Institutional Tsunami: How Wall Street’s ETH & Altcoin Frenzy Is Redefining Crypto in 2025

Wall Street's latest playground? The crypto markets—where Ethereum and altcoins are surfing a tidal wave of institutional capital.

The big money shuffle

Forget your grandma's Bitcoin FOMO. The real action's in ETH and select alts as hedge funds pivot from 'digital gold' to 'deFi infrastructure plays.' Because nothing says prudent investing like chasing 100x leverage on internet money.

Regulators left playing catch-up

While the SEC debates which crypto is a security, institutions are quietly building positions that could make 2021's bull run look like a warm-up act. The irony? These are the same firms that called crypto a scam three years ago.

One thing's clear—when banks start front-running retail, the game changes forever. Whether that's progress or predation depends on which side of the trade you're on.

In brief

- Ethereum attracts capital with a record increase in its open interest in one week.

- The GENIUS Act restores confidence in institutions, favoring the crypto ecosystem at the expense of bitcoin.

- The Altseason index reaches 57, a sign of a gradual rotation toward dominant alternative cryptos.

- Ethereum ETF volumes exceed those of bitcoin for two consecutive days: a strong signal.

ETH, SOL, XRP: the new toys of the wealthy

The signals are no longer mistaken. Ethereum, Solana, and XRP are no longer reserved for daring crypto investors. Institutional behemoths are taking a close interest. In one week,. This altcoin surge does not come from retail. It’s the corporate treasuries, hedge funds, and influential asset managers entering the game.

The, recently signed, played a role of. By bringing clarity to the rules around stablecoins, it restores confidence to professional operators.. ethereum leading, followed by Solana, then XRP.

This capital migration is not without consequence. It mechanically reducesin a few days. Meanwhile,now captures. The landscape is changing rapidly.

A structured crypto ecosystem, converging signals

Thehas crossed an important threshold. At, it signals an ongoing shift towards altcoins. This score hadn’t been reached since December. And when it rises above 50, thesignificantly increase. Moreover, treasury movements are multiplying. Ether Reserve announced its upcoming listing on Nasdaq, proof of sector structuring.

Upexi, a player in the solana segment, confirms the trend. Its strategy director, Brian Rudick, puts it bluntly:

This legislation is likely to spur more on-chain development and activity and that benefits altcoins more so than bitcoin. While the preponderance of digital asset treasury companies continue to be [for BTC], they are increasingly moving down the risk spectrum to assets like ETH, SOL, and beyond.

also illustrate this paradigm shift. Long call spread positions aim forby year-end. These bets come from heavyweights anticipating a steady but solid rise of ETH in the global crypto landscape.

ETHUSD chart by TradingViewAltcoins on the attack: an accelerating scenario

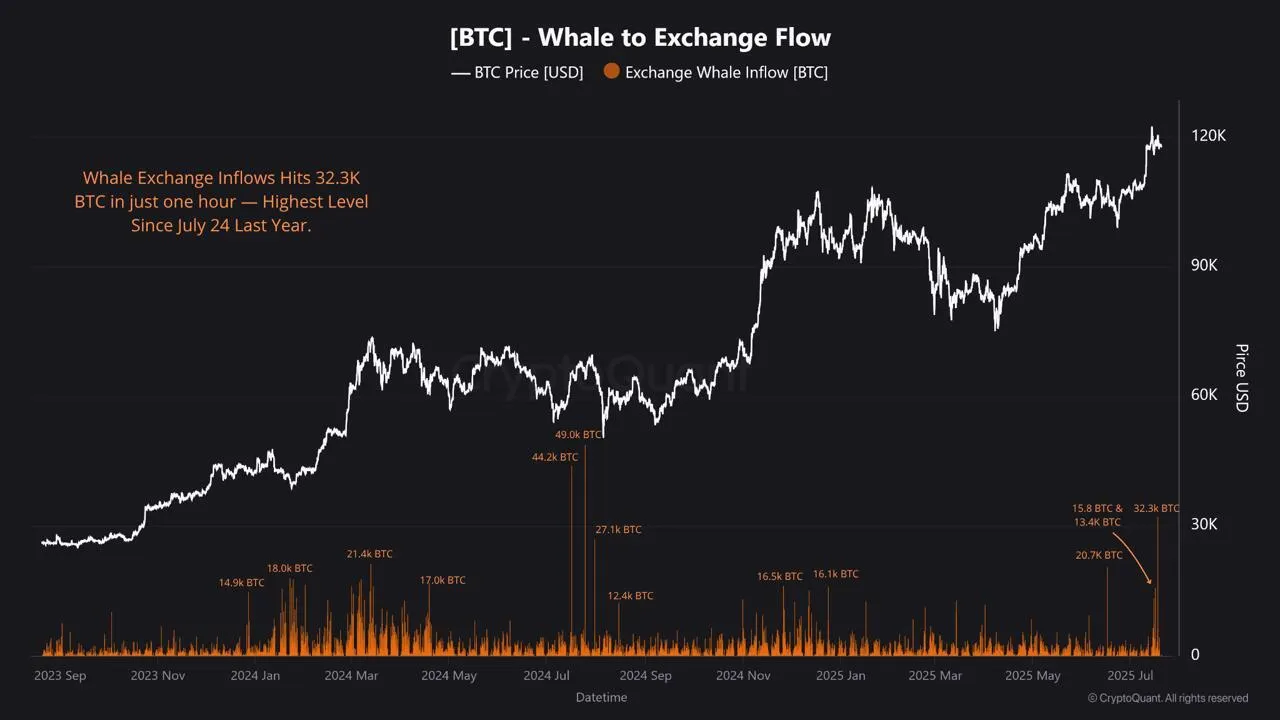

are gaining ground. And not just on the charts. Crypto whales have recently injected decisive momentum. On July 17,. This suggests massive profit-taking. Meanwhile, altcoins saw their capitalization jump, capturing flows diverted from bitcoin.

Arthur Hayes, former CEO of BitMEX, talks about an. According to him, every time Bitcoin consolidates, altcoins benefit. It’s the starting point of an explosive cycle.

- The Altcoin Season Index stands at 57, a decisive threshold;

- ETH open interest increased by $10 billion in one week;

- BTC recently lost 4 dominance points;

- For two consecutive days: Ethereum ETF flows exceeded those of bitcoin;

- Meme coin capitalization approaches $90 billion

Between dynamic presales, new entrants, and rapid rotations, the altcoin universe is awakening with a bang.

In four weeks, Ethereum has jumped over 50%. The euphoria is palpable, the compasses spinning. Some even dare to propose ten thousand dollars as a credible horizon. The prince of cryptos no longer just follows: he leads the dance. And this altseason might well be his crowning.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.