Bitcoin’s Stagnation Crisis: Capital Inflows Hit Historic Lows

Bitcoin flatlines as fresh money evaporates from crypto markets.

The Liquidity Drought

Network metrics reveal a troubling pattern—exchange inflows have slowed to a crawl. Trading volumes across major platforms dropped 40% last quarter. Mining hash rates plateau while transaction fees hit 18-month lows. The usual institutional players? They're parking funds in treasury bonds instead.

Technical Stagnation

Price action tells the story. Bitcoin's 90-day volatility sits at historic lows, trapped in its narrowest trading range since the 2023 bear market. Options markets price minimal movement through Q1. Even the perpetual funding rate turned negative twice last month—traders won't pay to bet on upside anymore.

The Macro Squeeze

Traditional finance finally learned what crypto veterans knew: you can't eat promises. With real yields hitting 4% and recession fears mounting, risk capital seeks concrete returns. The 'digital gold' narrative faces its toughest test yet—gold itself rallied 12% while Bitcoin went sideways. One hedge fund manager quipped, 'Our crypto desk now spends more time compliance training than trading.'

This isn't a dip—it's a fundamental reassessment. Bitcoin either proves its worth as a capital magnet or becomes another tech relic collecting digital dust.

Read us on Google News

Read us on Google News

In brief

- A significant dry-up in capital inflows has slowed Bitcoin’s momentum, contributing to its price stagnation.

- Institutional investors have reduced selling pressure, but capital has shifted away from Bitcoin to traditional assets like stocks and precious metals.

- Experts predict that Bitcoin will likely stay in a consolidation phase until market sentiment shifts or a catalyst drives a breakout.

Capital Rotation Away from Bitcoin

Ki Young Ju, the founder of CryptoQuant, recently shared his insights into Bitcoin’s current market dynamics. Ju highlighted a notable shift in the Flow of capital, pointing out that institutional investors like MicroStrategy, which currently holds over 673,000 BTC, have significantly reduced the selling pressure typically seen from whales. This has led to a slowdown in capital flowing into Bitcoin.

Ju noted that rather than entering the crypto market, capital has rotated into traditional assets like stocks and precious metals. He added that this shift is unlikely to result in a dramatic price crash like those seen in previous bear markets. Instead, he predicts a period of sideways price movement for Bitcoin over the next few months.

Similarly, Farzam Ehsani, CEO of VALR, offered an additional perspective on why Bitcoin is facing consolidation. He attributes the current market conditions to a shift in investor focus towards safe-haven assets, particularly gold and silver. Over the past year, both metals have experienced significant price increases, with gold gaining 69% and silver rising by 161%.

According to Ehsani, this movement of capital away from cryptocurrencies is a temporary trend. He expects that once the momentum in the precious metals market subsides, capital will likely flow back into Bitcoin and Ethereum. Ehsani projects that Bitcoin could reach a price of $130,000, while ethereum could hit $4,500 by the first quarter of 2026, assuming the precious metals market cools down.

However, Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence, offered a more cautious view on Bitcoin’s future. He suggested that Bitcoin could experience a significant pullback, possibly returning to around $50,000 as part of a “normal reversion” in the market.

McGlone’s outlook reflects broader macroeconomic shifts, such as a potential deflationary correction in equities, which could place downward pressure on both stocks and digital assets.

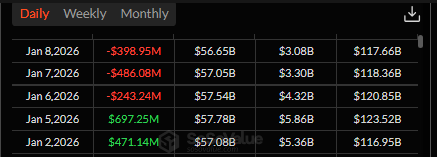

Bitcoin ETF Outflows Highlight Ongoing Market Caution

Amid these market dynamics, there have also been consistent outflows from the US BTC Spot ETF. Over the past few days, the outflows have been significant: $243.2 million on Tuesday, $486.1 million on Wednesday (the highest outflow this year), and another $398.95 million on Thursday.

These consistent withdrawals from Bitcoin-based ETFs suggest that investor sentiment remains cautious, further contributing to Bitcoin’s inability to break through the $94,782 resistance level.

Technical Indicators Point to Potential Breakout

On the technical front, Bitcoin has been in a period of consolidation, with the price fluctuating between key levels since November. Here’s what the current market is showing:

- Bitcoin has been range-bound between the $84,459 support and $94,782 resistance levels, with no significant price movement breaking out of this range in either direction.

- The Relative Strength Index (RSI) is currently at 53.50, slightly above the neutral 50 level. This suggests mild bullish momentum, though it hasn’t reached overbought conditions, indicating a lack of strong directional force.

- With the price movement remaining within this range and RSI showing moderate momentum, the market seems to be waiting for a catalyst to drive a breakout, either upwards or downwards.

Interestingly, a contributor at CryptoQuant has observed a shift in whale behavior despite the recent consolidation. Historically, increased whale activity on exchanges has often signaled a bearish trend, as large holders tend to sell off their positions during price rallies. However, this time, whale activity on exchanges has decreased, even after Bitcoin’s recent price rebound.

This shift indicates that large-scale investors are less likely to sell, which suggests that the selling pressure from institutional investors remains low. The decline in whale exchange activity is seen as a positive signal for the market, implying that Bitcoin’s price could stabilize or recover in the NEAR future.

With this shift in mind, Bitcoin’s price action is now under close scrutiny as it holds steady within its current range. A breakout above the upper level could signal a new uptrend, while a drop below the lower level might lead to a bearish shift. Until then, Bitcoin is likely to remain within this range, awaiting a clear directional move.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.