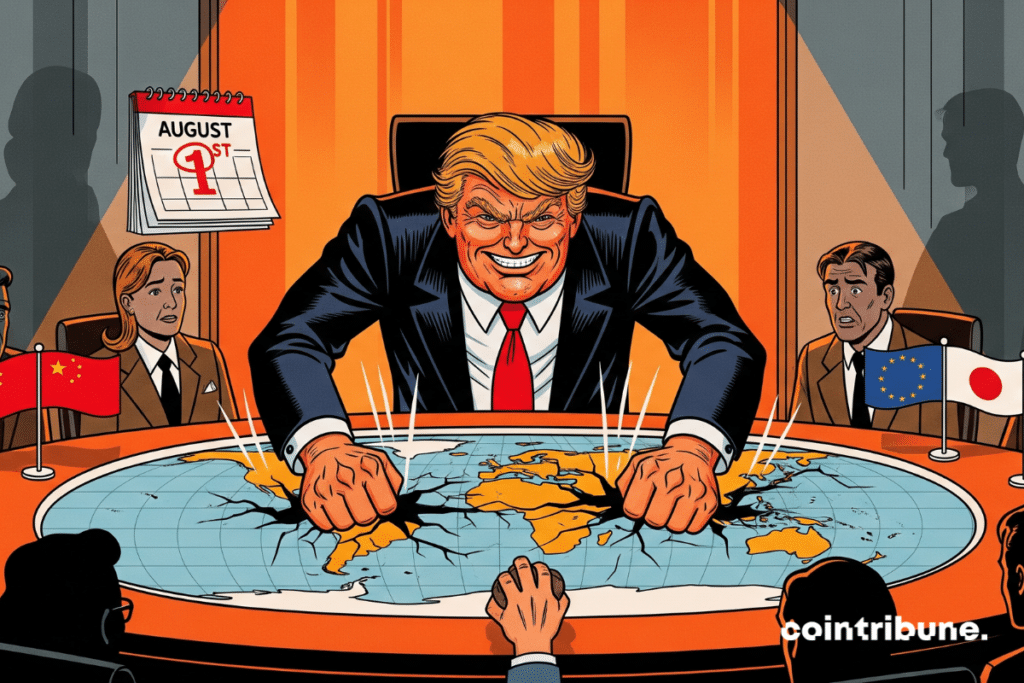

Trump’s August 1 Tariffs: How They’re Rattling Global Markets in 2025

Another round of tariffs—another headache for the global economy. Trump’s August 1 levies are slicing through supply chains like a hot knife, and markets are bracing for impact.

Trade Wars 2.0: Who Really Pays?

Forget ‘America First’—this is ‘Everyone Hurts.’ Import costs spike, inflation creeps, and consumers foot the bill (surprise!). Meanwhile, CFOs are scrambling to rework their spreadsheets—because nothing says ‘strategic planning’ like reactive panic.

Crypto’s Quiet Win?

While traditional markets flinch, Bitcoin whales are smirking. Decentralized finance doesn’t care about border taxes. Another reminder: maybe the real ‘hedge against chaos’ was the friends (and altcoins) we made along the way.

Closing Thought: If tariffs were a crypto token, they’d be a shitcoin—volatile, politically mined, and backed by nothing but hot air.

In Brief

- The Trump administration threatens to impose tariffs of up to 70% starting August 1st.

- The global economy could be destabilized if 18 trading partners are targeted simultaneously.

Maximum pressure on the global economy and its partners

Washington is preparing to relaunch. Without a quick agreement, the new taxes announced in early April will indeed take effect in less than a month. The goal: to force the United States’ economic partners to rebalance the trade deficit.

The strategy now seems to be embraced by the Trump administration. Proof: Treasury Secretary Scott Bessent announced on Sunday. President Donald Trump himself has already signed a dozen letters from Air Force One.

The economies of the European Union, China, and other major trading powers find themselves directly in the crosshairs. The reason: their share in the US trade deficit that Trump considers unacceptable.

Direct consequences on trade and economic growth

This maneuver risks shaking up international trade. By targeting, the United States could indeed destabilize global trade relations as a whole. Admittedly, Europe has begun negotiating under threat. That said, other countries remain defensive.

Good to know:would cause a sharp rise in import prices. This WOULD inevitably affect supply chains as well as financial markets.

The already fragile global economy could therefore falter under this new pressure.

For crypto investors, this instability could rekindleoutside traditional circuits. The economy could then experience a brutal rebalancing, reshuffling the cards of global trade power.

In any case, Trump is playing a tight game. If the threats materialize, the global economy could shift into a new era of tensions. A situation to watch very closely in the coming weeks!

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.