Aave Charts Aggressive 2026 Growth Trajectory as SEC Probe Wraps Up

Aave just cleared a major regulatory hurdle—and its roadmap for 2026 looks nothing short of ambitious.

The All-Clear Signal

The SEC's investigation into the decentralized lending protocol has officially concluded. No enforcement action. No penalties. Just a quiet closing of the file that had loomed over the project for months. For the team, it's a green light to execute.

Mapping the Next Frontier

With the regulatory fog lifting, Aave's focus sharpens on 2026. The plan isn't about incremental updates; it's about capturing new markets and redefining on-chain finance. Think cross-chain expansion, novel collateral types that would give a traditional risk manager heartburn, and deeper institutional onboarding tools.

Why This Timing Matters

Regulatory certainty is the rarest of commodities in crypto. Getting it now, as the broader market rebuilds, positions Aave with a massive first-mover advantage. While rivals navigate uncertainty, Aave can build—aggressively.

The protocol isn't just planning to grow; it's planning to lead. The 2026 blueprint suggests a push to become the indispensable liquidity layer for a multi-chain financial system, finally making good on DeFi's promise to bypass the gatekeepers. Of course, in finance, the biggest plans often come right before the next 'unforeseen' market event.

Read us on Google News

Read us on Google News

In brief

- Aave moves into a new growth phase after the SEC closes a four-year investigation, removing regulatory obstacles.

- Aave will launch V4 to centralize liquidity, expand Horizon for real-world assets, and introduce the Aave App to simplify DeFi for users.

- Record growth in 2025 positions Aave as a market leader, with $75 billion in net deposits, and nearly $1 trillion in loans issued.

Aave V4 and the Path to Next-Level Growth

Kulechov highlighted that, while Aave has grown into the largest and most trusted lending platform in decentralized finance, the project remains in its early stages. Current figures, impressive as they are, represent only a fraction of what the CEO believes the protocol can achieve.

The CEO outlined three main priorities for the year ahead, beginning with Aave V4, a complete overhaul of the protocol that he believes will position ‘Aave as the backbone of all finance.’ It replaces isolated liquidity pools with a hub-and-spoke system, centralizing liquidity on each network while allowing custom lending markets through dedicated spokes.

Kulechov explained that this approach will allow Aave to manage trillions in assets, making the protocol a preferred choice for banks, tech-driven financial firms, and other corporations seeking access to its extensive and reliable liquidity.

In 2026, Aave will be home to new markets, new assets, and new integrations that have never existed before in DeFi.

Stani KulechovExpanding Access with Horizon and the Aave App

Another priority is Horizon, introduced earlier this year as a bridge to the next trillion dollars. The platform is designed for institutional real-world assets, allowing approved organizations to use tokenized holdings as backing to access stablecoin loans.

Horizon currently holds $550 million in net deposits, and Aave aims to scale it to over $1 billion in 2026 by working with partners such as Circle, Ripple, Franklin Templeton, and VanEck. This initiative could expand the protocol’s total addressable asset base to more than $500 trillion.

Kulechov stated, “Aave cannot play a central role in all of finance without first bringing equities, ETFs, funds, real estate and mortgages, commodities, receivables, and bonds and fixed income for onchain lending. Horizon positions Aave to do that.“

The third key element of Aave’s strategy is the Aave App, a mobile platform designed to simplify decentralized finance for everyday users. By hiding complex technical details and providing a clear, intuitive interface, the app aims to attract the next million users. Kulechov indicated that the full rollout will begin early next year, opening up an entirely new user base and fueling further growth for the protocol. Mass adoption on the product level is seen as essential for Aave to reach its goal of managing assets in the trillions of dollars.

Record Growth and Market Leadership

Meanwhile, so far in 2025, Aave has reached several important milestones, with key achievements standing out:

- The protocol has reached $75 billion in net deposits and processed a total of $3.33 trillion in deposits since its launch five years ago, issuing nearly $1 trillion in loans.

- Its size now rivals the top 50 banks in the United States, capturing 59% of the DeFi lending market and 61% of all active loans across decentralized finance.

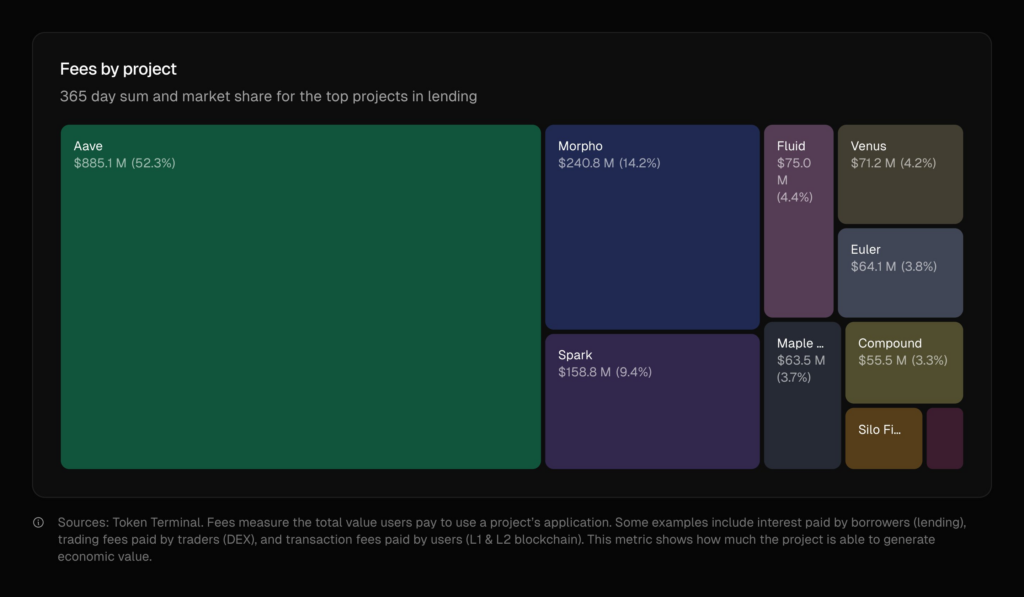

- Aave has generated $885 million in lending fees this year, representing more than half of all fees from lending protocols.

- The protocol’s earnings exceed the combined total of its five closest competitors, showing its market dominance.

With this strong position, the CEO confirmed yesterday that the SEC investigation has officially concluded, expressing relief that this chapter is behind the company and emphasizing that developers can now focus on creating innovative financial solutions. Despite these achievements, the Aave token has seen a decline, falling nearly 2% in the last 24 hours and 7% over the past week. The recent decline mirrors the wider movement across the cryptocurrency market.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.