The Global Economy Is Crumbling Before Our Eyes – Here’s What Comes Next

Markets tremble as traditional finance shows cracks—while crypto stands defiant.

Fiat systems falter, Bitcoin shrugs

Central banks scramble to patch sinking ships with duct-tape monetary policies. Meanwhile, decentralized networks process transactions at ATH speeds—no bailouts needed.

The great wealth transfer accelerates

Goldman Sachs analysts whisper about 'currency debasement' over martinis. Retail traders stack SATs instead.

Legacy finance’s last act?

SWIFT transactions crawl while cross-chain swaps hit new highs. Some still believe the Fed can print its way out—bless their hearts.

In Brief

- The “Fourth Turning” theory predicts historical cycles of 80–100 years, each ending in a major crisis.

- Economic imbalances accumulated since 2008 are setting the stage for a systemic collapse.

- Geopolitical tensions between the U.S. and China risk triggering a major conflict.

A historical theory that predicts collapse

The trade war triggered by Trump, the debt crisis, and the growing tensions between the United States and the Russia-China bloc are all signs announcing a crisis of the capitalist model.

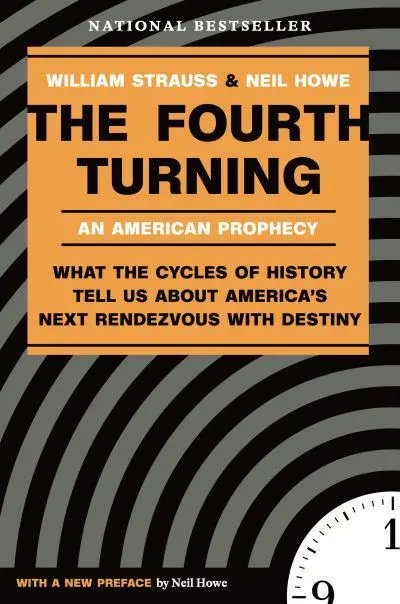

In 1997, Neil Howe and William Strauss revolutionized historical analysis with their book “The Fourth Turning: An American Prophecy.” Their bold theory proposes that History evolves according to predictable four-phase cycles, each lasting about twenty years.

Thesefollow each other invariably. First the “High,” a period of prosperity and social cohesion, like the Thirty Glorious Years. Then the “Awakening,” a phase of questioning institutions by younger generations, as in the 1960s-70s. Next the “Unraveling,” marked by growing individualism and institutional weakening since the 1980s.

Finally comes theHistorical examples include the American Revolution, the Civil War, and the Great Depression leading to World War II.

According to Howe, we entered this critical phase between the mid-2000s and the early 2020s.

Catalysts of the current collapse

Severalexplain why this Fourth Turning is happening today. The first concerns theaccumulated over decades.

After the 2008 crisis, governments, companies, and individuals took advantage oftoThis artificial monetary expansion inflated asset prices while creating aon cheap credit. Today, global debt reaches unprecedented levels, pushing countries and economies to their limits.

Meanwhile,intensifies. Trust in governments, financial institutions, and media continuously erodes.widen, fueling polarization and the rise of populist movements worldwide, from TRUMP in the US to Meloni in Italy.

Theis the third major catalyst. Beijing’s rise since the 1990s challenges American dominance, creatingreminiscent of rivalries in previous Fourth Turnings. This superpower competition invariably destabilizes the established world order.

Economic scenarios for the coming years

Facing these, the economic consequences could be dramatic. When debts reach unsustainable levels, governments have three main options: drastically cut spending, default, or

Inflation remains historically the, as it discreetly reduces debt without unpopular budget cuts. However, this approach devastates ordinary citizens by eroding their savings and purchasing power. The pandemic previewed this reality, with governments massively creating money, triggering.

If inflation spirals out of control, authorities typically resort tosuch as financial repression, forcing investors and citizens to hold government assets despite their rapid devaluation.

amplify these economic dangers. A conflict in the Taiwan Strait could quickly escalate between the US and China, breakingand causing widespread panic in financial markets. This geopolitical polarization already forces nations to choose sides, especially between the West and BRICS countries.

Bitcoin and actions to survive the collapse

Thisdemands a radically different investment approach. Financial expert Russell Napier predicts a prolonged era of.

Traditional bonds, once SAFE havens, become dangerous. Faced with rising inflation, bondholders will demand, causing existing prices to fall. Holding government or corporate bonds during this Fourth Turning couldyour portfolio.

Regarding stocks, the new economic landscape favors: infrastructure, defense, raw materials, manufacturing, and energy. Governments will increase spending in these areas to rebuild economies, restore supply chains, and strengthen national security.

offer particular protection. Gold and silver historically perform well during inflation and monetary devaluation periods. Gold could even become aif confidence in traditional currencies falters, explaining its recent sustained rally.

BTCUSDT chart by TradingViewFor cryptocurrencies, only those withwill likely survive the next bear market. Aside from bitcoin and Ethereum, most cryptos will fall.

The decade 2020-2030 heralds a tumultuous period. Wise investors must start repositioning their portfolios now towards tangible sectors, diversify geographically, and prioritize preserving their wealth, particularly by acquiring Bitcoin. Although the NEAR future looks chaotic, History teaches us that these crisis periods invariably lead to renewed eras of peace and prosperity.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.