New Hampshire Goes Full Bitcoin: State Treasury Bets the Farm on Crypto Reserves

While Wall Street hedgies fiddle with tokenized ETFs, the Granite State just dropped a $100M BTC bomb on traditional finance. Governor Sununu’s move makes NH the first US state to allocate public funds directly to Bitcoin—no custodial middlemen, no apologies.

The playbook? Simple. Take 5% of the state’s rainy day fund, convert to self-custodied BTC, and wait for the Fed’s money printer to make it look genius. Treasury officials claim it’s a ’hedge against dollar debasement.’ Detractors call it political theater with taxpayer money.

Here’s the kicker: the state’s mining its own moonshot. New legislation slashes taxes for Bitcoin businesses, while a new state-run mining operation—powered by stranded hydro—kicks off in Q3. Suddenly, those ’Live Free or Die’ license plates look prophetic.

Will it work? Who knows. But watching bureaucrats HODL through a bear market beats another snooze-fest SEC hearing. Just don’t ask about the energy FUD—these guys still burn wood for heat.

In brief

- New Hampshire becomes the first U.S. state to invest part of its public funds in bitcoin.

- Only digital assets exceeding $500 billion in market capitalization, like bitcoin, are eligible for a reserve.

- New Hampshire could inspire other states to integrate crypto into their public financial strategies.

A Small State, a Big Step for Bitcoin

Governor Kelly Ayotte signed the HB 302 law on May 6. Behind this somewhat austere name lies a quiet revolution: the state treasurer is now allowed to invest up to 5% of public funds in “leading digital assets“. No playing around here with memecoins or obscure tokens. The law sets a clear rule: only assets with a market capitalization of more than $500 billion are authorized. To date, this leaves only one candidate in the running: bitcoin.

Well, one might think the state will store its satoshis in an old Ledger hidden under a desk. But no. The text is precise about custody conditions:

- Multisignature wallets;

- Authorized custodians;

- ETFs.

Everything is designed to ensure the public bitcoins are well protected. New Hampshire wants to do this properly, with rules worthy of a good portfolio manager. And it’s no accident: the idea is to add an arrow to the state’s financial quiver, without taking reckless risks.

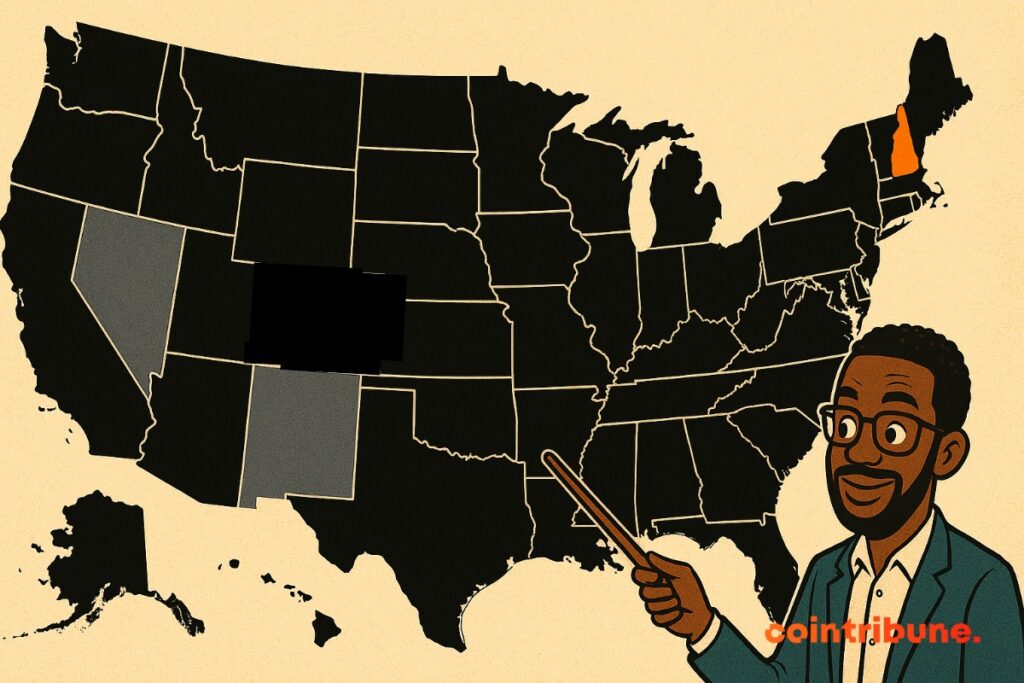

New Hampshire Leads the Way

This is not the first to try the experiment. Florida, Texas, Arizona, and a few others have tried, without success. But now, it is approved, signed, and enacted. And Bitcoin fans are applauding. Dennis Porter, from the Satoshi Action Fund, even calls it a “model to follow“. The idea is simple: why let the dollar erode with inflation when you can store some BTC in anticipation of uncertain tomorrows?

Maybe this is the CORE of the story. Bitcoin is starting to take the place gold long held in the collective imagination:

- A safe haven;

- An insurance in case of monetary crisis.

And while El Salvador has made it official in its economy, New Hampshire establishes it as a strategic asset. A way of saying: “we’re not going as far as paying taxes in BTC, but we take it seriously.”

Bottom line? What looked like a crazy bet is gradually becoming a state strategy where even the Czech Republic could invest 7 billion dollars. And this could very well be the start of a trend: other states, other countries could be inspired by this committed bitcoin turn. So, just a flashy move or the beginning of a new budgetary era? We’ll be watching closely.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.