JPMorgan’s Ethereum Move: Tokenized Money-Market Fund Targets Institutional Giants

Wall Street's blockchain invasion just got real. JPMorgan—yes, the same bank that once called Bitcoin a fraud—just parked a tokenized money-market fund on Ethereum. This isn't a pilot or a test. It's a live, institutional-grade product built for clients who measure risk in billions.

The Mechanics: Cutting Out the Middleman

Forget paper certificates and settlement delays. The fund's shares exist as digital tokens on a private Ethereum network. That means instant transfers, 24/7 liquidity, and a ledger so transparent it makes traditional fund accounting look like a black box. JPMorgan isn't just dipping a toe in crypto waters—it's building the plumbing for the next era of finance.

Why This Time Is Different

Previous bank-led blockchain projects often felt like expensive science experiments. This one serves a clear, ruthless purpose: efficiency. By tokenizing a money-market fund—the cash parking spot for corporations and wealthy investors—JPMorgan directly attacks the friction and cost bogging down traditional finance. It's a hedge against obsolescence, wrapped in a client service.

The Institutional On-Ramp Is Here

This launch signals a critical shift. The infrastructure for major capital is now operational. Regulatory hurdles? Navigated. Security concerns? Addressed with private, permissioned chains. The message to other institutions is clear: the tools for large-scale, compliant digital asset deployment are ready. The race isn't about who believes in crypto—it's about who can monetize it first.

A cynical take? It's the ultimate hedge. Banks spent years dismissing public blockchains, only to now build their own walled gardens on the same technology—proving once again that in finance, principles often follow profits.

Read us on Google News

Read us on Google News

In brief

- JPMorgan Asset Management launched MONY on Ethereum, seeding the tokenized money-market fund with $100 million in firm capital.

- Access to the fund is limited to qualified investors, with a $1 million minimum and digital tokens issued to represent ownership.

- Investors earn daily yield from short-term debt while subscribing and redeeming in cash or USDC on-chain.

- Clearer US regulation and rising demand for tokenized real-world assets continue to drive adoption among large asset managers.

JPMorgan Responds to Client Demand With On-Chain Yield Product

The fund, called the My OnChain Net Yield Fund, or MONY, was introduced by JPMorgan Asset Management and built on the ethereum network. It launches with $100 million from the firm and is expected to open to outside investors on Tuesday, according to a report in the Wall Street Journal. Oversight comes from the asset-management division, which manages about $4 trillion in client assets.

Support for the fund is provided by Kinexys Digital Assets, the firm’s tokenization platform. Participation is limited to qualified investors, defined as individuals with at least $5 million in investments and institutions with at least $25 million in assets.

A minimum investment of $1 million applies. Subscriptions are processed through the Morgan Money portal, and investors receive digital tokens representing fund ownership, which are held in a crypto wallet.

Like traditional money-market funds, MONY invests in short-term debt securities and seeks to offer yields above standard bank deposits. Interest is paid, and dividends accrue daily. Subscriptions and redemptions can be made using either cash or Circle’s USDC stablecoin, keeping assets on-chain while earning yield.

The fund includes several defining characteristics:

- Operates on Ethereum through JPMorgan’s Kinexys platform

- Launches with $100 million in firm capital.

- Limits access to qualified investors with high minimum thresholds.

- Provides daily interest and dividend accruals.

- Accepts subscriptions and redemptions in cash or USDC.

Client demand played a key role in the rollout. John Donohue, head of liquidity at JPMorgan Asset Management, said investors are seeking tokenized products that mirror traditional money-market funds while operating on blockchain infrastructure. Plans are in place to expand the firm’s digital offerings in response.

Regulatory Momentum Drives Growth in Tokenized Money-Market Products

Regulatory developments in the United States also influenced the timing. Passage of the GENIUS Act earlier this year established a federal framework for dollar-backed stablecoins. Movement around the proposed Clarity Act has pointed toward a more defined approach to oversight of blockchain-based financial products. Together, these measures have increased confidence among large financial firms considering on-chain structures.

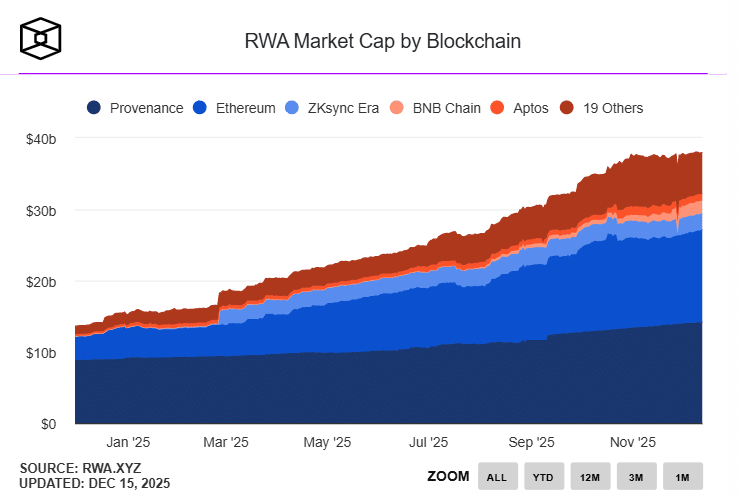

According to The Block data, Tokenized real-world assets reached a record value of $38 billion in 2025. Tokenized money-market funds have drawn particular interest from crypto-focused investors seeking yield without moving assets off-chain, addressing the issue of idle stablecoin balances.

JPMorgan joins other major asset managers experimenting with similar models. BlackRock operates the largest tokenized money-market fund, with assets of more than $1.8 billion. Goldman Sachs and Bank of New York (BNY) have also announced plans to collaborate on issuing digital tokens tied to money-market funds. In select regions, crypto exchanges have introduced tokenized stocks and securities.

Recent activity shows the firm’s continued move toward public blockchains, despite past criticism of Bitcoin from CEO Jamie Dimon. Last week, JPMorgan helped arrange a commercial paper issuance for a Galaxy Digital subsidiary on the Solana network, using a USCP token settled in USDC.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.