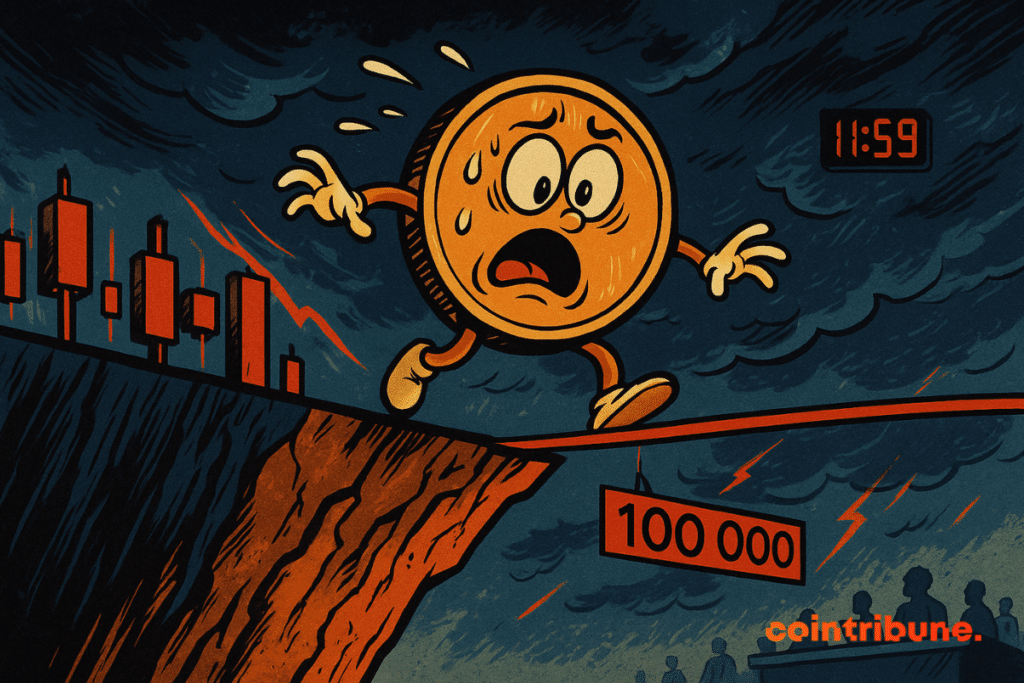

Bitcoin Teeters: Technical Indicators Flash Warning as Price Threatens to Slip Below $100K

Bitcoin’s bull run hits a snag—key signals suggest a potential retreat beneath the psychological $100,000 barrier today. Traders brace as momentum wavers.

RSI overheated, MACD flips bearish—classic signs of exhaustion after a 30% monthly pump. ’Buy the dip’ crowd lurks, but leverage liquidations loom.

Meanwhile, Wall Street analysts suddenly remember ’volatility’ exists. Funny how that works when bonuses are already banked.

In Brief

- Bitcoin briefly dropped below $102,400 on May 12, despite a favorable macroeconomic climate.

- This correction occurs as traditional markets react positively to a trade deal between the US and China.

- Analysts mention a technical liquidation linked to profit-taking and risk reduction ahead of the CPI release.

- Despite this drop, fundamentals remain strong: MicroStrategy has purchased 13,390 BTC and spot Bitcoin ETFs record positive inflows.

A technical correction driven by the macroeconomic context

On May 12, Bitcoin recorded a sudden drop, falling from an intraday peak of $105,819 to a low of $102,388, without a clearly bearish macroeconomic catalyst. Yet, this decline occurs in an overall favorable context.

Trade negotiations between Washington and Beijing progressed in Geneva, which sparked Wall Street’s enthusiasm. Indeed, US President Donald TRUMP himself praised the progress on his Truth Social platform, and spoke of a promising agreement.

BTCUSDT chart by TradingViewAt market open, the Dow Jones jumped 1,000 points, but bitcoin did not follow. Some traders believe the market has already priced in the effects of Trump’s deal with China, since bitcoin failed to hold above $104,000 despite such major news.

Beyond this macroeconomic interpretation, market data shows profit-taking and risk reduction by some investors. This caution could be linked to anticipation of the CPI (Consumer Price Index) release scheduled for May 13. Technical and behavioral indicators support this hypothesis:

- Derivatives markets saw a net increase in short positions, accompanied by rising funding rates, signaling a shift in sentiment;

- Sales volume increased on both the spot market and perpetual futures as BTC approached $106,000;

- The liquidation rate of long positions intensified, indicating many traders closed their positions before the CPI or fearing a sharper correction;

- Finally, selling pressure mainly comes from profitable actors, whose behavior contributes to the current consolidation.

These signals confirm BTC’s retreat is essentially technical and opportunistic, rather than a reaction to a deteriorated fundamental factor.

Bullish fundamentals still in place

Beyond this technical correction, several factors indicate underlying bullish momentum driven by growing adoption dynamics. On the same day as the drop, Michael Saylor, CEO of MicroStrategy, announced a new massive purchase of 13,390 BTC, bringing the company’s treasury to 568,840 BTC.

At the same time, the stock of KindlyMD soared dramatically by 600%. This increase followed the announcement of its merger with Nakamoto Holdings, an investment firm specializing in bitcoin. Nakamoto Holdings was founded by David Bailey, Donald Trump’s current crypto advisor. While these announcements did not immediately support the price, they nonetheless reinforce the sentiment that institutions continue positioning for the long term.

The on-chain data provided by Glassnode confirm this assessment. The RSI indicator remains at an exceptionally high level of 100, which “shows sustained strength in new demand,” according to analysts.

However, profit-taking indicators are rising. This setup is typical during transition periods when the market consolidates gains before a new cycle. Moreover, positive flows on spot Bitcoin ETFs recorded over the past seven days indicate persistent confidence among institutional investors despite volatility.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.