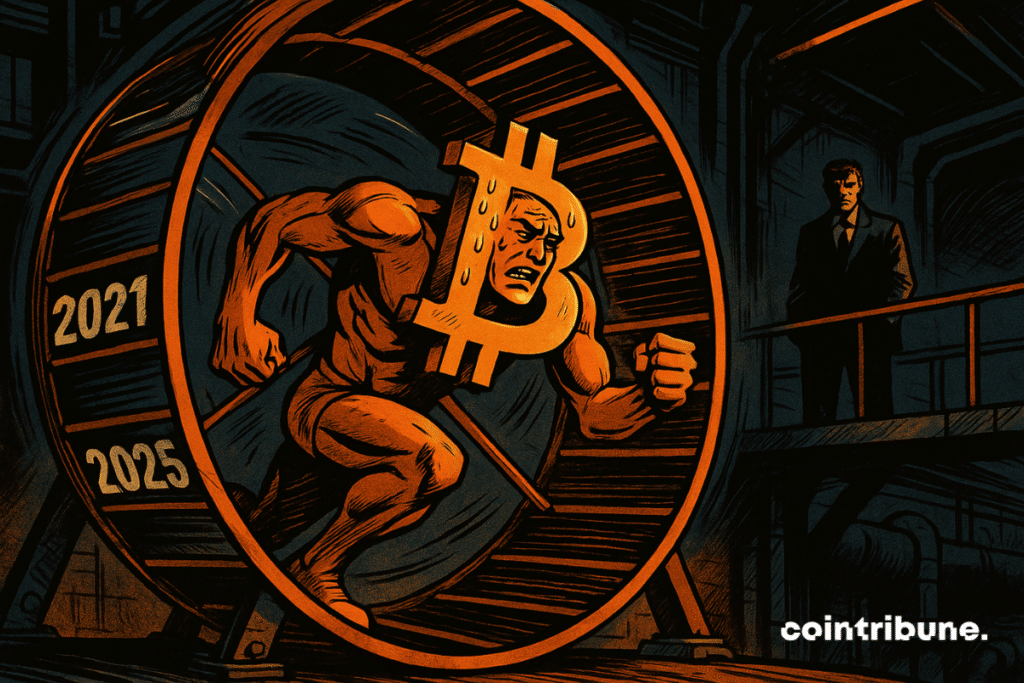

Bitcoin Stuck in Its 4-Year Cycle: Xapo Bank CEO Sounds the Alarm

Bitcoin's quadrennial boom-bust pattern just got a stark warning from one of crypto's most seasoned insiders. The CEO of Xapo Bank—a heavyweight in digital asset custody—is flashing caution lights as BTC grinds through another predictable cycle.

Here's why institutional players are sweating the déjà vu.

Four years. Like clockwork. Bitcoin's halving events, price peaks, and brutal corrections keep replaying like a broken record. Now, with the 2024 halving in the rearview, Xapo's chief sees history rhyming dangerously—while Wall Street's latecomers still pretend 'this time it's different.'

The kicker? Even with spot ETFs and corporate treasuries piling in, BTC's volatility remains as reliable as a hedge fund manager's performance fees. Will this cycle finally break the pattern—or just enrich the usual suspects?

In brief

- The Bitcoin four-year cycle remains relevant according to the CEO of Xapo Bank, despite massive institutional adoption.

- The next correction could be triggered by a simple slowdown in crypto news, with no catastrophic event.

- Institutional adoption is not enough to break the cyclical psychology of the markets.

- Overleveraged companies holding bitcoin could amplify the next crisis.

The Bitcoin cycle is not dead and could hurt

Seamus Rocca prefers to break the enthusiasm rather than feed illusions. In an interview with Cointelegraph, the CEO of Xapo Bank states that the arrival of institutions does not question the cyclical nature of bitcoin.

“Many people say: “Oh, institutions are here, and therefore the cyclical nature of bitcoin is dead.” I am not sure I agree with that“, he asserts.

This position stands out in the current context. US spot Bitcoin ETFs exceed $50 billion in net inflows, BlackRock holds more than 700,000 BTC, and several companies worldwide are adopting crypto as a store of value. A picture that nevertheless seems revolutionary.

BTCUSDT chart by TradingViewFor Rocca, these spectacular advances are not enough to break a dynamic more than fifteen years old. The market remains subject to waves of euphoria and panic caused not by technology or regulation, but by an Immutable factor: human psychology.

Human psychology will never change. The cycles have nothing to do with bitcoin, but with people. This time, the same boom and the same crash will happen.

An analysis shared by Aleksandar Svetski, author of The Bushido of Bitcoin, who anticipates “the same boom and the same crash” as before.

Another strong signal: the still high correlation between bitcoin and traditional stock markets, especially the S&P 500.

Despite its growing reputation as a reserve asset, bitcoin remains, according to Rocca, a speculative asset, high-risk, still far from the status of a definitive SAFE haven.

The silent threat of an organic collapse

Unlike previous corrections triggered by spectacular events, the next one could be born from a simple “breathlessness”.

Rocca warns against an insidious scenario: “The contagion effect could be as simple as no news on the market.“

This organic mechanism worries more than external shocks. Without an identifiable catalyst, investors risk being caught off guard. A slowdown in developments, a decline in media interest, or portfolio rebalancing could be enough to trigger a downward spiral.

The venture capital firm Breed adds an additional dimension to this threat. Companies that have massively invested in bitcoin through debt could trigger a domino effect.

However, not all signals are red. Breed’s analyses suggest that if most companies continue to finance their bitcoin purchases mainly through equity rather than loans, the contagion could remain limited. This nuance offers a glimmer of hope in an overall worrying picture.

In short, bitcoin may be living its last months of euphoria before the next cyclical correction. Despite massive institutional adoption and new all-time highs, human psychology and market mechanisms remain unchanged. Savvy investors WOULD do well to prepare for this eventuality, as this time, the collapse could occur without warning.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.