Solana Memecoin Insider Trading Lawsuit Gains Momentum - Investors Allege Market Manipulation

Solana's wild memecoin ecosystem faces its first major legal reckoning.

## The Allegations Take Shape

Investors have formally escalated claims of coordinated insider trading within a prominent Solana-based memecoin project. Court documents now detail specific transactions and wallet patterns that plaintiffs argue reveal pre-launch accumulation by connected parties. The lawsuit doesn't just target anonymous developers—it names several associated entities and promoters, alleging they orchestrated a 'pump-and-dump' disguised as community-driven virality.

## A Pattern, Not an Anomaly?

Legal experts suggest this case could become a template. The Solana blockchain's low fees and high throughput made it the perfect breeding ground for speculative token launches, often with minimal disclosure. Regulators have watched this space with growing unease, comparing the frenzy to the ICO boom of 2017—just with more dog-themed mascots and even less substance. It's the age-old finance story: find a loophole, exploit it, and hope the music doesn't stop before you cash out.

## The Ripple Effect for Crypto

A successful lawsuit would send shockwaves beyond Solana. It would establish precedent for holding pseudonymous teams accountable and could force major decentralized exchanges to tighten listing policies. While some argue this stifles innovation, others counter that it merely removes the 'get-rich-quick' schemers polluting the ecosystem. After all, when your project's primary utility is generating tweets, maybe it was never about technology in the first place.

## The Bottom Line

This legal battle cuts to the heart of crypto's decentralization myth. When large, concentrated profits appear from nowhere, someone usually has the map. The outcome won't kill memecoins, but it might finally make their creators think twice before treating retail investors as their personal exit liquidity. Because in the end, the only thing faster than Solana's transaction speed is the wealth transfer from the latecomers to the insiders.

Read us on Google News

Read us on Google News

In brief

- Investors allege Solana, Pump.fun, and Jito firms gave insiders faster access to memecoin trades through priority transaction tools.

- More than 5,000 private messages are cited as evidence of coordination during Pump.fun’s development phase.

- A federal judge approved an amended complaint, giving plaintiffs until January 7 to submit new claims.

- Lawsuit seeks damages, licensing requirements, and forfeiture of gains tied to alleged unfair memecoin trading practices.

Filing Points to Internal Messages in Solana Memecoin Case

The lawsuit was filed earlier this year by memecoin investor Michael Okafor and other plaintiffs. Defendants include executives linked to Solana Labs, the Solana Foundation, Jito Labs, the Jito Foundation, and Pump.fun. Investors claim the groups worked together to design a system that favored insiders while marketing it as fair to everyday users.

Plaintiffs compare the setup to a casino where outcomes were tilted before bets were placed. According to the complaint, insiders had access to tools that allowed them to trade faster than regular users, giving them an edge in newly launched tokens.

Several defendants asked the court in September to dismiss the case, arguing the claims lacked detail. Before the judge ruled, however, Okafor’s legal team presented new evidence. The material includes more than 5,000 private messages from a confidential source that allegedly show Solana Labs and Pump.fun engineers discussing technical decisions during the platform’s development.

Judge Sets January Deadline for Updated Solana Memecoin Filing

Okafor’s attorney, Max Burwick, said an early review of the messages showed direct discussions about software integration and transaction handling. He said the conversations took place as Pump.fun was growing rapidly and processing heavy trading volumes.

On December 11, Judge Colleen McMahon approved a request to file an amended complaint that includes the new material. Plaintiffs have until January 7 to submit the updated filing.

Defense lawyers tied to Solana-linked companies have said the lawsuit is unlikely to succeed. They argue the allegations rely on broad accusations rather than proof of illegal activity. Still, the court’s decision to allow amendments marks a key step in the case.

Burwick also said he received violent threats after sharing updates about the lawsuit on social media. He said the messages WOULD not affect his work. No further details were provided.

