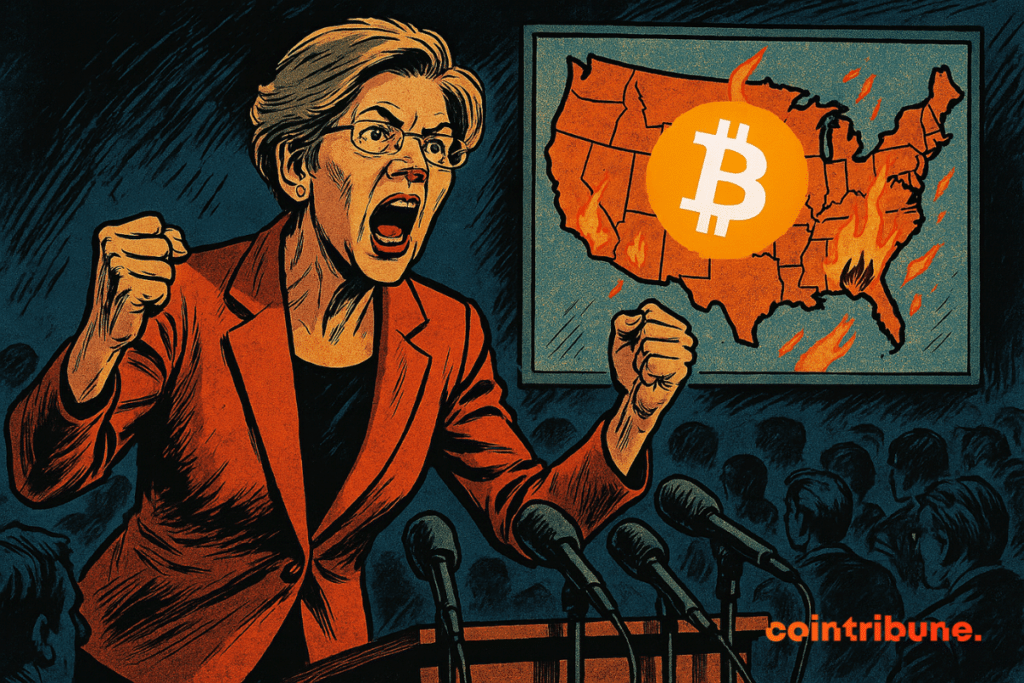

Elizabeth Warren Declares War on Crypto: Slams GENIUS Act as ’Dangerous Gamble’ in 2025 Showdown

Washington's crypto clash reaches boiling point as Senator Warren takes aim at proposed legislation.

The gloves are off

Progressive firebrand Elizabeth Warren just launched her sharpest attack yet against the controversial GENIUS Act - calling it a 'get-rich-quick scheme dressed as policy' during a fiery Senate Banking Committee hearing.

Why Wall Street is watching

The bill's potential to reshape digital asset regulation has crypto exchanges nervously refreshing their lobbying budgets - while traditional finance players quietly cheer from the sidelines. Nothing unites rivals like watching disruptors get disrupted.

Regulation roulette

Warren's scathing critique highlights Washington's fundamental divide: embrace innovation's messy potential or clamp down before the next FTX-style implosion. Meanwhile, Bitcoin holders shrug and HODL through another political storm.

The only certainty? This fight's just getting started - and the crypto industry's favorite punching bag isn't pulling any punches back.

In brief

- Warren compares the GENIUS Act to the law that preceded the 2008 financial crisis.

- She accuses Trump of personal enrichment through crypto regulation favorable to his economic interests.

- Experts fear bank runs if private stablecoins escape any real control.

- The GENIUS Act could wrongly legitimize currencies without clear institutional safeguards.

The return of a déjà vu scenario, crypto version

Elizabeth Warren waves a specter: that of a repeated financial disaster. By mentioning, she revives the memory ofthat paved the way to the. In her view,, this time in the crypto universe.

We have already seen this movie when the industry writes its own laws.

In 2000, she recalls, thesubmitted a weak text to Congress that gave the. Result: a bubble that bursts eight years later. Today, it is the crypto sector playing the same role by offering a tailor-made legal framework.

In 2000, the derivatives industry handed lawmakers a bill that weakly regulated the sector while giving the illusion of government support.

For Warren, thecould hide. Stablecoins, backed by the dollar but issued by private firms, could well become the new subprimes.

An economy shaped to enrich the powerful

Elizabeth Warren does not just criticize a law: she reveals. She accuses TRUMP of, controlling both the currency and its arbitrators. “Trump uses the presidency to enrich himself through cryptos, and he does so in full view of everyone“, she insists.

She denounces. The dissolution of the crypto unit at the Department of Justice, pressure on the SEC, and the appointment of allies from the industry form, according to her, a dangerous cocktail.

Donald Trump is the first president in American history to enact a law placing him at the head of regulators responsible for determining the value of a large part of his own fortune.

The American economy, in this configuration, becomes. Warren says it clearly: this law does not protect citizens; it institutionalizes a conflict of interest.

Behind regulation: a new power without control

Beyond the promises of stability,, where stablecoins become quasi-banks. Sergi Basco, professor of economics, warns: “It is not certain that issuers of private stablecoins are sufficiently regulated to avoid potential bank panics“.

Theis a sad reminder. There too, assets deemed SAFE were not enough to avoid the client run. Trust, the key to any economy, falters faster than people think.

Warren adds that these stablecoins could mislead: “The public could mistakenly believe the government backs these currencies“.

Key points to remember:

- 98% of stablecoins are backed by the dollar, but the majority of transactions take place outside the United States;

- Stablecoins give the illusion of state stability while escaping traditional banking rules;

- Trump launched his own cryptos while imposing a law favorable to their expansion;

- The illusion of security could trigger a global crisis if trust disappears.

Warren calls for vigilance: what is presented as innovation could become a lever for very real instability.

The GENIUS Act embodies an ambition: to relaunch the digital dollar and give the United States a competitive advantage again. But behind this goal lies a complex, unstable, and potentially dangerous architecture. According to Amundi, this project could even weaken the global financial system if flows massively shift to private stablecoins. In trying to save the dollar, the United States risks destabilizing the very economy it still dominated.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.