Michael Saylor Doubles Down: Plans New Bitcoin Purchase Even as MSTR Stock Tumbles

Michael Saylor isn't flinching. While his company's stock price takes a hit, the Bitcoin evangelist is reportedly gearing up for another major crypto acquisition.

The Unwavering Conviction

Market turbulence for MicroStrategy shares isn't deterring its executive chairman. Saylor's strategy remains laser-focused on accumulating Bitcoin, treating short-term equity volatility as mere noise against the long-term signal of digital scarcity. It's a high-stakes bet that continues to define his—and his company's—identity.

Strategy Over Stock Price

The move highlights a fundamental divergence: corporate performance measured in traditional markets versus treasury strategy measured in satoshis. For Saylor, the latter holds ultimate priority, framing Bitcoin not as a risky asset but as the foundational reserve asset. This latest planned purchase reinforces that doctrine, sending a clear message to both critics and disciples.

A Calculated Gamble

This isn't blind faith—it's a calculated position on monetary evolution. While skeptics see recklessness, proponents see a masterclass in corporate hedging against fiat devaluation. Of course, on Wall Street, they call that either visionary leadership or a brilliant distraction from other, less shiny, financial metrics. The playbook is simple: when in doubt, buy more Bitcoin.

Read us on Google News

Read us on Google News

In brief

- Michael Saylor teases a new bitcoin purchase despite the 43% drop in MSTR stock in 2025.

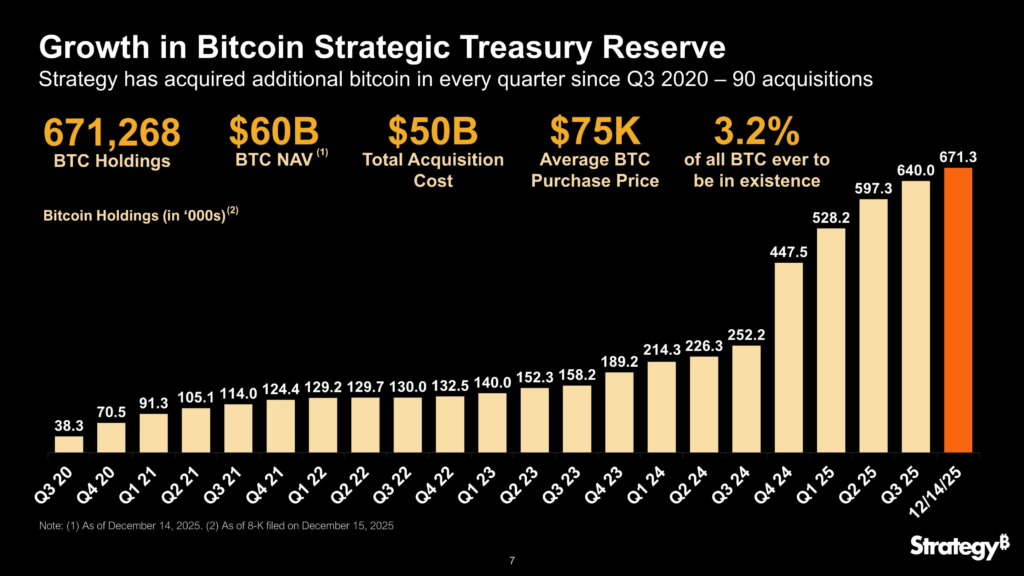

- Strategy holds 671,268 BTC (3.2% of the total supply) but its mNAV ratio close to 0.93 dangerously approaches the critical zone of 1.

- An additional drop of 15 to 20% in bitcoin could force Strategy to sell its BTC reserves.

Saylor’s teasing: a new bitcoin purchase approaching?

On December 21, 2025, Michael Saylor posted an enigmatic message on X: ” Green Dots ₿eget Orange Dots “. A direct reference to the SaylorTracker visualization, often followed by an SEC filing confirming a massive bitcoin purchase. This pattern, repeated throughout the year, has created an almost ritual expectation among investors. Each tease is now interpreted as the announcement of an imminent acquisition, usually official on Monday morning.

This method of communication, both cryptic and calculated, reinforces Saylor’s image as the tireless bitcoin strategist. Yet, it happens in a tense context: MSCI is considering removing Strategy from its global indices, believing the company operates more as an investment vehicle than an operational company. A decision that could further weaken MSTR’s position in traditional markets.

Strategy: a purchase on hold despite the fall of MSTR

MSTR stock has lost 43% of its value since the beginning of the year, a collapse partly reflecting bitcoin’s 30% decrease since its October 2025 peak. Yet, Strategy continues to accumulate BTC, bringing its reserves to 671,268 BTC, or 3.2% of the total supply. These purchases, often funded by share issuances, raise questions about shareholder dilution and the sustainability of the model.

The latest purchases, such as the 10,624 BTC acquired in early December for 963 million dollars, illustrate this determination. The company has even set aside a reserve of 1.44 billion dollars to avoid liquidating its holdings if needed. A precaution showing the limits of the strategy: each new share issuance increases the pressure on MSTR stock price.

Bitcoin in the red zone: Will Strategy be forced to sell its BTC?

According to Phong Le, Strategy will only sell its bitcoins under one condition. Which one? An mNAV ratio below 1, combined with drying up access to capital. A situation that, if realized, WOULD send a disastrous signal to the market. At $88,000 at the end of 2025, bitcoin keeps Strategy’s mNAV ratio just above 0.93, near the critical threshold of 1.

An additional 15 to 20% drop in bitcoin would be enough to tip it over, forcing the company to consider BTC sales to avoid financial suffocation. However, Saylor bets on a market rebound or new fundraising to avoid the unthinkable. But with a price already down 30% since October, the room for maneuver is shrinking. If bitcoin falls below $75,000, Strategy could find itself cornered, turning its “hold” strategy into an increasingly risky bet.

Michael Saylor’s bitcoin strategy remains a risky bet in an uncertain market. While buy signals multiply, one question remains: Can Strategy keep its promise never to sell, even in adversity? In your opinion, is Strategy’s massive BTC accumulation a strength or a weakness for the market?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.