Metaplanet & Semler’s Bitcoin Gambit: The High-Stakes Strategy Shaking Crypto Markets

Two financial heavyweights double down on Bitcoin—while traditional investors clutch their pearls.

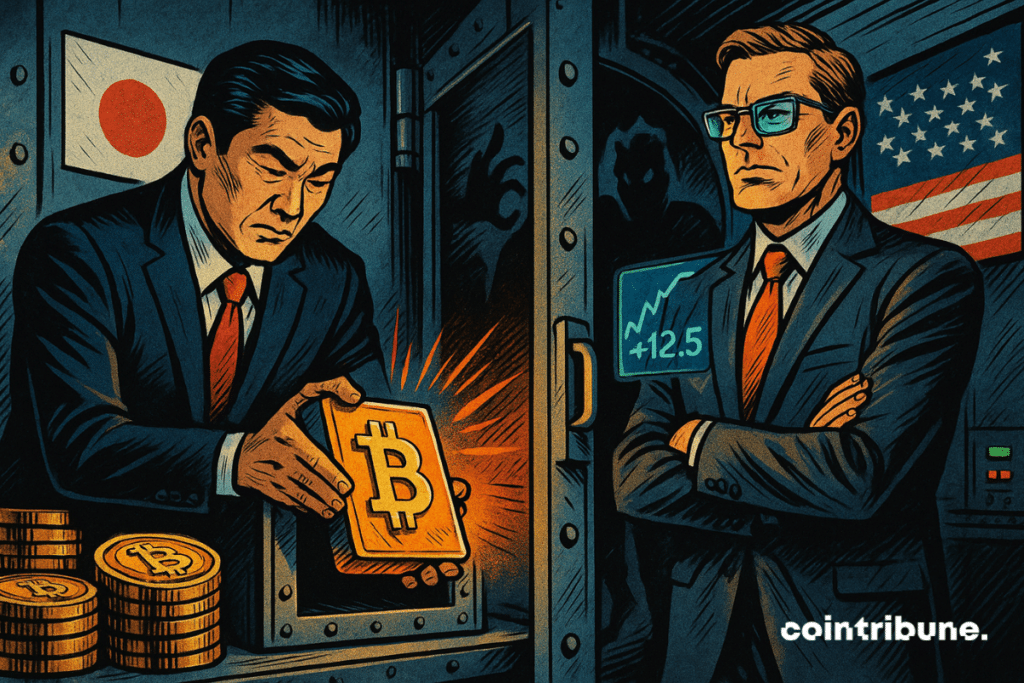

The Play: Metaplanet and Semler Scientific aren't just dipping toes in crypto—they're cannonballing into Bitcoin's volatile waters. Their aggressive accumulation strategy screams confidence (or desperation, depending who you ask).

Why It Matters: When institutional players go all-in on BTC, it's either a masterstroke or a cautionary tale in the making. Meanwhile, Wall Street still thinks 'HODL' is a typo.

The Bottom Line: This isn't your grandma's dollar-cost averaging—it's a billion-dollar bet that could redefine corporate treasuries... or become finance textbook footnotes.

In Brief

- Two listed companies, Metaplanet (Japan) and Semler Scientific (USA), significantly increased their Bitcoin treasuries on July 7, 2025.

- Metaplanet acquired 2,205 BTC for about $238.7 million, bringing its total to 15,555 BTC, valued at nearly $1.7 billion.

- Semler Scientific added 187 BTC for $20 million, reaching a total of 4,636 BTC in its accounts.

- These purchases come as Strategy (MicroStrategy) exceptionally suspends its weekly buys, breaking a streak that began in April.

A coordinated offensive despite uncertainties

While Strategy announced a colossal fundraising to buy more bitcoin on Monday, July 7, two listed companies announced substantial bitcoin acquisitions in a context where crypto remains near its all-time highs. These moves were publicly confirmed by the parties involved and shared by several key industry figures on social media.

BTCUSDT chart by TradingViewAgainst the grain of a cautious market, Metaplanet and Semler Scientific continue their aggressive accumulation policies.

Here are the key points to remember :

- Metaplanet, a Japanese investment company, acquired 2,205 BTC for approximately $238.7 million, at an average price of $108,237 per bitcoin ;

- It now holds 15,555 BTC, valued at nearly $1.7 billion, with a total acquisition cost of around $1.54 billion ;

- It shows an internal performance called BTC Yield, reaching +416 % since the start of this year;

- Semler Scientific, a US medical sector company, bought 187 BTC for $20 million ;

- It currently holds 4,636 BTC, valued at over $500 million, and reports a BTC Yield of 29 % ;

- Both companies adopt unconventional financing solutions to support these purchases, following a logic introduced by Strategy, the pioneer of the BTC treasury model.

These moves are far from isolated. They fit into a landscape where listed companies are increasingly adopting bitcoin-linked performance indicators, such as BTC Yield, to assess their asset strategies.

This dynamic suggests that, for some companies, bitcoin is becoming much more than a simple speculative asset: it is now a lever for financial and stock market valuation in its own right, although results remain mixed depending on the actors.

An aggressive strategy in response to Strategy’s pause

This renewed enthusiasm is observed even as Strategy paused its weekly purchase program, breaking an uninterrupted streak since April 14. “Some weeks, it’s better to just hold your positions,” summarized Michael Saylor, its co-founder, Sunday evening on the social network X.

https://twitter.com/saylor/status/1941833235845034478He thus anticipates the company maintaining the status quo for this new week. A pause all the more remarkable since Strategy now holds nearly $65 billion in BTC, after adding $7 billion during the second quarter alone.

This contrast between Strategy’s temporary restraint and the renewed aggressiveness of Metaplanet and Semler reflects divergent tactical visions. While Strategy seems to favor a wait-and-see approach in the face of bitcoin flirting with its all-time high ($108,061 currently, 3.4% off the ATH of $111,814), Metaplanet and Semler seem instead to want to capitalize on this consolidation phase to strengthen their positions.

Beyond the numbers, these moves signify a rise in influence of secondary actors seeking to compete with or emulate the pioneers of corporate bitcoin. The fact that over 852,000 BTC are now held by listed companies suggests a growing institutionalization of bitcoin as a long-term strategic asset.

This raises new questions about volatility management, the sustainability of credit purchase strategies, and these companies’ capacity to absorb market reversals.

These new operations by Metaplanet and Semler mark a turning point. They remind us that bitcoin accumulation by companies is no longer the preserve of a single player like Strategy. BTC is gradually becoming a strategic balance sheet asset, even an identity-defining one for some companies.

Although market performances diverge, with Metaplanet rising strongly and Semler declining, a broader trend emerges: the adoption of an asset management logic where bitcoin is no longer just a speculative bet but a SAFE haven and a structural component of balance sheets, as evidenced by the $2000 billion valuation of the asset. The question remains how long this model will hold up against the realities of financial markets, regulation, and an asset as unpredictable as bitcoin.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.