Lawsuit Targets Pump.fun, Jito Over Alleged Insider Trading Advantages

At the center of the dispute is Pump.fun, a platform used to launch and trade memecoins on Solana. Investors claim it operated as part of a coordinated scheme involving other Solana-linked firms. The lawsuit compares Solana to a casino floor, Pump.fun to a slot machine, and Jito’s software to the system that decides who trades first.

According to the complaint, Jito’s transaction tools allowed some traders to pay extra fees, or “tips,” to MOVE ahead in the transaction queue. That system allegedly allowed insiders to buy large amounts of new tokens before retail users could participate.

Lawyers say the alleged scheme worked in several ways:

- Token creators and select traders received faster access to transactions.

- Jito software allowed priority execution for users who paid higher fees.

- Pump.fun promoted token launches as fair while insiders used advanced tools.

- Retail traders saw the same interface but lacked speed advantages.

- Insiders captured profits while many retail users suffered losses.

Pump.fun maintained that the platform promoted “fair launches,” “no presales,” and protection against rug pulls. Investors argue that those claims did not reflect how the platform actually operated. Tutorials allegedly encouraged token creators to buy their own tokens early using priority tools.

The lawsuit describes the memecoin market as “extractive” and calls the system a “rigged slot machine.” Plaintiffs estimate that up to 60% of users lost money, with total losses possibly exceeding $4 billion.

Legal Challenge Questions Fairness of Solana Memecoin Trading

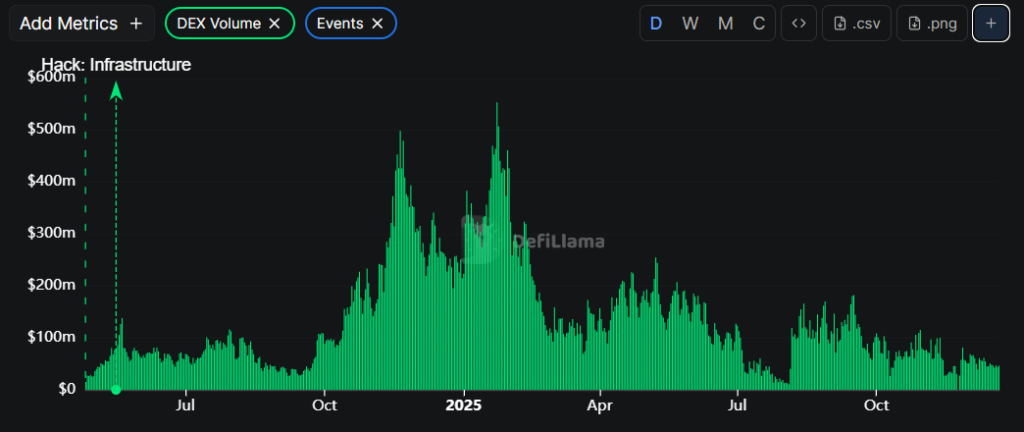

Legal filings also question why Pump.fun would benefit from a system that drives users away. Plaintiffs argue that the constant creation of new memecoins kept trading activity high despite losses. Even after a sharp drop since January, Pump.fun still records nearly $50 million in daily trading volume, according to DefiLlama data.

Other firms also benefited from the activity, according to the lawsuit. Many transactions passed through Jito’s software, generating fees. Heavy use of the Solana blockchain increased demand for SOL, pushing up its price during peak periods. Plaintiffs say those price gains benefited Solana-linked groups while retail traders faced unequal conditions.

Beyond damages, the lawsuit seeks strong court action. Plaintiffs want the companies placed into receivership unless they obtain gambling and money transmitter licenses. Additionally, the case seeks customer verification requirements, anti-money laundering controls, and forfeiture of gains tied to the alleged scheme, including gains linked to SOL’s price.

Defendants continue to deny wrongdoing on their part. In earlier court filings, Pump.fun, Jito Labs, and the Solana Foundation said the lawsuit is an attempt by losing traders to shift blame. Statements about fairness and safety, they argued, were general marketing language and not enforceable promises.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.