Russia’s Central Bank Reveals Crypto Mining Now Bolsters Ruble Strength

Russia's central bank just dropped a bombshell: crypto mining is propping up the national currency. Forget sanctions—this is economic warfare with a digital twist.

The New Geopolitical Weapon

Mining rigs hum where traditional finance falters. By converting mined crypto into rubles, miners create a steady, hard-to-track demand for the currency. It's a backdoor liquidity pump that bypasses international payment rails entirely.

Sanctions? What Sanctions?

The mechanism is brutally simple. Energy gets converted into digital assets, which get converted into local currency. It turns electricity reserves into monetary reserves, all while giving a polite nod to the financial regulators trying to block every other avenue.

The Ironic Stability Play

Here's the kicker: the volatile asset class everyone warned about is now a pillar of currency stability. It's the kind of plot twist that would make a traditional banker's head spin—assuming they're still paying attention between quarterly earnings calls.

The ruble gets stronger, miners get paid, and the central bank gets to claim it saw this coming all along. Everyone wins, except maybe the folks who still think monetary policy is something you decide over cigars and brandy.

Read us on Google News

Read us on Google News

In brief

- Central Bank Governor Elvira Nabiullina said cryptocurrency mining contributes to ruble strength but is hard to measure and not the sole factor behind recent gains.

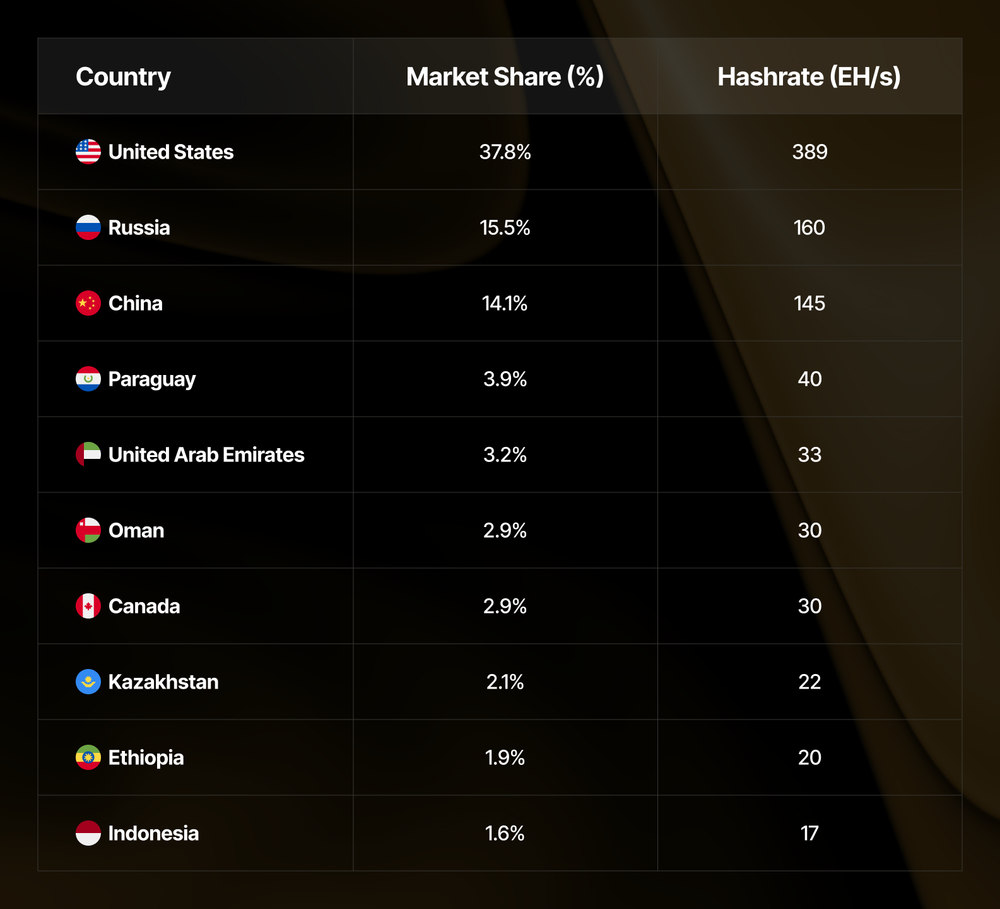

- Russia currently holds 15.5% of global Bitcoin mining power, slightly down from 16.6%, while the United States leads with 37.8%.

Assessing the Mining Influence

Speaking to RBC, Nabiullina explained that measuring mining’s impact on the ruble is difficult because much of the activity remains in a ‘gray zone.’ She pointed out that mining has existed in Russia for several years, meaning recent ruble gains cannot be attributed to a sharp increase in 2025 alone. However, she acknowledged that mining activity has likely grown somewhat this year and serves as an additional factor supporting the currency’s performance.

The growth of industrial cryptocurrency mining indicates a gradual shift in Russia, with even cautious officials like Nabiullina appearing more open to discussions around broader crypto adoption. Earlier this month, Maxim Oreshkin, Deputy Chief of Staff of the Presidential Executive Office, said that forecasts for the ruble were off because the financial contributions from mining and cryptocurrency had not been fully considered. He added that these activities now provide a new inflow of funds into Russia and are affecting the ruble’s position in global currency trading.

Oreshkin added that the Bank of Russia is evaluating the cryptocurrency mining sector and believes its financial flows should be included in the country’s balance of payments.

Regulatory Steps and Coordination

In 2024, Russia implemented regulations to govern cryptocurrency mining. Despite this, a significant portion of activity continues outside formal oversight.

According to RBC, the Central Bank is now coordinating with the Ministry of Finance, Rosfinmonitoring, and other government bodies to consider potential rules for cryptocurrency operations. Transactions are expected to continue through established market participants operating under current regulatory approvals, ensuring that digital asset activity remains within a monitored framework.

Supporting these efforts, Vladimir Chistyukhin, First Deputy Chairman of the Bank of Russia, emphasized the need to establish greater order in the cryptocurrency sector. He stressed the importance of enacting legislation quickly to regulate digital asset operations, including imposing strict limits or bans where necessary.

Meanwhile, global Bitcoin mining remains concentrated in a few countries, according to the Global Hashrate Heatmap by Hashrate Index. In the fourth quarter of 2025, the United States accounted for 37.8% of mining power, approximately 389 EH/s, while Russia held 15.5%, or about 160 EH/s. Russia’s share declined by 1.09 percentage points from 16.6% to 15.5%, reflecting a slight shift in the worldwide distribution of mining activity.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.