Nike Faces NFT Fraud Lawsuit: Crypto Investors Left Holding the Bag

Swoosh meets lawsuit—Nike’s NFT venture under fire as plaintiffs allege millions lost in digital sneaker scheme.

Legal heat rises: Sportswear giant accused of misleading investors with overhyped blockchain collectibles.

Web3 wake-up call: When celebrity endorsements meet volatile crypto markets, who really gets left with worthless JPEGs?

Bonus burn: Another case of traditional companies treating crypto like a get-rich-quick scheme—until the SEC comes knocking.

In Brief

- Nike is being sued for abruptly shutting down RTFKT, causing significant losses to NFT investors.

- The case reignites debate on the legal classification of NFTs as securities in the United States.

- This lawsuit could mark a turning point for digital asset regulation in the crypto sector.

Nike sued after shutting down its crypto unit RTFKT

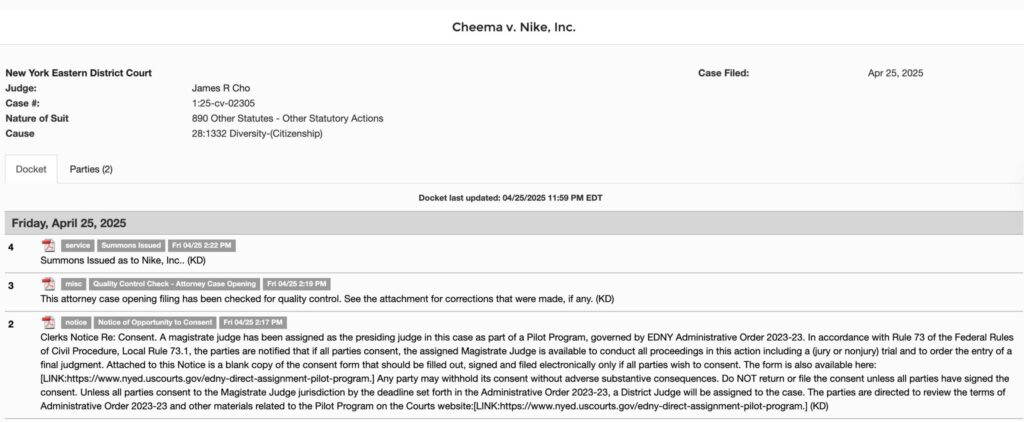

Nike faces a class action lawsuit in the United States after abruptly shutting down RTFKT, its division specialized in NFTs and crypto assets. The plaintiffs, led by Australian Jagdeep Cheema, are claiming over $5 million in damages, citing violations of consumer protection laws in New York, California, Florida, and Oregon.

The complaint, filed in a federal court in Brooklyn on April 25, accuses Nike of selling unregistered securities in the form of NFTs before “pulling the rug out from under” buyers by abruptly shutting down RTFKT. According to the plaintiffs, if the risks had been properly disclosed, they would never have invested in these digital tokens or would have done so at much lower prices.

The NFT market shaken again!

This unexpected shutdown drastically depreciated the value of NFTs linked to RTFKT, leaving many buyers uncertain. The case also raises a burning question in the crypto world: should NFTs be considered securities subject to American regulation? The Nasdaq is precisely putting pressure on the SEC to enforce this regulation. For now, Nike has not commented on the case and the plaintiffs’ lawyer, Phillip Kim, has also remained silent.

As a reminder, Nike acquired RTFKT in December 2021, applauding its innovative approach blending fashion, culture, and the gaming universe. But on December 2, 2024, the sports equipment company quietly announced the end of the RTFKT integration process, stating that the legacy of the brand would survive through other creators and projects.

This lawsuit against Nike thus illustrates the growing challenges that major brands face when venturing into the still unclear and risky NFT and crypto sector. The outcome of this case could well influence the future regulation of digital assets in the United States, which we hope will be favorable under Paul Atkins’s leadership.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.