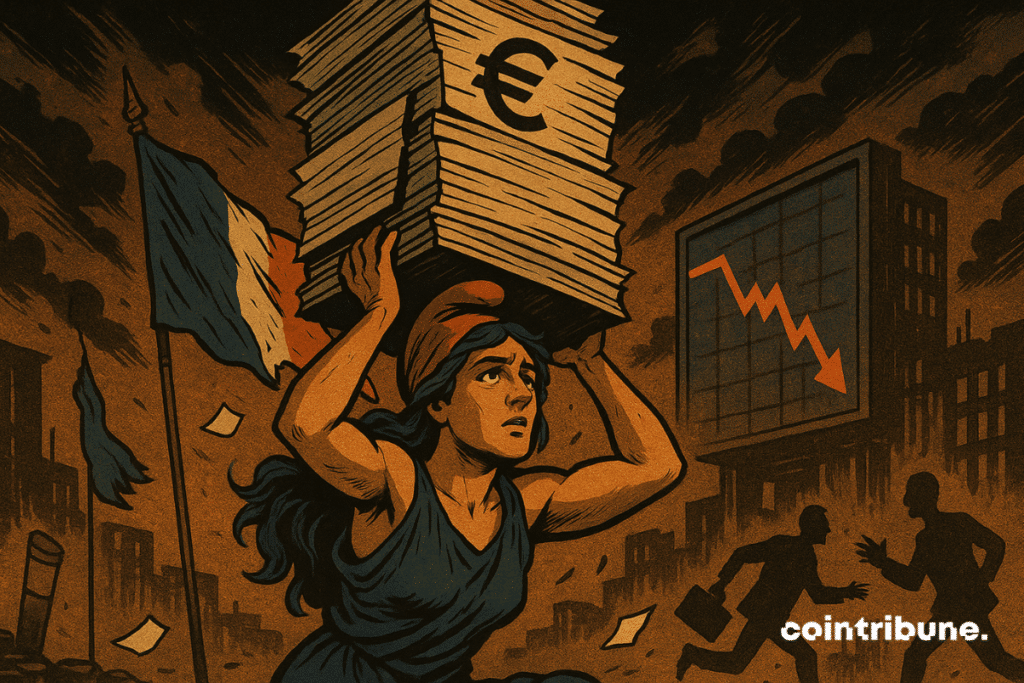

France’s Debt Costs Overtake Italy’s for First Time in Two Decades – What’s Breaking in Eurozone Finance?

Eurozone debt markets just flipped the script. For the first time since 2005, France is paying more to borrow than Italy—yes, the same Italy that's been Europe's perennial fiscal problem child.

How the tables turn

French 10-year yields crept past Italy's this week, a historic role reversal that's got analysts scrambling. Suddenly, the 'safe' core looks shaky while the risky periphery gets… less risky? Only in 2025's topsy-turvy bond markets.

Behind the numbers

No one's calling this a full-blown crisis—yet. But it's a stark warning sign when the eurozone's second-largest economy starts looking riskier than its third-largest. Maybe those French pension reforms came too late? Or perhaps markets finally noticed Italy's debt-to-GDP stopped climbing?

The cynical take

Here's the kicker: both countries still pay less than crypto staking yields. But hey, at least with government bonds you can pretend you're not gambling.

In brief

- For the first time since 2005, the 5-year interest rate on French debt exceeds that of Italy.

- This symbolic inversion marks a sign of market distrust towards the French signature.

- Despite a better credit rating (AA-), France borrows at a higher cost than countries historically considered riskier.

- This situation is explained by a very high level of public spending and an unconvincing budgetary trajectory.

A signal of distrust in the bond markets

While the interest on French debt is exploding, last Friday a symbolic threshold was crossed on the European debt markets. For the first time since 2005, the interest rate demanded by investors to lend to France over five years exceeded that granted to Italy.

“France borrows at higher rates than Italy”, specified Éric Lombard, Minister of the Economy. Indeed, the rate on the French five-year bond reached 2.67 %, compared to 2.65 % for its Italian equivalent. This reversal, although temporary, constitutes a strong signal sent by the markets regarding the perception of sovereign risk in the eurozone.

Such a movement is not isolated. It fits into an overall dynamic of risk premium adjustment in Western Europe. While French interest rates have remained almost unchanged since early 2023, those of other countries with more disciplined budgetary trajectories have declined. This is illustrated by the evolution of five-year rates:

- France : 2.54 % at the beginning of 2023, and 2.67 % today ;

- Italy : 3.62 % at the beginning of 2023, 2.67 % today (significant decrease);

- Spain (with an A rating by S&P) : 2.94 % at the beginning of 2023, and 2.42 % today ;

- Portugal (also rated A) : 2.75 % at the beginning of 2023, then 2.36 % today.

This picture is all the more worrying since France remains theoretically better rated by agencies (AA-). Yet in practice, investors demand higher compensation to hold its debt. This discrepancy between rating and perception reflects a progressive and tangible loss of credit in the markets.

A deterioration fueled by budget fundamentals

Beyond the symbolic shock on rates, this situation reflects growing concern related to the management of French public finances. “Public spending represents 57 % of GDP, ten points higher than the average of European countries”, emphasized Éric Lombard in his warning.

This well-known but rarely translated structural gap into credit cost until now seems to weigh increasingly on the perception of French debt. Unlike its southern neighbors, who have multiplied budgetary consolidation efforts since the sovereign debt crisis, Paris appears to lag behind, with few significant structural reforms in recent years.

This difficult budgetary trajectory, combined with uncertain political context and sluggish growth, contributes to increasing the risk premium demanded by investors. The government, engaged in savings plans discussed at Bercy for the 2026 budget, is now under pressure to avoid a runaway increase in borrowing costs.

However, these measures remain vague and struggle to convince the markets. The mere fact that historically more fragile states, such as Portugal or Spain, can benefit from better access to financing illustrates a reversal of dynamics that rating agencies and major asset management firms will closely monitor.

If this trend were to continue, the consequences could go far beyond the cost of sovereign debt. It WOULD call into question the perceived stability of the French fiscal framework, which could impact medium-term foreign investment, local equity markets, and savers’ confidence.

In a climate where states’ credibility is challenged by rising rates and debt burden, certain monetary alternatives attract investors’ attention. Bitcoin, often described as a decentralized store of value, sees its legitimacy strengthen as sovereign debts create distrust.

For observers, this growing distrust of classic sovereign assets could also fuel attraction to alternatives related to decentralized finance. France thus finds itself in a delicate position: it can either restore trust through political and economic resurgence, or risk a lasting downgrade within the European financial order.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.