Bitcoin Smashes Realized Cap ATH—Traders Brace for Next Leg Up

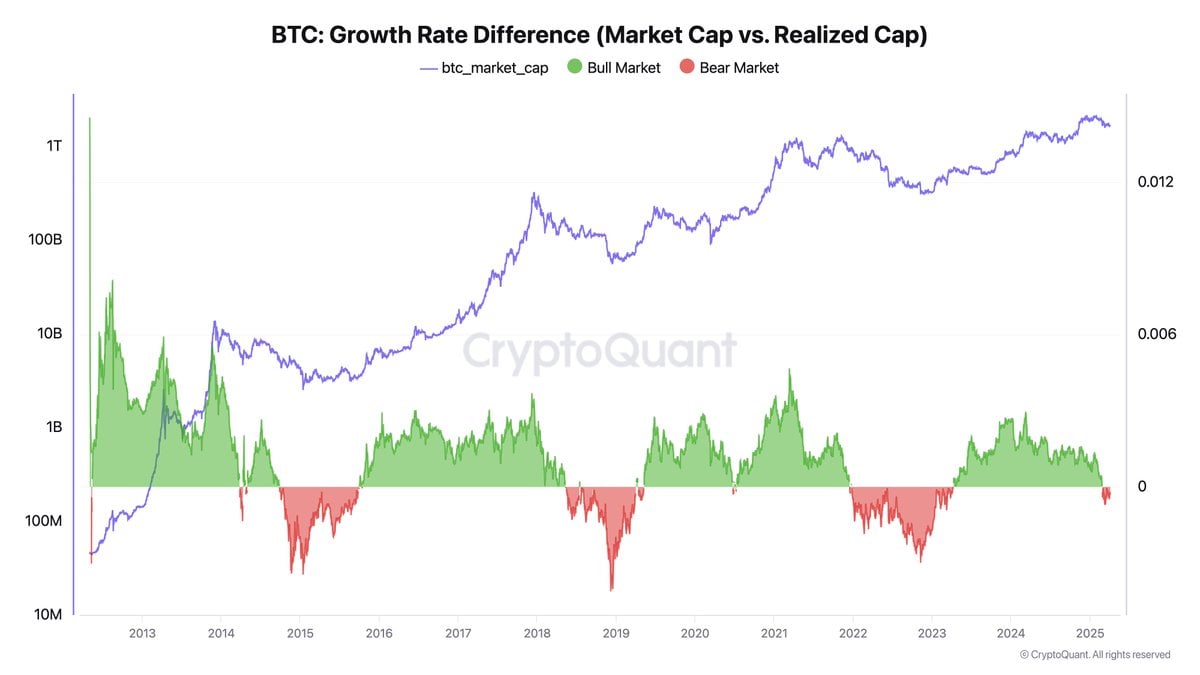

Bitcoin’s realized capitalization—the aggregate cost basis of all circulating coins—just punched through its previous all-time high. Glassnode data shows investors are sitting on unrealized profits not seen since the 2021 bull run.

The metric that matters: Realized cap filters out speculative noise by valuing each BTC at its last transacted price. When this number climbs, it signals strong hands are accumulating—not just day traders flipping bags.

What the charts won’t tell you: Wall Street’s latest ’crypto research’ teams are suddenly bullish after years of calling it a scam. How convenient—just as their clients need exit liquidity.

Buckle up: With spot ETF flows accelerating and miner capitulation over, this market’s primed for volatility. Whether that means $100K or another 50% haircut depends on who’s holding the leverage this time.

In Brief

- Bitcoin reaches a new record in Realized Capitalization.

- The current stagnation masks a likely bullish surge.

- Investor accumulation remains strong and ongoing.

- A rise toward 100,000 dollars seems imminent.

Realized Capitalization: a new bullish indicator

Bitcoin’s Realized Capitalization recently reached, beating its previous All Time High. But what does this indicator really mean? Unlike market capitalization, which is based on the current BTC price multiplied by the total supply,It therefore better reflects the actual investment in the asset.

The fact that this metric is hitting highs isAccording to CryptoQuant, the analytics platform that noted this ATH, such a historic accumulation of Realized Cap has historically been

In other words, if investors continue to accumulate without selling,It is interesting to note that this data does not account for bitcoins lost or left aside for years, which reinforces the validity of this accumulation.

CryptoQuant summarizes it very well:

Historically, large accumulations of Realized Capitalization have often been followed by significant increases in bitcoin price.

This highlights the importance of this indicator as a precursor signal of a future rise, even if the market remains relatively calm for now.

Price stagnation: just a plateau before the next bullish wave?

It is clear that, though in a stagnation phase, remains inIts price fluctuates between 92,000 and 95,000 dollars, but this stability could be the key to its future rise. Far from being a sign of weakness, these sideways movements are often a prelude to a new bullish surge.

BTCUSD chart by TradingViewIndeed, bitcoin’s history shows thatThis accumulation during calm periods is thus seen as a waiting moment before a price explosion.

Investment volumes andcontinue to grow, which could very well signal the preparation of a new bullish wave. A few days ago, CryptoQuant observed:

Realized Cap continues to rise while prices stagnate. This shows the inflow of capital without the price increasing yet, which is typical before a new surge.

This accumulation of BTC by investors thus reinforces the likelihood thatIt is therefore reasonable to think that breaking this price zone could open the way to a much larger bull market.

The current situation: confidence, accumulation, and outlook

Despite price stagnation,remains tangible. Investors are more engaged than ever, and this long-term accumulation approach shows increased market stability. Bitcoin continues toreinforcing the perception that it is now a SAFE haven against the traditional volatility of financial markets.

The effect ofcan also be explained by the growing confidence of institutional and individual players in the cryptocurrency, increasingly viewed as a safe asset. The CryptoQuant quote reinforces this analysis:

The capital entering the market is proof that investors believe in a solid future for bitcoin.

Many investors eagerly await the next rise, convinced that current signals are an excellent omen for bitcoin’s future.

Although bitcoin is currently stagnant, the ATH in Realized Capitalization is a strong signal. This massive capital accumulation seems to be laying the groundwork for a future rise. Moreover, according to Standard Chartered, a very optimistic forecast places bitcoin’s price at $200,000 for the year 2025. With such a solid investment base and this symbolic record, all elements are set for bitcoin to reach new heights in the coming months.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.