FTX Fallout: SEC Slams Caroline Ellison with 10-Year Ban, Associates Get 8 Years

Regulators just dropped the hammer on FTX's inner circle. The SEC's latest enforcement action sends a chilling message to the crypto executive suite.

The Verdict from Washington

Caroline Ellison, once a central figure in the exchange's operations, is now barred from the securities industry for a decade. Her close associates face an eight-year exile. The numbers are stark—ten years, eight years—a timeline measured in lost careers and shattered credibility.

Zeroing In on the 'How'

The case wasn't about bad market bets. It was a classic failure of controls, a story of what happens when oversight is an afterthought. The SEC's move targets the individuals behind the corporate veil, focusing on the decision-makers who steered the ship.

A New Era of Accountability?

This isn't just a penalty; it's a precedent. The lengthy bans signal a shift from negotiating corporate fines to pursuing personal liability. It's a warning shot to anyone who thinks crypto's wild west days grant immunity from traditional finance's rulebook—a rulebook that, for all its flaws, tends to catch up eventually. After all, in finance, the only thing faster than a bull run is a regulator's memory when the music stops.

Read us on Google News

Read us on Google News

In brief

- The SEC has officially banned Caroline Ellison from leading for 10 years, and Gary Wang and Nishad Singh for 8 years, after their role in the FTX scandal.

- Caroline Ellison will benefit from early release in February 2026 due to her cooperation with justice, while Sam Bankman-Fried is serving a 25-year sentence.

- The defrauded investors will not be reimbursed at the current bitcoin price, but at its value at the time of bankruptcy, worsening their financial losses.

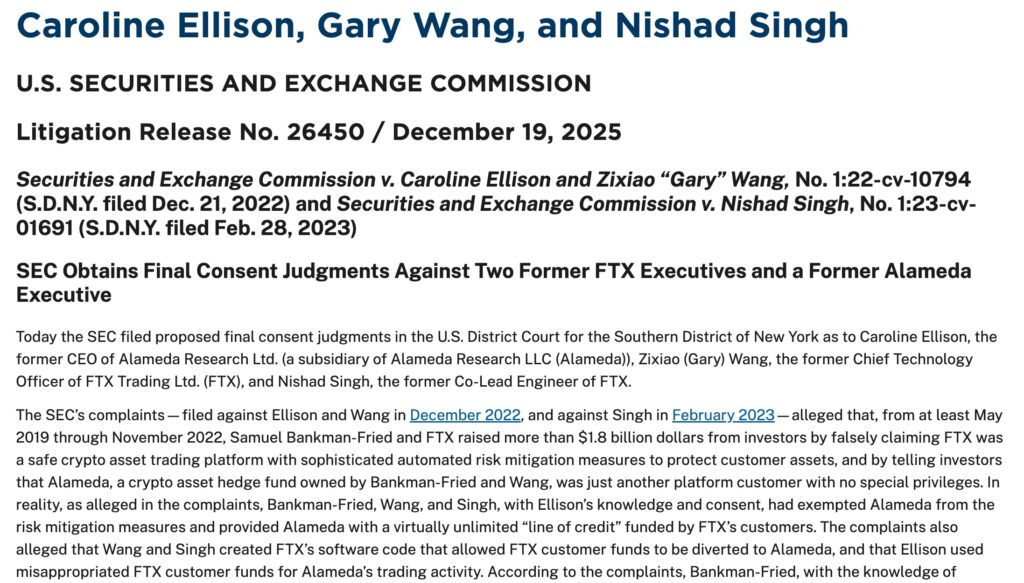

Crypto: the SEC confirms bans for Alameda executives

The SEC has officially banned Caroline Ellison, Gary Wang, and Nishad Singh from leading or serving on boards for 8 to 10 years. An unprecedented decision in the crypto world, aimed at protecting investors after the fall of FTX and the disappearance of billions of dollars. These bans send a clear message: the era of impunity is over.

Yet, some question the actual effectiveness of these measures. The penalties, although heavy, remain symbolic for actors involved in one of the largest crypto frauds in history. Ellison, Wang, and Singh have cooperated with justice, testifying against Sam Bankman-Fried. Has their collaboration mitigated their responsibility? The SEC shows its teeth, but will it be enough to restore trust in a sector still perceived as the Wild West?

Early release for Ellison, hope for clemency for SBF: double standards?

Despite the 10-year ban on corporate leadership, Caroline Ellison, former CEO of Alameda Research, is expected to be released in February 2026 after only 11 months in prison. Transferred to community detention in October 2025, she benefits from a sentence reduction for good behavior and cooperation. A favored treatment contrasting with the fate reserved for crypto magnate Sam Bankman-Fried, sentenced to 25 years in prison.

Bankman-Fried, meanwhile, is betting on an appeal and rumors of presidential clemency after financially supporting the Democratic Party. A risky strategy, as his refusal to cooperate with justice sealed his fate. Why such disparity? Does the American judicial system reward those who “play the game”? Judicial cooperation certainly reduces sentences but does not bring justice to the victims. For many, Ellison and Bankman-Fried should answer for their acts equally.

Bitcoin at the heart of the FTX conflict – will defrauded investors pay twice?

FTX victims will not recover their funds at the current Bitcoin rate. According to liquidation rules, reimbursements will be based on BTC’s value at the time of bankruptcy, in November 2022. A decision that could be costly for investors, as the crypto queen’s price has greatly fluctuated since then.

For example, an investor who deposited 1 BTC at $60,000 in 2021 will only recover the equivalent of $16,000, the Bitcoin price at the bankruptcy date. A direct loss raising questions about the fairness of the process. Victims’ attorneys denounce a system that punishes investors twice: first through crypto fraud, second through reimbursement rules.

The FTX-Alameda case and Caroline Ellison’s ban reveal the inequalities of a judicial system where cooperation may mitigate sentences but where victims are often forgotten. While the SEC tries to restore order, one question remains: how to protect investors in an ever-evolving crypto world?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.