Robinhood Disrupts Europe: Game-Changing L2 Blockchain for Stock Trading Goes Live

Robinhood just flipped the script on European markets—launching a slick Layer 2 blockchain designed to revolutionize stock trading. No more legacy settlement delays, no more middlemen skimming fees. Just fast, transparent trades on-chain.

Why Europe? The region's tightening crypto regulations ironically made it the perfect sandbox for a compliant yet disruptive equity trading experiment. Traders get instant settlements; regulators get an immutable audit trail. Everyone wins—except maybe the old-guard brokers still charging 0.5% per trade.

The kicker? This isn’t some theoretical whitepaper play. It’s live now, with real euros flowing through smart contracts. Watch out, traditional finance—your 'efficiency' just got benchmarked.

In brief

- Robinhood launches an L2 network on Arbitrum for trading tokenized stocks and ETFs in Europe.

- American securities will be available commission-free, 24/7, five days a week.

- Robinhood obtains its MiCA license to offer these services in 27 European countries.

- Robinhood stock jumps to a historic high after the announcement, fueled by its crypto ambitions.

A technological revolution that propels Robinhood to new heights

Robinhood has just reached a decisive milestone in modernizing financial markets. This Monday, the platform launched its own LAYER 2 blockchain on Arbitrum, allowing European investors to access more than 200 American stocks and ETFs in tokenized form. An innovation that goes far beyond a mere announcement: it redefines the rules of trading.

The markets immediately welcomed this initiative. Robinhood stock climbed 11.25%, reaching an all-time high of $92.37, a 148% increase since January. This surge illustrates investors’ confidence in the disruptive strategy adopted by the company.

Thanks to its MiCA license, Robinhood can now operate in 27 European countries, providing a solid regulatory framework for its blockchain ambitions.

But the real novelty lies in how the tokenized securities work: tradable without commission, 24/7 and 5 days a week, they break down the time and financial barriers of traditional markets.

Europeans can now freely invest in American giants like Apple, Tesla, or Microsoft through a smooth, regulated Web3 interface… built for the future.

A clear global crypto strategy

Robinhood’s blockchain breakthrough did not come out of nowhere. It fits into an international expansion strategy started with the acquisition of Bitstamp for $200 million last June.

This acquisition, focused on regulated and institutional crypto markets, already announced a turn towards a more integrated and tokenized finance. The launch of its own layer 2 blockchain on Arbitrum today is the realization of that vision.

Analysts have taken note. Ed Engel at Compass Point raised his price target from $64 to $96, betting on increased revenue from margin trading.

The tokenization of stocks indeed opens a still underexploited segment, but with considerable monetization prospects.

During a demonstration, CEO Vlad Tenev conducted a live trade of tokenized OpenAI shares on Arbitrum, proving the robustness of the infrastructure. A successful operation marking the transition from theory to practice.

A booming RWA market… and competition that’s organizing

Meanwhile, Robinhood is diversifying its offer with perpetual futures contracts offering leverage up to 3x, in partnership with Bitstamp. A way to capture both small investors and more experienced traders.

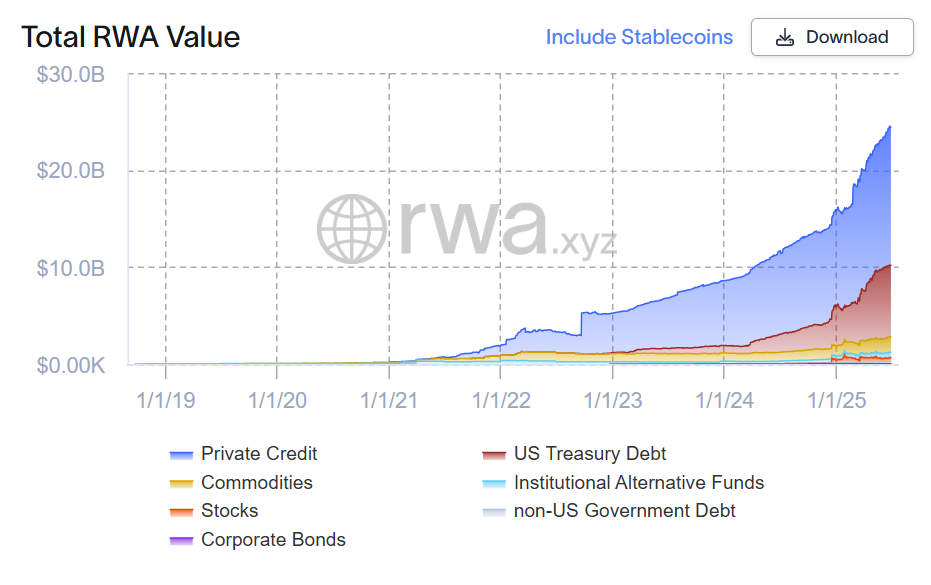

This positioning aligns with the rise of the tokenized real-world assets (RWA) market, which crossed $24 billion in June, according to RedStone. Yet tokenized stocks only represent about $400 million, highlighting enormous growth potential.

But Robinhood is not alone in this race. Gemini already offers tokenized MicroStrategy shares, while Kraken is developing its xStocks service on solana for European investors. This buzz reflects a profound change in market structure.

Faced with this dynamic, Robinhood is not just following the trend. It seeks to redefine the standards of digital trading, with a vision resolutely focused on interoperability, regulation, and global accessibility.

Tokenization is no longer a technological gamble: it is a strategic tool. For Europe and global markets, the movement is underway, and Robinhood is on the front line.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.